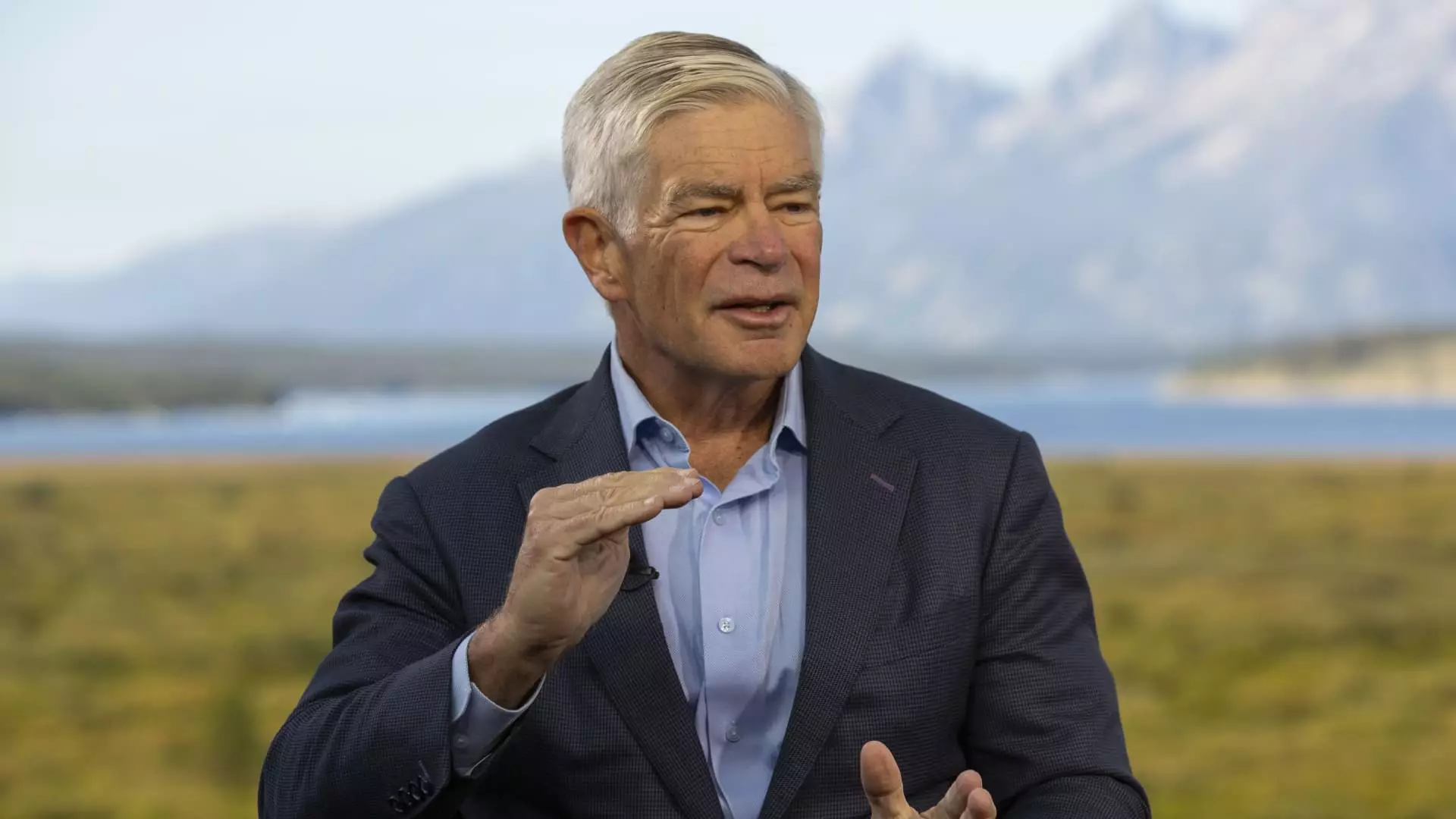

Philadelphia Federal Reserve President Patrick Harker recently expressed his support for an interest rate cut in September. Speaking at the Fed’s annual retreat in Jackson Hole, Wyoming, Harker emphasized the need for monetary policy easing to address potential weaknesses in the economy. He believes that a gradual and well-signaled approach to lowering rates is necessary.

While markets are currently pricing in a high likelihood of a quarter percentage point cut, Harker remains cautious about committing to a specific rate reduction. He mentioned that more data is needed before making a final decision on whether a 25 or 50 basis point cut is appropriate. The Federal Reserve has maintained its benchmark overnight borrowing rate for several years to combat inflation but is now considering a change due to shifting economic conditions.

Independence from Political Concerns

Harker emphasized the independence of the Federal Reserve from political pressures, particularly with the upcoming presidential election. He stated that Fed policymakers are proud technocrats whose primary responsibility is to analyze data and make informed decisions. Despite external factors, the Fed’s primary focus is on maintaining economic stability and making necessary adjustments to monetary policy.

Implications for the Labor Market

Kansas City Fed President Jeffrey Schmid echoed Harker’s sentiments regarding the need for potential rate cuts. He highlighted the rising unemployment rate as a significant factor in the decision-making process. A shift in the labor market dynamics, including a slowdown in job indicators and a gradual increase in the unemployment rate, has prompted policymakers to consider easing monetary policy to stimulate economic growth.

Assessment of Banking Sector

Although acknowledging the challenges posed by the high-rate environment, Schmid expressed confidence in the resilience of the banking sector. He believes that monetary policy is not overly restrictive and has contributed to overall financial stability. As policymakers evaluate the impact of potential rate cuts, they must also consider the implications for the banking industry and overall economic health.

Both Harker and Schmid do not have voting rights this year on the Federal Open Market Committee but play a crucial role in providing input and insights for future policy decisions. While Harker will have a vote in 2026, Schmid’s input will be essential for shaping the Fed’s policy direction in the coming year. As economic conditions evolve and new data emerges, the Fed will continue to assess the need for further adjustments to interest rates to support sustainable economic growth.

The case for an interest rate cut in September is gaining momentum as policymakers recognize the need for proactive measures to address potential economic risks. The Federal Reserve’s commitment to data-driven decision-making and independence from political pressures will be critical in guiding policy adjustments. As the economic landscape continues to evolve, policymakers must remain vigilant and responsive to emerging trends to ensure stability and growth in the financial markets.

Leave a Reply