The recent sell-off in GameStop shares has intensified, coinciding with a spike in trading volume of call options owned by the meme stock leader known as “Roaring Kitty”. This individual, whose real name is Keith Gill, disclosed his portfolio on Monday night, revealing that he still held 120,000 call options contracts with a strike price of $20 and an expiration date of June 21. The trading volume of GameStop calls with the same strike price and expiration date on Wednesday soared to 93,266 contracts, which is significantly higher than its 30-day average volume of 10,233 contracts. This surge in trading activity led to a more than 40% drop in the price of these contracts, accompanied by a 16.5% decline in the stock price.

Speculation and Uncertainty Surrounding Roaring Kitty’s Involvement

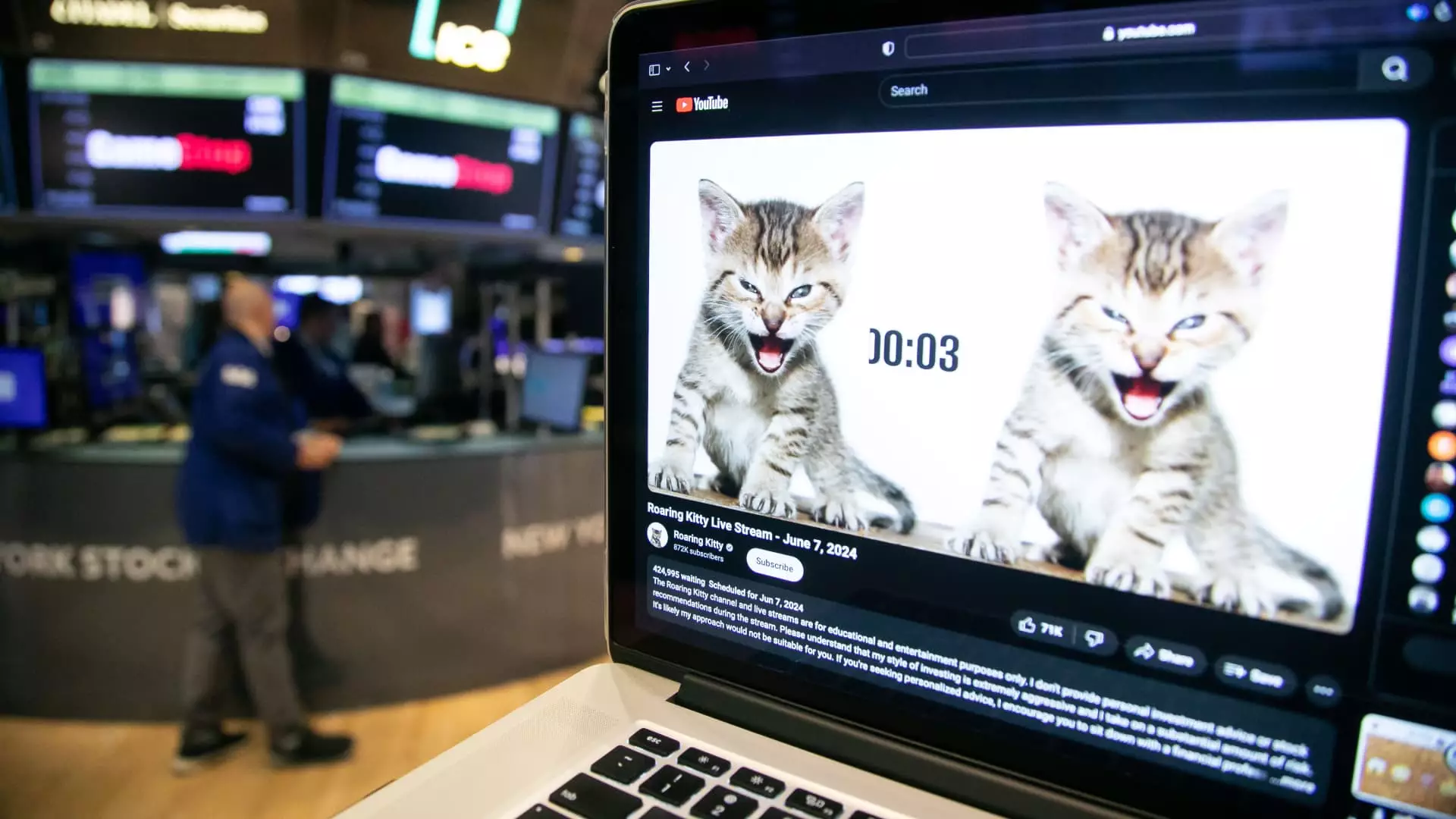

The article highlights that it remains uncertain whether Roaring Kitty was behind the substantial increase in trading volume, although options traders suggest that he could be involved due to his significant holdings of these contracts. There has been speculation among options traders that Gill might need to sell his calls before they expire or roll the position into another call option to avoid the need to raise a substantial amount of cash to exercise them by June 21. The potential sale of these contracts by Gill has caught the attention of Wall Street, as it could potentially impact the price of GameStop shares. In order for Gill to exercise his calls, he would require $240 million to acquire 12 million shares at $20 each, an amount that surpasses what he has publicly disclosed in his E-Trade account.

Market Reaction and Implications

The significant drop in the price of the call options and the corresponding decline in GameStop shares raise concerns about the potential impact on the broader market. The speculation surrounding Roaring Kitty’s actions and the uncertainty about his intentions add a layer of complexity to the situation. The need for Gill to either sell his calls or come up with a substantial amount of cash to exercise them by the expiration date introduces a level of risk and uncertainty for investors and traders alike. The market will likely continue to monitor this situation closely to gauge the potential repercussions and adjust their strategies accordingly.

The recent developments in GameStop’s options trading and the actions of Roaring Kitty have added volatility and uncertainty to the market. The surge in trading volume, coupled with the significant price fluctuations, underscores the complexities involved in options trading and the potential impact on stock prices. As investors navigate these turbulent waters, it is crucial to stay informed, exercise caution, and adapt to the evolving market dynamics.

Leave a Reply