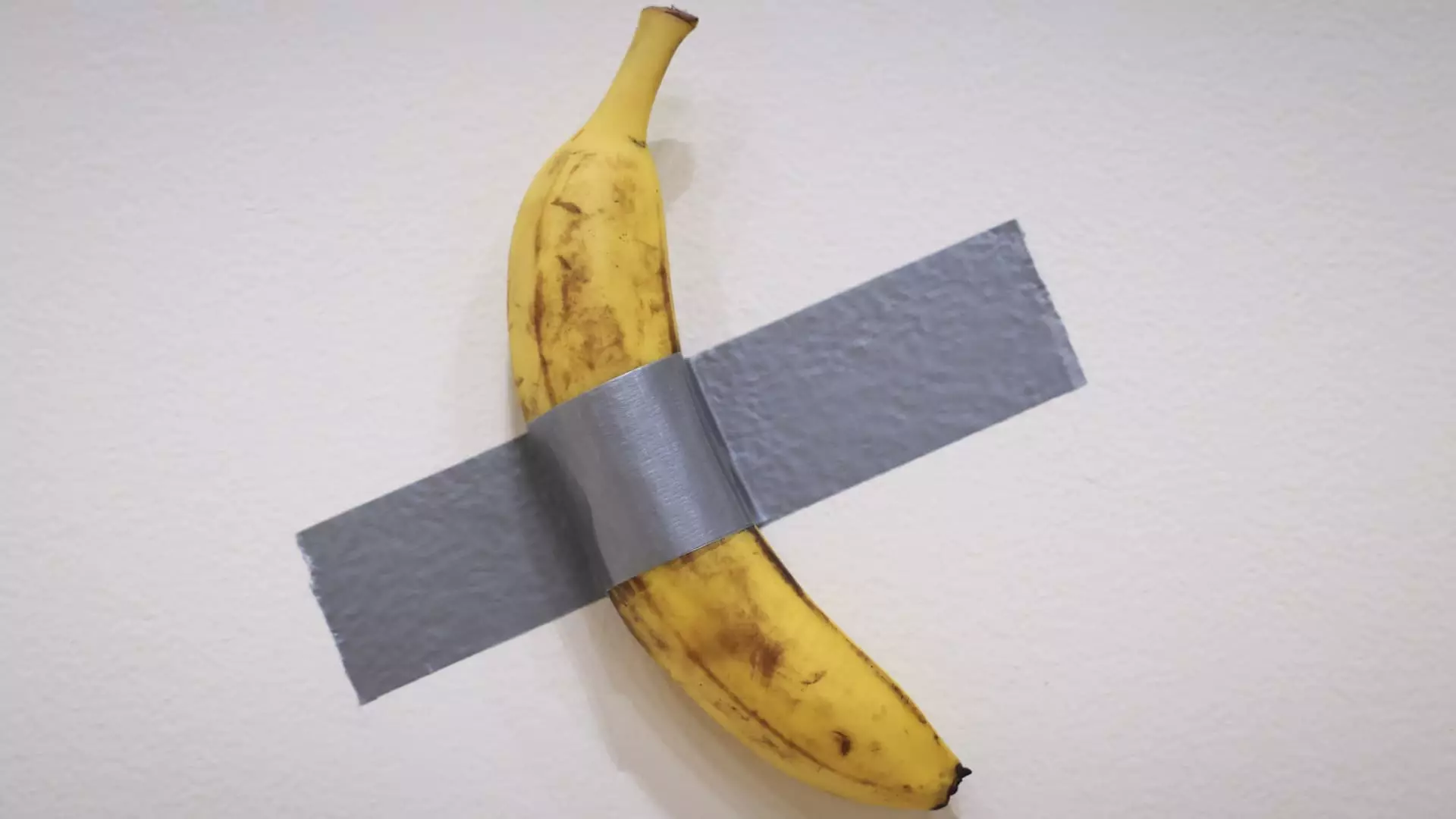

In an age where the lines between art, celebrity culture, and digital finance continue to blur, one recent investment stands as both a statement piece and a spectacle of excess. Crypto investor Justin Sun made headlines by purchasing a banana duct-taped to a wall for a staggering $6.2 million. This bizarre transaction, executed during a Sotheby’s auction, epitomizes the current zeitgeist—the convergence of cryptocurrency, art, and cultural memes. This audacious purchase raises critical questions about the nature of value, the evolution of art appreciation, and the dynamics of affluence in contemporary society.

Sun’s triumph at the auction was not just a simple transaction; it was a culmination of a bidding war among six contenders vying for the infamous piece titled “Comedian.” Created by Italian artist Maurizio Cattelan, this artwork debuted at Art Basel Miami Beach in 2019, initially priced at a comparatively modest $120,000. The absurd nature of the artwork—a banana affixed to a wall with duct tape—turned it into a viral sensation, flooding social media and captivating the public imagination. The event was indicative of a broader trend in which unconventional art forms attract immense attention and, subsequently, a premium price tag.

Sun’s victorious bid, which he made using cryptocurrencies, highlights the growing acceptance of digital currencies within high-art transactions. In his comments following the auction, he emphasized that “Comedian” transcends mere artistic merit; for him, it embodies a cultural phenomenon that connects the realms of art, internet memes, and the crypto community. By positioning the piece as a “cultural bridge,” Sun suggests that the art transcends its physical presence, ultimately gaining value from the narrative and community surrounding it.

The artwork itself, while seemingly absurd at first glance, can be interpreted as a commentary on the state of consumerism and value in the modern world. The banana, which can be quickly consumed or perish in a matter of days, stands in stark contrast to the permanent status generally associated with fine art. The real value lies not in the physical object but in the certificate of authenticity provided to the buyer—a notion reminiscent of non-fungible tokens (NFTs).

This comparison to NFTs brings to the forefront the philosophical quandaries about ownership and value in the digital age. If the worth of an artwork can be derived from a digital certificate, then it prompts thoughtful discourse about what it means to own art in an evolving landscape. Does ownership still pertain to the physical object, or has it shifted towards the idea, the concept, or even the brand that the artwork represents? Such a shift not only challenges traditional art markets but also encapsulates the essence of 21st-century capitalism where perceived value often outweighs the intrinsic properties of the object itself.

The Market Impact: A Sign of Recovery?

Sun’s purchase comes at a multifaceted moment in the art market’s history. After experiencing two years of declines, recent sales have hinted at a resurgence, possibly spurred by revived investor confidence following stock market rallies and a changing economic landscape post-elections. The sale of high-profile pieces, such as Monet’s water lilies fetching $65.5 million and Rene Magritte’s painting commanding $121 million, underscores a rejuvenation in collector interest.

These developments suggest that wealthy individuals are increasingly willing to invest in art not merely as aesthetic appreciation but as a financial instrument—an asset class that promises not just satisfaction but capital appreciation. The intersection of cryptocurrencies and high art adds another layer of complexity to this narrative, appealing to a new generation of collectors who view art through the prism of investment.

Justin Sun’s bold acquisition of a duct-taped banana is emblematic of a transformative era in the art world—a fusion of culture, technology, and finance. It provokes serious reflection on how we define art, ownership, and value in an increasingly digital landscape. As collectors navigate this new paradigm, the outcomes of such investments may redefine art’s role in society, challenging the age-old structures that have traditionally governed the appreciation and valuation of artistic endeavors. The case of the banana may not just be a curious anecdote; it could well mark the beginning of a new movement wherein art is seen not merely as a product but as an evolving idea, ripe with potential for discourse and debate.

Leave a Reply