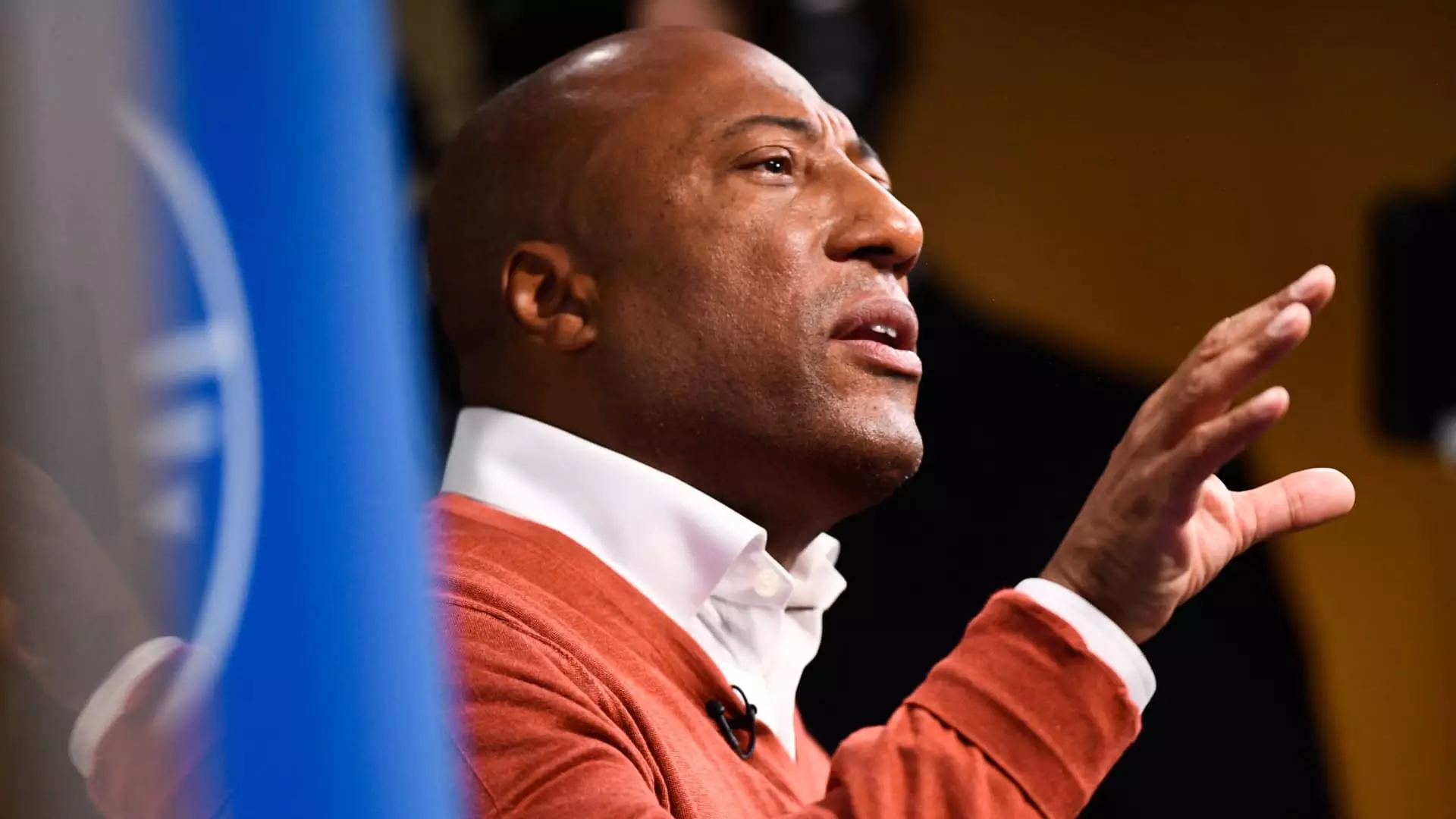

Byron Allen’s media empire, consisting of broadcast stations owned by Allen Media Group, has found itself in hot water due to consistently late payments to network owners, including major players like ABC, CBS, and NBC. The delayed payments, totaling tens of millions of dollars, have left network owners frustrated and feeling neglected. This lack of financial responsibility has not only angered media allies but has also created a rift between Allen and potential deal partners. The extent of the lateness in payments has only worsened over time, as the group has been as much as 90 days past due on their financial obligations.

The reasons behind Allen Media Group’s repeated tardiness in payments remain unclear, leaving industry insiders perplexed and concerned. Network owners rely on timely payments to fund their operations and to acquire content rights, making Allen’s behavior particularly problematic. In addition to the financial troubles, various divisions of Allen’s company, located across multiple markets, have reported undergoing layoffs in recent months. Another round of job cuts is looming on the horizon, adding to the uncertainty surrounding the future of the media empire.

Despite the financial hiccups and internal challenges, Byron Allen has continued his pursuit of major media acquisitions, with bids totaling billions of dollars. However, his track record of failed deals has raised doubts among investment bankers and financial institutions about his credibility as a serious buyer for large media assets. Allen’s recent bids, including a $30 billion offer for Paramount Global, a $10 billion bid for ABC, and a reported $3.5 billion offer for Paramount’s BET Media Group, signify his ambitions to expand his media holdings. Yet, his inability to follow through with these deals has cast shadows over his reputation as a reputable buyer in the industry.

Byron Allen’s journey from a comedian to a media mogul is well-documented, with the founding of Entertainment Studios, now known as Allen Media Group, in 1993. The formation of Allen Media Group Broadcasting in 2019 marked a pivotal moment in his quest to build a broadcast media empire. With a series of smaller deals and acquisitions, Allen has expanded his reach to include assets like The Weather Channel, broadcast TV stations, and smaller TV networks like Pets.tv and Comedy.tv. His most recent acquisition of seven stations from Gray Television for $380 million demonstrates his commitment to growing his media empire.

The broadcasting industry, like many other sectors, is facing challenges due to changing consumer behavior and technological advancements. While broadcast stations generate revenue through advertising and retransmission fees, the shift towards streaming services has posed a threat to traditional TV. Record political advertising ahead of the presidential election is expected to provide a short-term boost to broadcast station owners, but long-term sustainability remains a concern. With the rise of cord-cutting and the migration of content to streaming platforms, broadcast station groups, including Allen Media Group, must adapt to survive in an evolving media landscape.

While Byron Allen’s media empire has experienced significant growth and expansion in recent years, the challenges of late payments, failed acquisitions, and layoffs highlight the fragility of the industry. As Allen continues to navigate the complexities of the media landscape, he must address the underlying issues within his organization to ensure its long-term success and viability. Only time will tell if Allen’s ambitions to become a major player in the media industry will come to fruition.

Leave a Reply