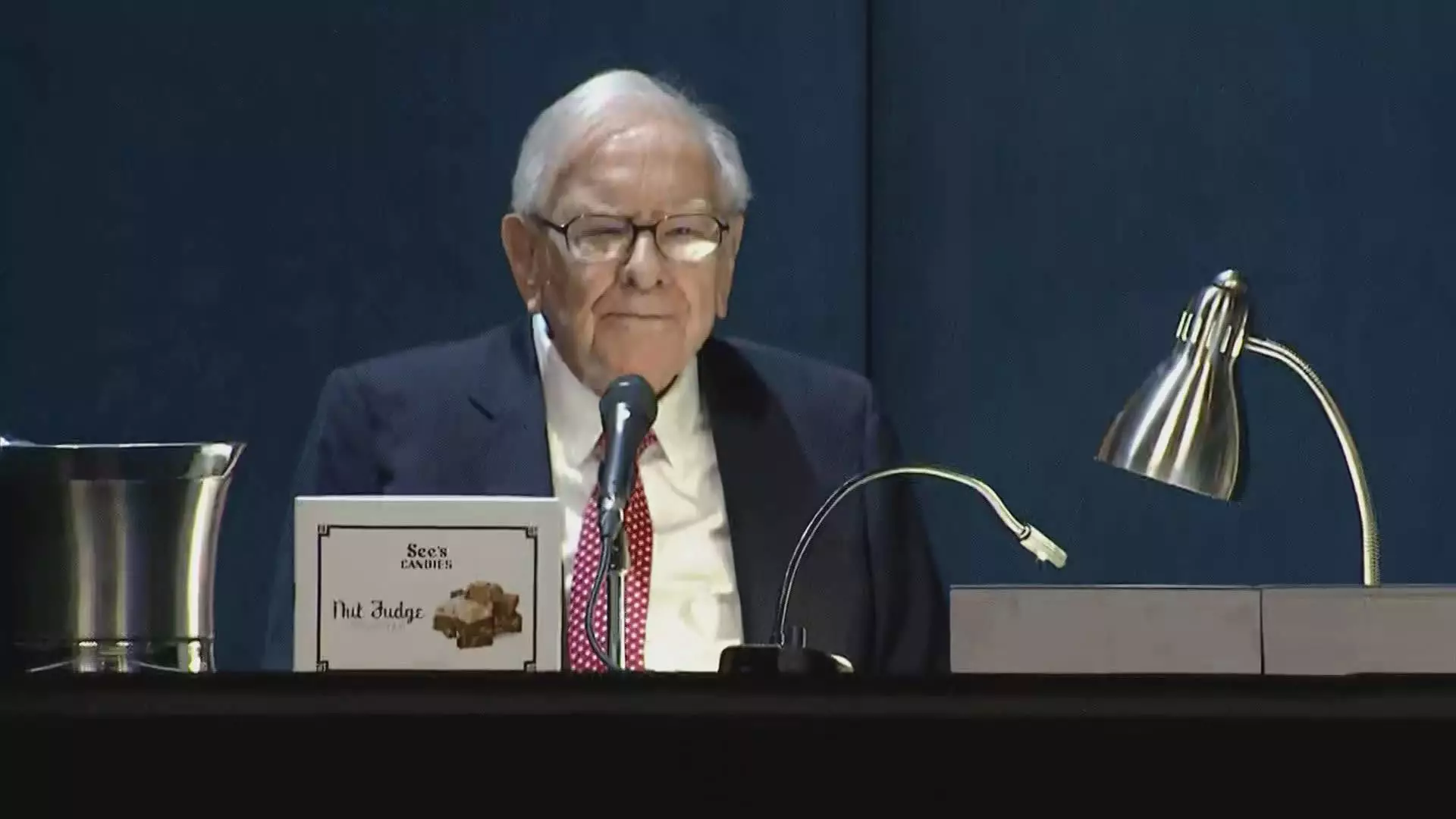

Warren Buffett, the CEO of Berkshire Hathaway, has long been noted for his keen investment strategies, particularly his emphasis on value investing. One of his most significant ventures has been his stake in Apple, which he initially purchased eight years ago. At the peak of this investment, Apple represented a staggering half of Berkshire’s equity portfolio. Buffett’s decision to invest in Apple marked a notable shift because, for decades, he had steered clear of technology companies, deeming them outside his realm of expertise. His affinity for Apple stemmed not from an admiration of tech, but from the company’s dedicated customer base and the ‘stickiness’ of the iPhone, which he viewed as a reliable product with impressive brand loyalty.

Over the past year, however, Buffett has embarked on a conspicuous strategy of trimming down his Apple shares. As of the end of September, Berkshire held $69.9 billion in Apple stocks, down approximately 67.2% from the same time last year. This dramatic reduction signals that Buffett sold off roughly 300 million shares, a significant portion of what was once his flagship investment. The decision to divest has occurred over several quarters, escalating in intensity during the second quarter when he notably halved his stake in the tech giant.

While some analysts have speculated that high valuations may be prompting this ongoing selling pressure, there also lurks the overarching notion of portfolio management and risk diversification. High concentration in a singular stock can create unwarranted risk exposure, which is likely concerning for a sophisticated investor like Buffett.

Possible Motivations Behind the Sales

Buffett hinted during the Berkshire annual meeting in May that his sales might be influenced by tax considerations. He implied that potential increases in capital gains taxes could be around the corner, suggesting that selling now could allow him to sidestep higher future taxes. However, the scale of his sell-off raises questions as to whether tax strategies alone drove his decisions or whether there are other substantial factors at play.

In the context of Berkshire’s financials, by selling off a portion of its Apple shares, Buffett has also managed to amass a historic cash reserve totaling $325.2 billion by the end of Q3. This indicates a shift in focus, perhaps hinting at a more cautious investment approach or positioning for future opportunities. The company even opted to halt share buybacks during this time of selling, raising queries about its future investment strategy.

As of now, while Apple has seen a commendable 16% increase in stock price over the year, it trails behind the S&P 500’s 20% growth. This presents a paradox; while Berkshire’s investment may have been sound at its inception, continued performance scrutiny and Buffett’s sustained sell-off seem to reflect a reevaluation of risk and reward in this partnership. It begs the question: Has Buffett’s faith in Apple waned, or is he simply reorienting his investment strategies to align with broader market dynamics?

Warren Buffett’s strategy regarding Apple signals a noteworthy shift both in his investment philosophy and in the tactical approach of Berkshire Hathaway. As we observe these changes unfold, it is essential to consider the implications of such decisions, not merely as a reflection of stock performance but as a broader commentary on how even the most astute investors adapt to changing financial landscapes.

Leave a Reply