The Nasdaq-100 index is a vital barometer of technology and growth-oriented companies. Comprising 100 of the largest non-financial firms listed on the Nasdaq, it often serves as a preferred investment vehicle for those looking to gain exposure to the tech sector. The index undergoes annual rebalancing, during which companies are added or removed based on several criteria, including market capitalization, liquidity, and share availability. As part of this rigorous assessment, the inclusion of firms not traditionally associated with technology has risen, perhaps illustrating a shift in market dynamics where digital assets are increasingly taking center stage.

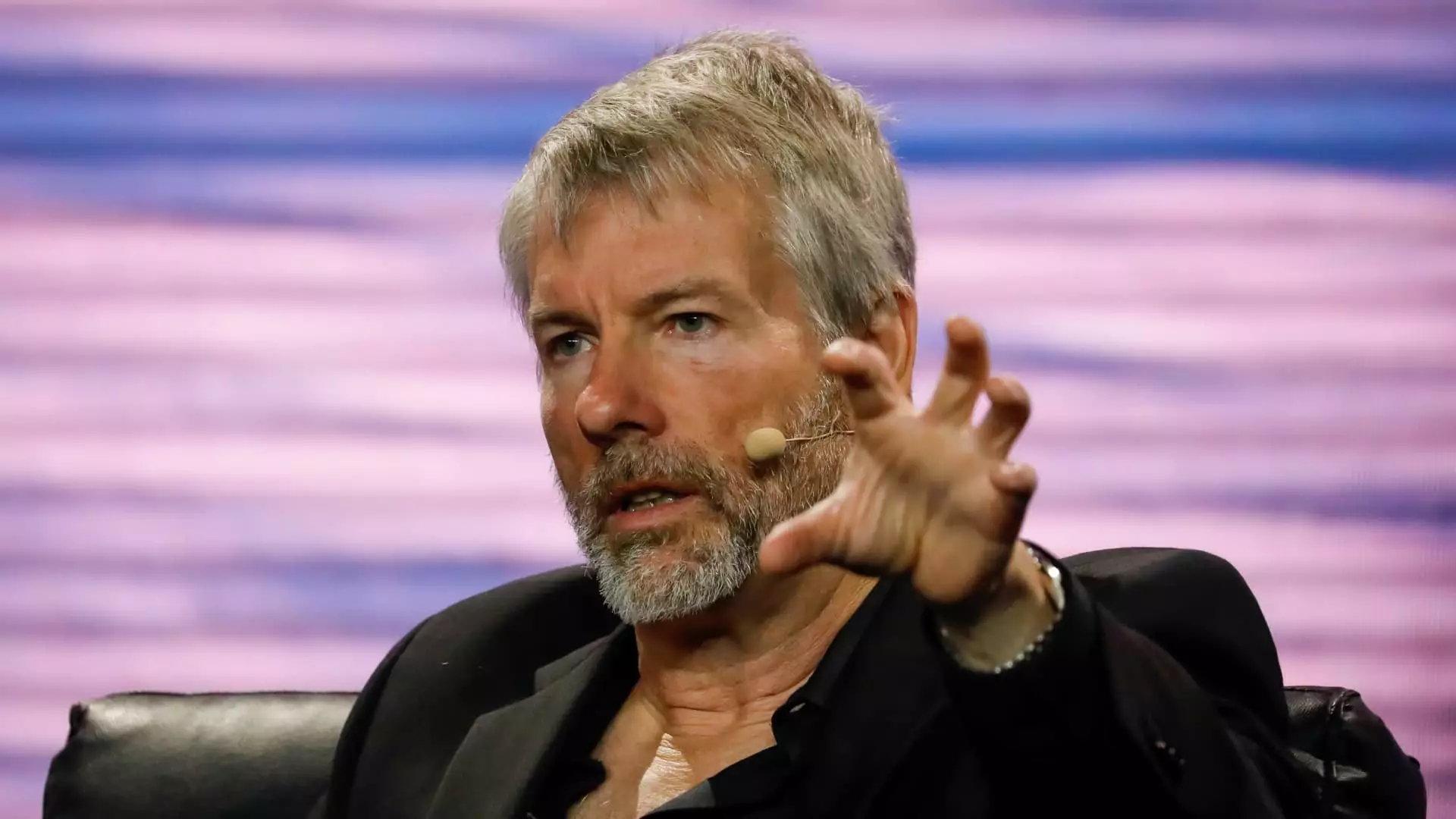

MicroStrategy’s Resounding Growth in 2024

MicroStrategy, a company that has boldly invested in Bitcoin, has seen an extraordinary rise this year, with shares soaring by an astonishing 547%. This growth trajectory starkly contrasts with the S&P 500, which has yielded a comparatively modest gain of 26.9% during the same period. Such a leap demonstrates not just a speculative investment trend but also the company’s strategic commitment to Bitcoin as a core asset in its portfolio. MicroStrategy’s decision to accumulate significant Bitcoin reserves—more than 420,000 BTC—positions it as a leading corporate influencer in the cryptocurrency sphere.

MicroStrategy’s upcoming inclusion in the Nasdaq-100 index, effective December 23, promises to spur passive investment inflows, especially through the Invesco QQQ Trust ETF, which tracks the Nasdaq-100. This exposure is likely to attract institutional investors who view MicroStrategy not merely as a software company but as a legitimate proxy for Bitcoin investment. As assets under management in ETFs linked to this index grow, MicroStrategy stands to benefit from enhanced visibility and credibility among financial market participants.

The cryptocurrency market is on the rise again, with Bitcoin nearing the $104,650 mark, reflecting a daily gain of over 1%. The connection between MicroStrategy and Bitcoin enhances the latter’s narrative as a store of value, especially amid a backdrop of economic uncertainty. According to analysts, the firm’s Bitcoin buying strategy is unprecedented, with MicroStrategy holding approximately 2% of the total Bitcoin supply, equating to a staggering $44 billion market value as articulated by Bernstein analyst Gautam Chhugani. Such figures underline MicroStrategy’s unique position as both a corporate entity and a Bitcoin champion.

As MicroStrategy prepares to join the ranks of the Nasdaq-100, it heralds both a new chapter for the company and highlights the shifting perspectives on Bitcoin in the traditional financial landscape. With increasing institutional interest and a growing acceptance of digital assets, MicroStrategy exemplifies how companies can successfully navigate the complexities of a rapidly evolving market. As the lines between technology, finance, and cryptocurrency blur, MicroStrategy’s trajectory may well serve as a template for future corporate strategies in the burgeoning world of digital assets.

Leave a Reply