In recent years, family offices have emerged as significant players within the venture capital landscape, especially in the realm of startup investments. According to a comprehensive analysis conducted by CNBC, in collaboration with Fintrx—a private wealth intelligence firm—it was revealed that the top 10 family offices made over 150 investments in private startups during 2024. This pivotal moment reflects not only the financial prowess of wealthy families but also a strategic shift in how they engage with and influence high-growth sectors such as biotechnology, energy, cryptocurrency, and artificial intelligence (AI).

Family offices, which manage the wealth of a single family and typically operate outside the public eye, have garnered attention for being agile and innovative investors. This shift can be attributed to the increasing sophistication of these investment entities, allowing them to take calculated risks in developing markets where traditional venture capital firms might hesitate. Such advancements indicate that family offices are not merely passive assets; they are now calculated investors that leverage personal ambition and wealth for strategic growth.

At the forefront of this venture capital renaissance is Maelstrom, the family office established by American investor Arthur Hayes, renowned for co-founding the crypto exchange BitMEX. Maelstrom has positioned itself as a leading investor in the blockchain technology sector, aggressively investing in 22 startups this year alone. The varied portfolio includes emerging companies like Cytonic and Infinit, establishing Maelstrom as a trailblazer within the competitive fintech and blockchain arena.

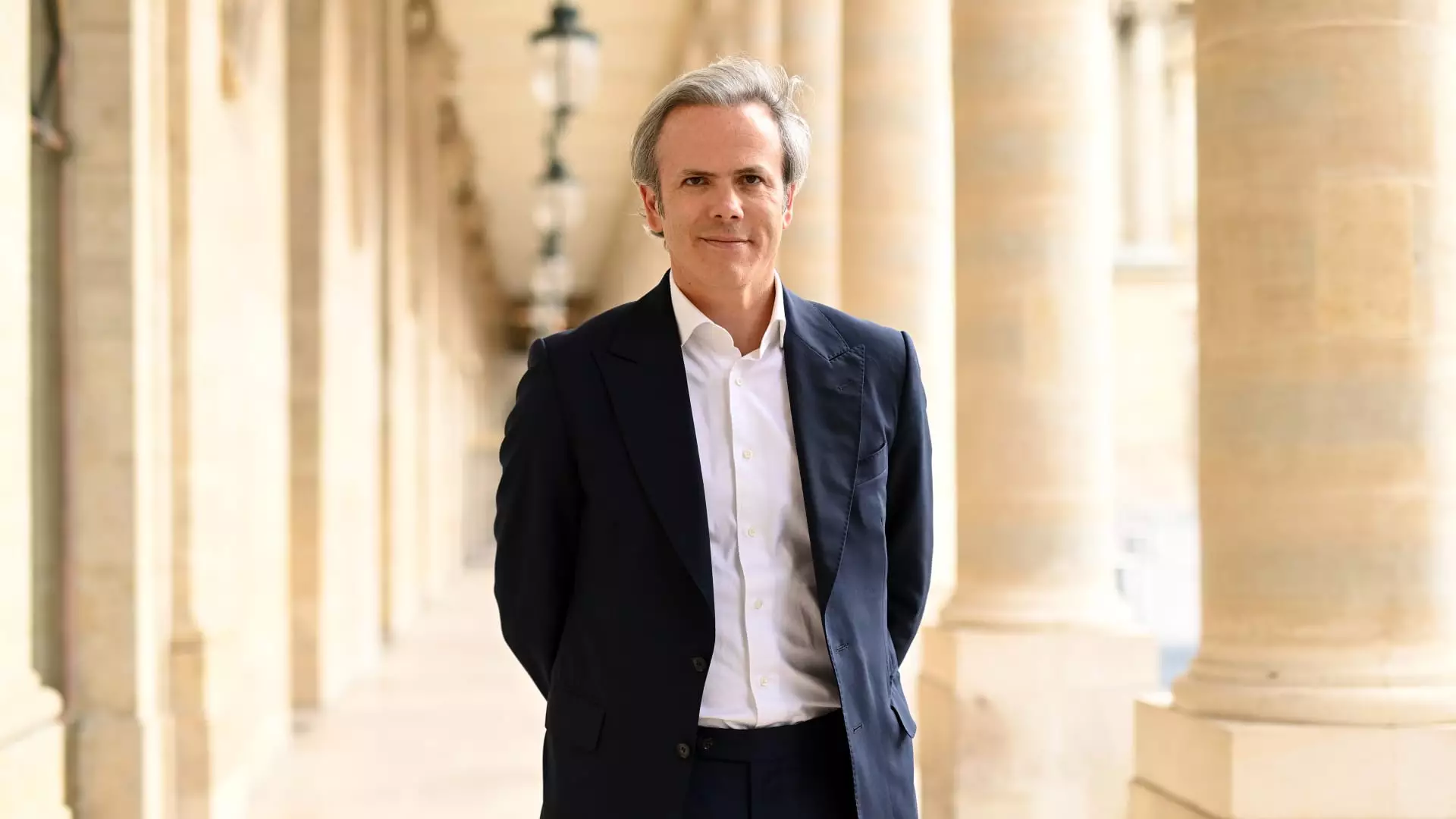

In close competition, Motier Ventures, led by Guillaume Houzé from the illustrious Galeries Lafayette family, has made notable strides with investments in both artificial intelligence and blockchain technologies. Having a keen eye for innovation, Motier became involved with promising endeavors such as Holistic AI, a French startup focusing on generative AI, and Flex AI, a company pushing the envelope on AI computing capabilities. This trend highlights a growing commitment from family offices toward sectors that are not only lucrative but also transformative in nature.

Family offices like Hillspire, Emerson Collective, and Thiel Capital are also making their mark in diverse fields. For instance, Thiel Capital’s investments range from a unique chess platform by champion Magnus Carlsen to an innovative fertility clinic firm, underlining a diversified investment strategy that is fueled by foresight and adaptability. This increasing trend toward multi-faceted investments among family offices indicates a deeper understanding of market dynamics and an appetite for pioneering industries.

One cannot overlook the role of artificial intelligence in steering family offices towards promising horizons. The UBS Global Family Office Report illuminates that over 78% of family offices plan to invest in AI over the next few years—a clear indication that AI has solidified its status as an investor favorite. Companies such as Aglaé Ventures, linked to LVMH’s Bernard Arnault, have also jumped on this trend, emphasizing AI’s potential to revolutionize various sectors.

This surge toward AI investments demonstrates that family offices are not merely spectators in the tech evolution but are actively engaging with and contributing to it. They leverage their wealth to explore cutting-edge technologies while seeking more profound insights related to their other investments in sectors like energy.

While the potential upside for family offices is increasingly evident, investing in startups directly presents distinct challenges. The volatility associated with tech ventures can lead to significant paper losses, particularly during periods of economic downturns. Family office advisor Nico Mizrahi astutely points out that some families may overextend their ambitions, chasing trends without the requisite experience. This lack of discipline could lead to disastrous consequences, highlighting the importance of strategic partnerships and co-investing with seasoned venture capital firms.

Co-investing has become a pivotal strategy as it allows family offices to partake in favorable deals without assuming the entire burden of risk. This cooperative approach not only minimizes exposure but also enhances learning opportunities for family wealth managers who may be navigating intricate tech landscapes for the first time.

The evolution of family offices into formidable players in the startup investment realm marks a new chapter in venture capital. Their penchant for innovative sectors such as AI reflects a broader trend of personalization in investing, one that combines prudence with a spirit of adventure. As these family offices continue to expand their reach and capabilities, they are likely to drive significant changes in the startup ecosystem, making their collective voice even more influential in shaping the future of investment.

Family offices are proving that they can not only hold wealth but use it strategically, adapting to market dynamics in an ever-changing financial landscape. As they persist in navigating these investments, the results will likely redefine not just their portfolios but also the industries they engage with.

Leave a Reply