Berkshire Hathaway, under the guidance of the late Charlie Munger, has been actively reducing its stake in BYD, China’s largest electric vehicle manufacturer. The conglomerate recently sold 1.3 million shares of BYD on the Hong Kong stock exchange, amounting to $39.8 million. This move brought down Berkshire’s ownership from 7% to 6.9%, marking a significant reduction in its initial investment.

Back in 2008, Berkshire Hathaway made a bold move by purchasing approximately 225 million shares of BYD for $230 million. This investment, driven by Munger’s vision, proved to be highly profitable as the electric vehicle market witnessed exponential growth over the years. However, the conglomerate started selling off its BYD shares in 2022 and 2023, capitalizing on the stock’s nearly 600% surge.

Founded by Wang Chuanfu, BYD initially focused on manufacturing batteries for mobile phones before transitioning to electric vehicles in 2003. The company quickly rose to prominence in China, emerging as a leading car brand and a major player in EV battery production. In a significant milestone, BYD surpassed Tesla in the fourth quarter of 2023 to become the top EV manufacturer globally.

Munger’s Influence and BYD’s Success

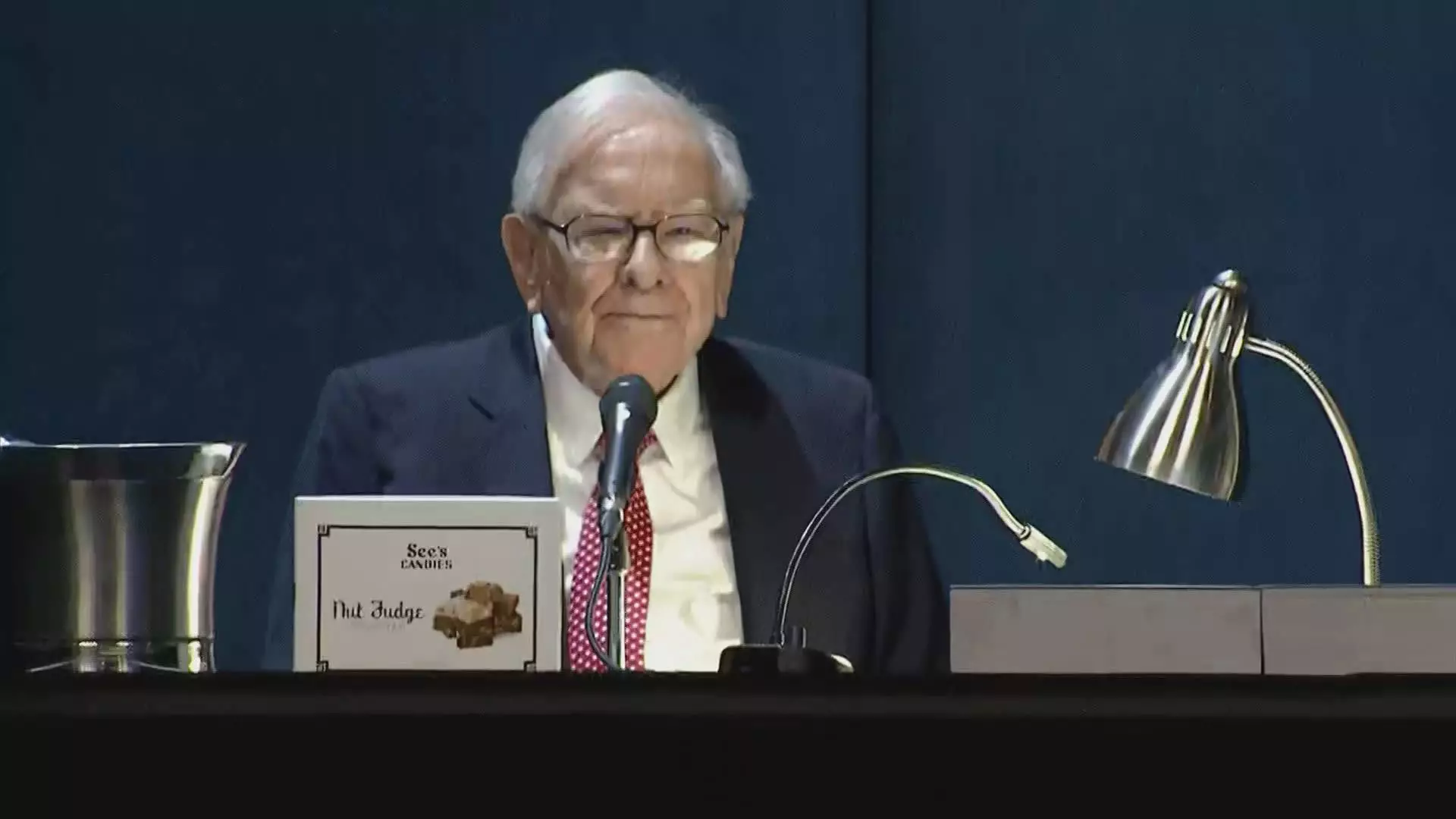

Warren Buffett credited Charlie Munger for identifying the potential of BYD early on, with Munger receiving full acknowledgment for the investment. Munger’s introduction to BYD came through his friend Li Lu, the founder of Himalaya Capital. This strategic move by Berkshire Hathaway, guided by Munger’s insight, played a crucial role in the conglomerate’s foray into the electric vehicle sector.

Berkshire Hathaway’s ongoing adjustment of its stake in BYD reflects the dynamic nature of investment strategies in the ever-evolving EV market. While the conglomerate’s decision to trim its holding may raise questions, it underscores the importance of strategic portfolio management in navigating the complexities of the global economy. As Berkshire Hathaway continues to adapt its investment approach, the legacy of Munger’s influence on BYD’s success remains a testament to the enduring impact of visionary leadership in the realm of finance and innovation.

Leave a Reply