As the news broke that major parts of the Saving on a Valuable Education, or SAVE, plan were put on pause due to two federal judges issuing preliminary injunctions, borrowers like Cody Gude felt a wave of disappointment and confusion. Gude, a resident of Tampa, Florida, was eagerly awaiting a drop in his student loan payment from $200 to $100 under the new repayment plan. However, with the legal battle unfolding, his relief turned into uncertainty, leaving him and millions of other borrowers in the dark about the fate of their student loan payments.

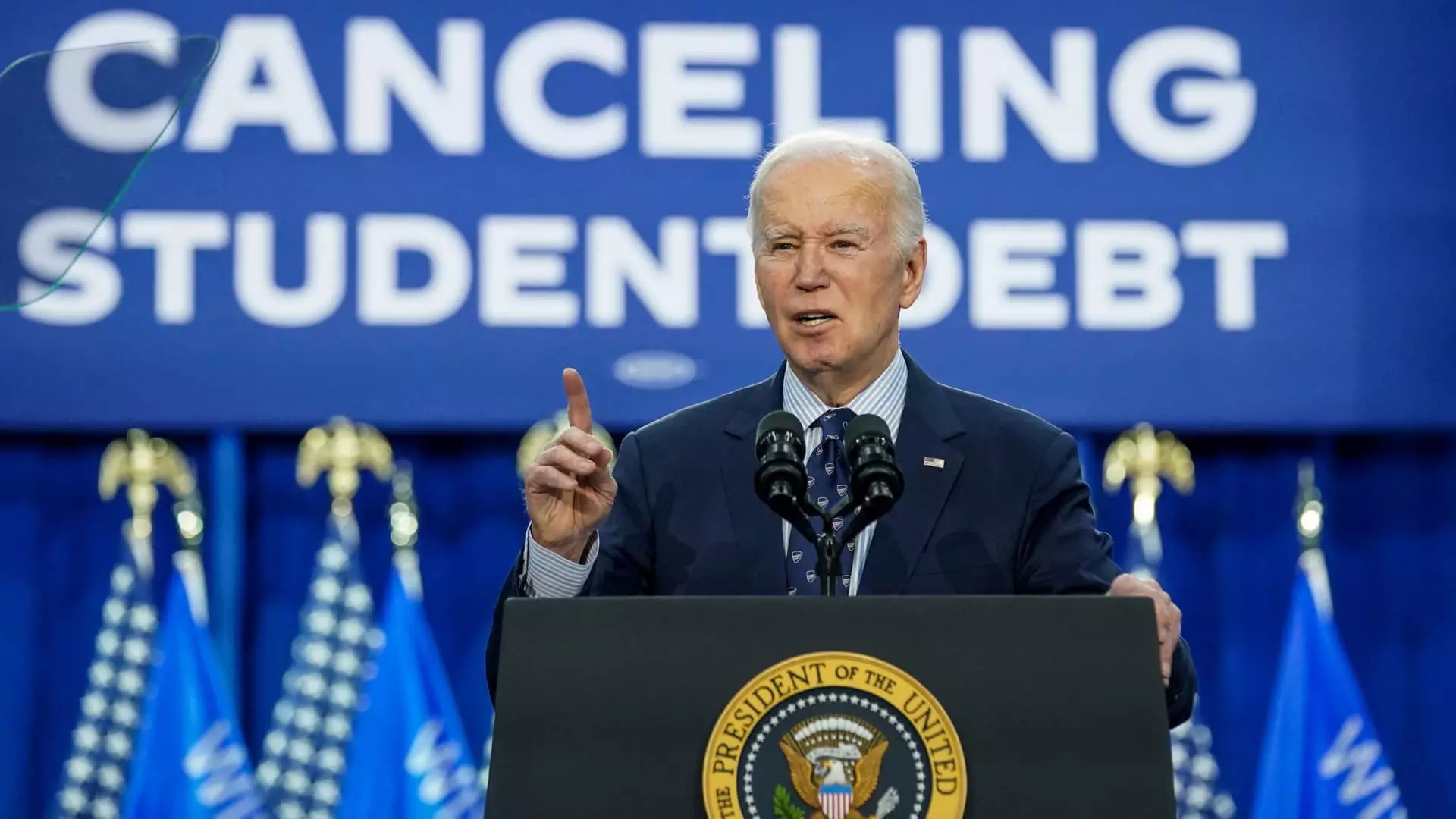

President Joe Biden introduced the SAVE plan as a more affordable alternative for student loan borrowers, with around 8 million borrowers already enrolled in the new income-driven repayment plan. The plan aims to reduce the financial burden on borrowers by only requiring them to pay 5% of their discretionary income towards their debt each month, compared to the previous 10% requirement under the REPAYE plan. Additionally, borrowers with lower incomes may have a $0 monthly payment, and some may be eligible for loan forgiveness in as little as 10 years. However, the generosity of the SAVE plan has sparked controversy and legal challenges from Republican-led states.

The Legal Battle Unfolds

The legal battle surrounding the SAVE plan escalated when federal judges in Kansas and Missouri granted preliminary injunctions against certain key provisions of the plan. Judge Daniel Crabtree in Kansas allowed some features of the SAVE plan that were already in effect to continue but paused the provision that significantly lowers borrowers’ monthly payments starting in July. He cited concerns about the massive cost disparity between the former REPAYE plan and the SAVE plan, stating that the latter represents an unprecedented expansion of regulatory authority without clear congressional authorization. In Missouri, Judge John Ross blocked the Biden administration from forgiving any more student debt under the SAVE program until further legal proceedings are concluded.

The uncertainty surrounding the legal battle has left many borrowers wondering about the future of their student loan payments. While they can still stay enrolled in the SAVE plan for now, the outcome of the legal case remains uncertain. Borrowers who have already seen a decrease in their monthly bills may soon experience a reversal back to the previous payment levels. Experts suggest that the court’s ruling is not retroactive, meaning that borrowers may have to resume paying higher amounts towards their student loans until a final decision is reached.

Given the complex nature of the legal challenges and the potential implications for federal student loan servicers, the legal battle over the SAVE plan is expected to be drawn out. Scott Buchanan, the executive director of the Student Loan Servicing Alliance, predicts that the cases may eventually reach the Supreme Court, leading to a prolonged legal process that could extend past the upcoming election. As borrowers navigate through this uncertain time, it’s crucial to stay informed about the developments in the legal battle and be prepared for possible changes to their student loan payments in the near future. The fate of the SAVE plan and its impact on millions of borrowers remain uncertain, emphasizing the need for clarity and resolution in the ongoing legal proceedings.

Leave a Reply