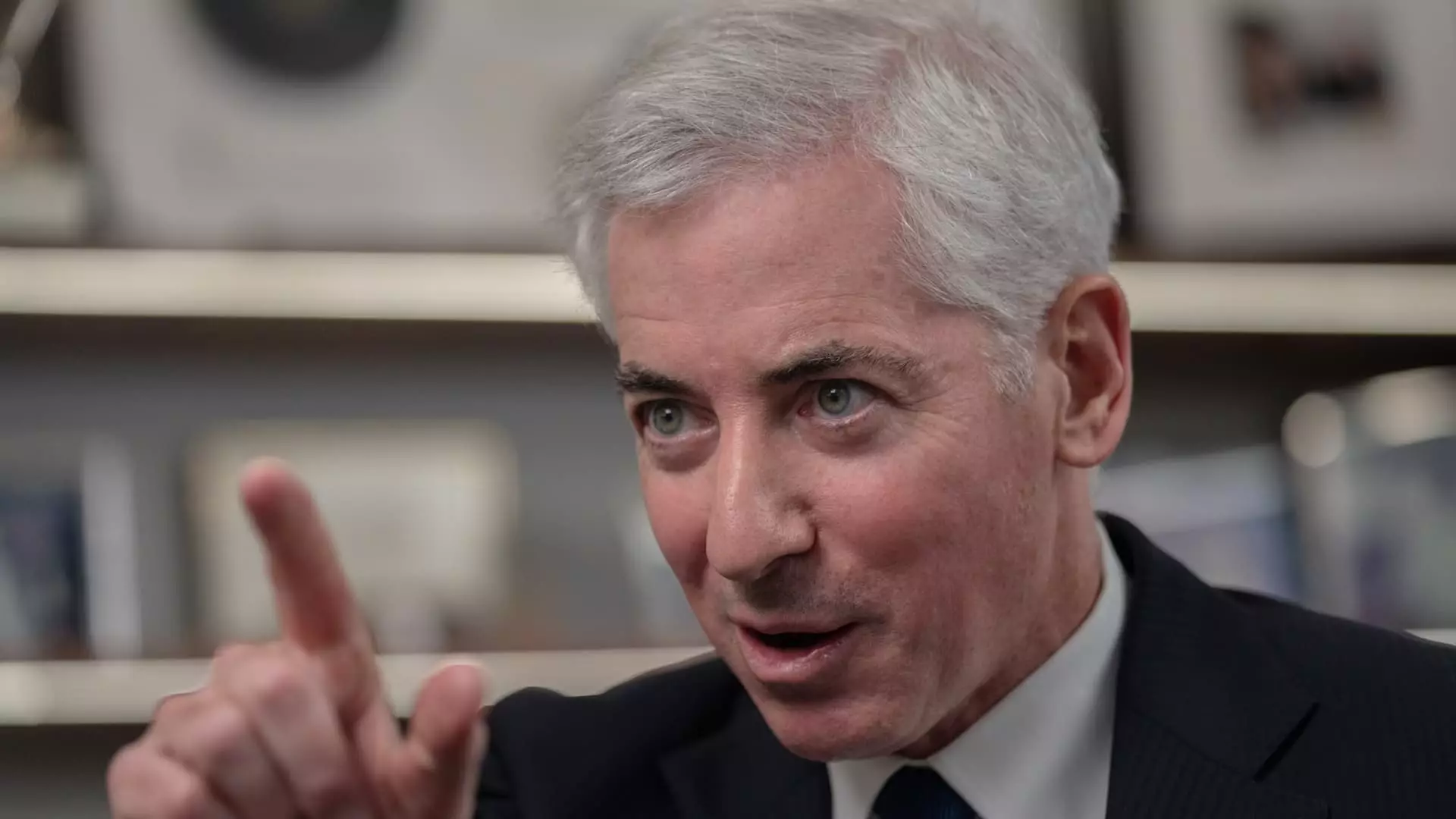

Bill Ackman, the well-known hedge fund manager, recently decided to withdraw his plans for an initial public offering (IPO) due to a perceived lack of investor interest. This decision comes as a surprise, especially considering Ackman’s initial aspirations to model his fund after the successful Berkshire Hathaway. It seems that the original expectations for the IPO did not align with the actual demand from investors.

Despite the setback, Ackman remains optimistic and has stated that he will come back with a revised plan for the offering. This demonstrates his determination and resilience in the face of challenges. Ackman’s decision to regroup and strategize for a more successful IPO attempt shows his commitment to the long-term success of his fund.

Initially hoping to raise $25 billion through the IPO, Ackman ultimately fell short with a target of $2 billion. This significant gap in funding goals likely contributed to the decision to withdraw the IPO plans. It is essential for fund managers to accurately gauge investor interest and set realistic funding targets to avoid disappointment.

The withdrawal of Ackman’s IPO plans also sparked reactions from the investment community. Reports indicate that prominent investment firms, such as Baupost Group, chose not to invest in the offering. This decision came after Ackman had touted the participation of Seth Klarman’s Boston-based hedge fund. Investor sentiment plays a crucial role in the success of an IPO, and Ackman’s experience highlights the importance of building trust and credibility with potential investors.

Public Perception and Retail Investors

Ackman’s decision to publicly list Pershing Square was seen as a strategic move to leverage his growing influence among retail investors. With over one million followers on social media platform X, Ackman has a significant platform to share his views on various topics. However, the discrepancy between his online presence and the actual investor interest in the IPO suggests that building a strong online presence does not guarantee success in fundraising efforts.

Bill Ackman’s experience with withdrawing his IPO plans serves as a valuable lesson in setting realistic goals, gauging investor interest accurately, and building trust with potential investors. Despite the initial setback, Ackman’s determination to revise his plans for the offering reflects his resilience and commitment to achieving long-term success in the financial markets.

Leave a Reply