In the second quarter of 2024, Berkshire Hathaway’s cash reserve hit a record high of $276.9 billion, surpassing the previous record of $189 billion from the first quarter. This increase was primarily driven by Warren Buffett’s decision to sell off a significant portion of his stock holdings, including a substantial portion of his stake in Apple. The Oracle of Omaha has been steadily selling off stocks for the past seven quarters, but his selling activity intensified in the second quarter, with over $75 billion worth of equities sold. This trend has continued into the third quarter, as shown by the recent filing indicating the trimming of Berkshire’s stake in Bank of America for 12 consecutive days.

Despite the selling of stocks, Berkshire Hathaway’s operating earnings saw a significant boost in the second quarter. Operating earnings, which include profits from fully-owned businesses, totaled $11.6 billion, marking a 15% increase from the previous year. This growth was largely attributed to the strong performance of auto insurer Geico, which enjoyed a substantial increase in underwriting earnings before taxes, reaching nearly $1.8 billion in the second quarter.

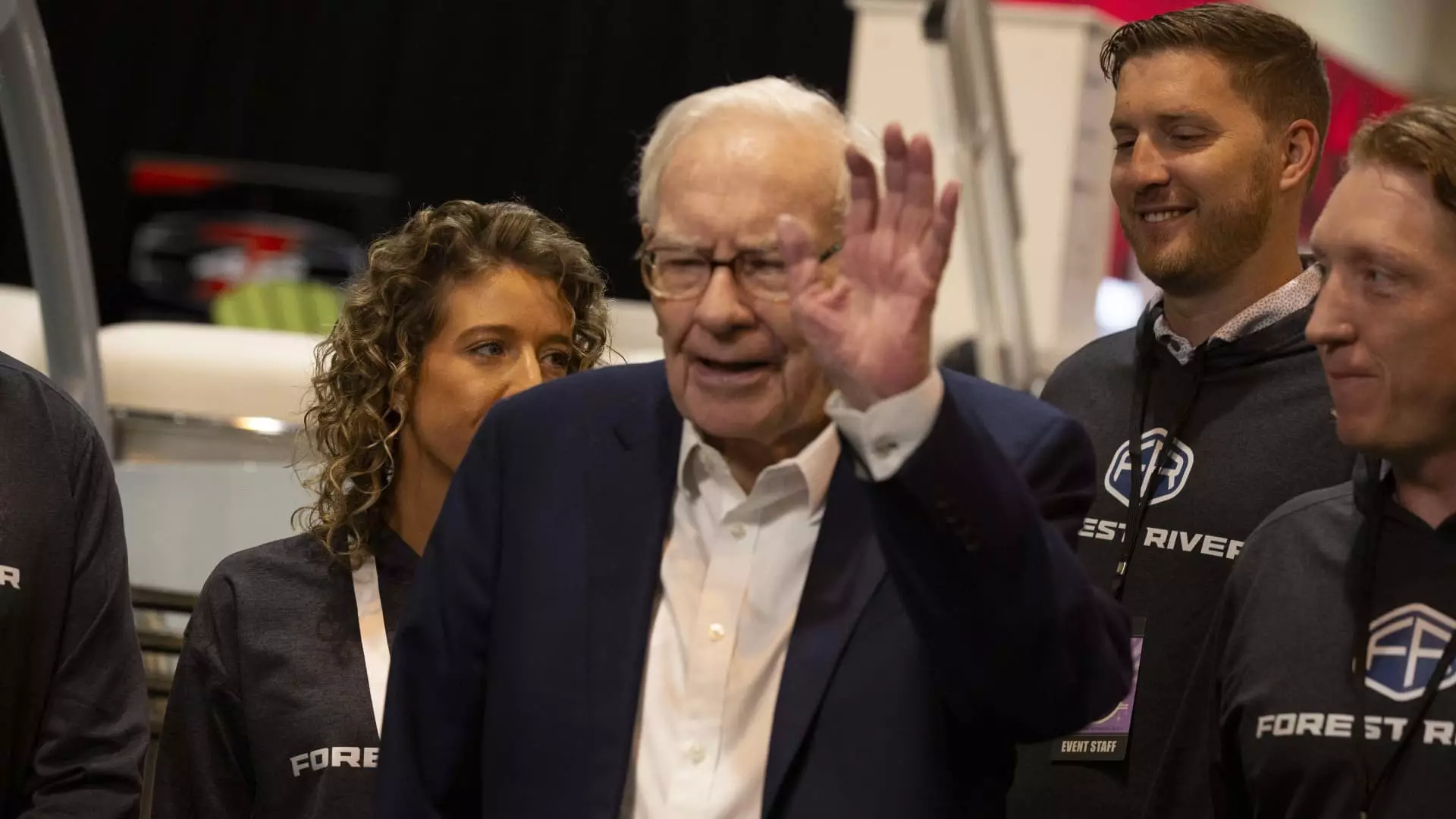

Buffett’s Investment Strategy

Warren Buffett, who will be turning 94, expressed his hesitancy to deploy capital in the current market environment due to high prices. At Berkshire’s annual meeting in May, Buffett emphasized the importance of investing in businesses with low risk and high return potential. Despite having a significant cash reserve, Berkshire bought back only $345 million of its own stock in the second quarter, a stark contrast to the $2 billion repurchased in each of the prior two quarters. Buffett’s cautious approach reflects his reluctance to invest in overvalued assets, even as the S&P 500 continues to reach record levels.

Market Concerns and Economic Outlook

The recent surge in the S&P 500 has been driven by investor optimism around the Federal Reserve’s inflation management and the avoidance of an economic recession. However, concerns about a slowing economy have resurfaced, with weak data, such as the disappointing July jobs report, sparking fears of an economic downturn. The recent market turbulence, as evidenced by the 600-point drop in the Dow Jones Industrial Average, has raised questions about the sustainability of the current bull market, particularly in the technology sector.

Berkshire Hathaway’s subsidiaries demonstrated varying performance in the second quarter. While Geico reported a significant increase in underwriting earnings, BNSF Railway’s profit remained consistent with the previous year. However, Berkshire Hathaway Energy’s utility business faced challenges, with earnings declining to $326 million, nearly half of the previous year’s earnings. The pressure from potential wildfire liability has further added to the challenges faced by BHE in maintaining profitability.

Berkshire Hathaway’s cash pile reached a new high in the second quarter of 2024, driven by Warren Buffett’s strategic selling of stocks. Despite the robust operating earnings from key subsidiaries like Geico, Buffett’s cautious investment approach reflects concerns about the market’s high valuation. As economic uncertainties persist and market volatility increases, Berkshire Hathaway faces challenges in deploying its massive cash reserve effectively to generate long-term value for its shareholders.

Leave a Reply