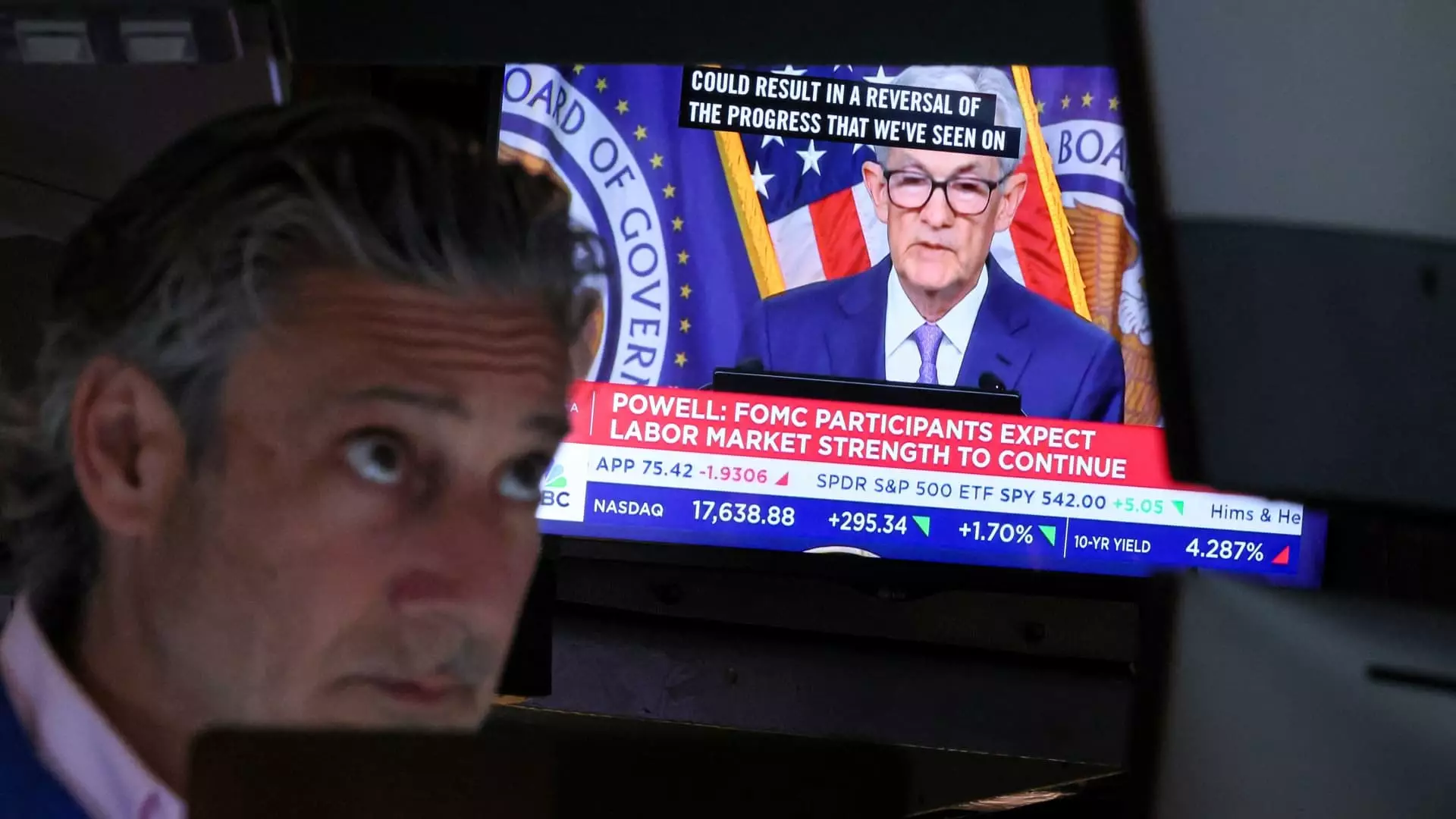

The recent speculation surrounding the Federal Reserve’s decision to lower interest rates has significantly impacted the stock market. With the CME FedWatch tool indicating a 100% likelihood of a rate cut by September, stocks have surged to new highs. This positive sentiment has been reflected in the performance of major indices like the Dow Jones Industrial Average, S & P 500, and Nasdaq Composite, all reaching record highs in recent weeks.

Amidst the bullish market sentiment, investors are capitalizing on opportunities for both profit-taking and strategic repositioning. The CNBC Investing Club, led by Jim Cramer, has made strategic moves to optimize its portfolio. While selling off shares of companies like TJX Companies to raise cash, the Club also locked in substantial gains by selling Meta Platforms and Palo Alto Networks. Additionally, the Club has taken advantage of the tech pullback by initiating positions in companies like Advanced Micro Devices.

One key theme that has emerged in the stock market is the increasing interest in sectors outside of Big Tech. The recent performance of the Russell 2000, which measures small-cap U.S. stocks, has outpaced that of tech-heavy indices like the Nasdaq. This trend is indicative of a broader market rotation, with investors seeking opportunities in sectors beyond traditional tech giants. Companies with heavy ties to China, such as Wynn Resorts, Starbucks, and Estee Lauder, have faced challenges amidst this market shift.

The top five performing stocks in the CNBC Investing Club’s portfolio reflect the current market dynamics. Companies like Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover have all delivered significant gains. Factors driving these gains vary from improved sales performance to potential policy changes and market demand. For instance, Ford Motor’s outperformance has been attributed to increased hybrid vehicle sales, while Morgan Stanley has benefited from positive investor sentiment surrounding policy changes.

As a subscriber to the CNBC Investing Club, members receive trade alerts before Jim Cramer makes a move in the portfolio. Cramer employs a cautious approach, waiting 45 minutes after sending a trade alert before executing a trade. This method ensures that members have timely information while also allowing for careful consideration of investment decisions.

The recent trends in the stock market underscore the importance of strategic portfolio management and timely decision-making. By staying attuned to market rotations, sector performance, and key driving factors for individual stocks, investors can position themselves for success in a dynamic and ever-changing market environment. Jim Cramer’s approach to trading, coupled with the insights provided by the CNBC Investing Club, offers valuable guidance for navigating the complexities of the stock market.

Leave a Reply