The U.S. stock market showed signs of recovery on Wednesday after a three-day losing streak. The S & P 500, Dow Jones Industrial Average, and Nasdaq Composite all experienced gains, with the S & P 500 climbing 1.5%, and the Dow and Nasdaq jumping 1% and 1.9%, respectively. Jim Cramer described the day as a positive one, following a previous decline driven by concerns over the “yen carry trade” and U.S. recession worries triggered by a disappointing jobs report.

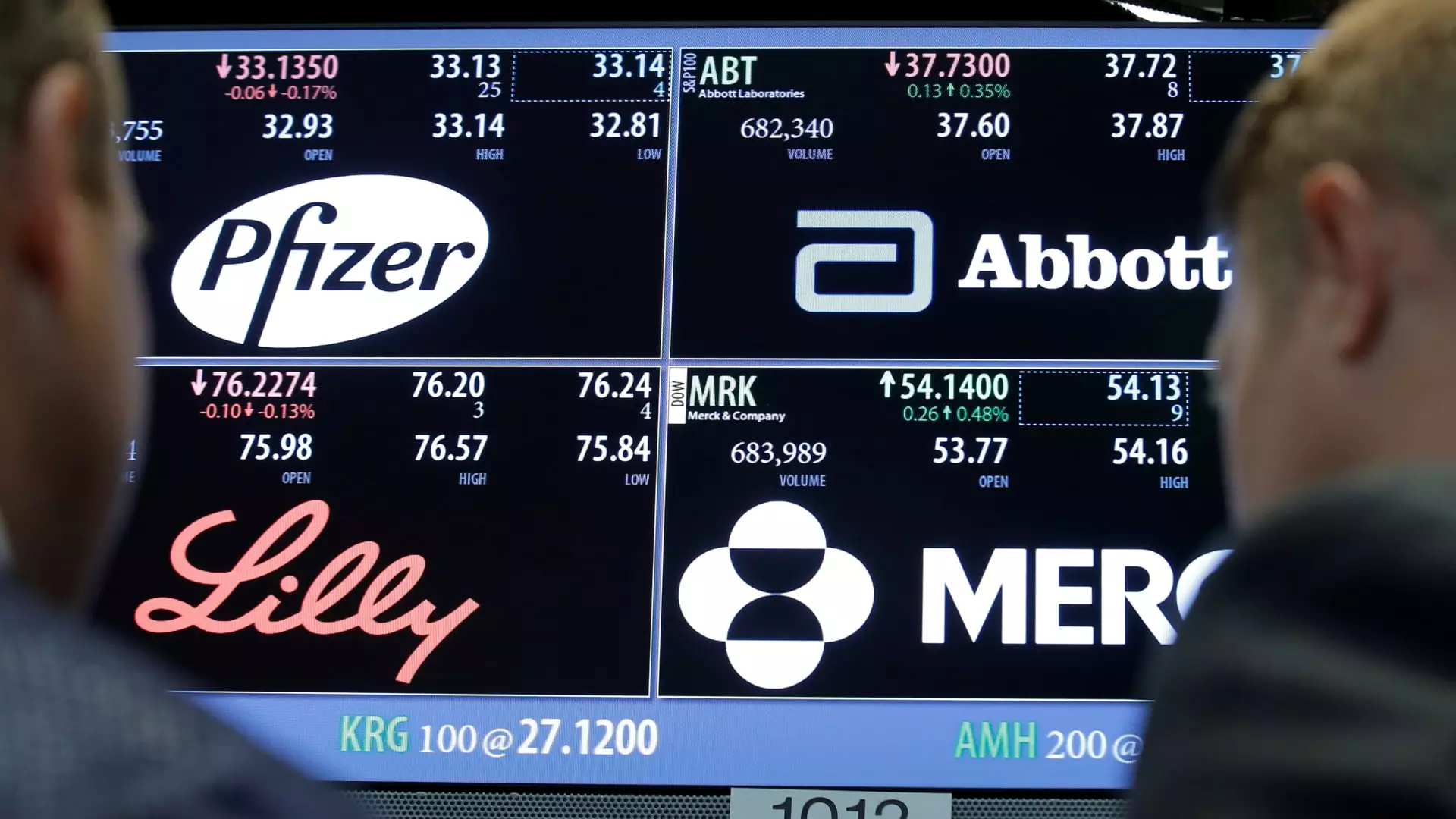

Shares of pharmaceutical company Eli Lilly declined by 1.7% on Wednesday after competitor Novo Nordisk reported underwhelming earnings prior to the market opening. Novo Nordisk’s weaker-than-expected net profit for the second quarter raised questions about Eli Lilly’s own performance, particularly regarding its GLP-1 drugs Zepbound and Mounjaro. Despite this, the sales miss from Novo Nordisk was attributed to higher concessions to U.S. pharmacy benefit managers rather than a decrease in drug demand. Jim Cramer warned that Eli Lilly’s shares could continue to fall following its upcoming quarterly results.

Amazon received positive news regarding its e-commerce business following CVS Health’s quarterly earnings report. CVS Health announced plans to close 900 retail drug stores by the end of the year, freeing up space for Amazon to dominate the shipping of essential items. This development led to a nearly 3% increase in Amazon’s stock value on Wednesday. Jim Cramer’s Charitable Trust holds positions in both Eli Lilly and Amazon, reflecting confidence in the potential of these companies.

Members of the CNBC Investing Club with Jim Cramer receive trade alerts prior to Jim’s trading activities. There is a delay of 45 minutes between the issuance of a trade alert and the actual trading of a stock in Jim’s charitable trust portfolio. Additionally, if Jim discusses a particular stock on CNBC TV, a waiting period of 72 hours is observed before executing a trade. It is essential for subscribers to be aware of the club’s terms and conditions, privacy policy, and disclaimer, as no specific outcome or profit is guaranteed. The club does not create a fiduciary obligation or duty based on the information provided.

Overall, it is evident that the stock market is influenced by various factors, including economic data, industry performance, and company-specific news. The CNBC Investing Club with Jim Cramer provides valuable insights and analysis to help members navigate the complexities of the market. By staying informed and proactive, investors can make informed decisions to optimize their portfolios and achieve their financial goals.

Leave a Reply