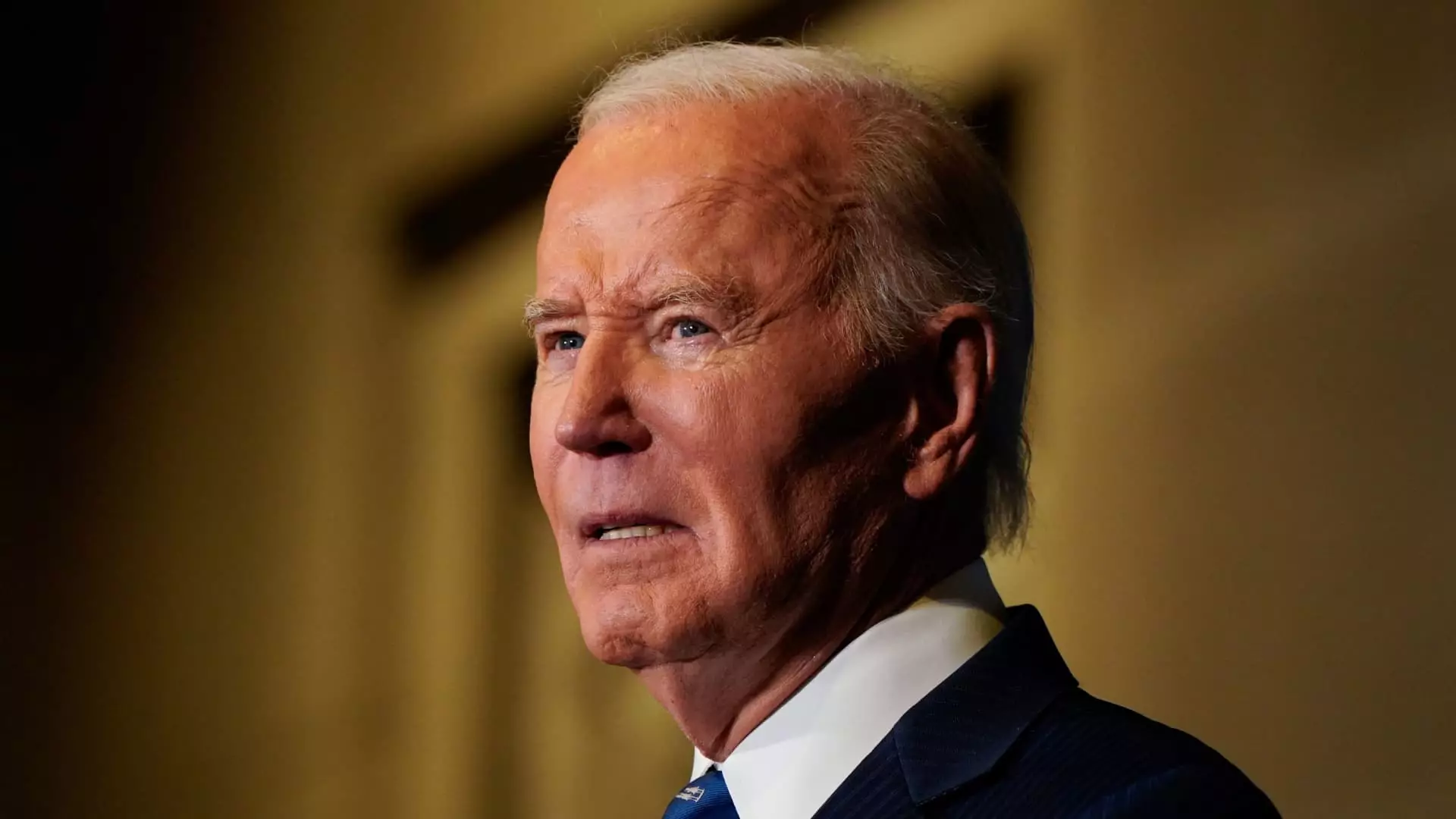

In a significant turn of events, the Biden administration has decided to retract two pivotal proposals aimed at providing student loan forgiveness to millions of borrowers across the United States. These plans were designed to empower the Secretary of the U.S. Department of Education to discharge student loans for specific groups, including long-term borrowers and those facing financial hardships. As a result of this withdrawal, the hopes of many Americans burdened by student debt have been dashed once more. This decision underscores the complexities and challenges associated with student loan forgiveness amid changing political landscapes.

The timing of the withdrawal is critical, occurring just weeks before President-elect Donald Trump assumes office. Trump’s vocal criticism of student loan forgiveness policies, labeling them “vile” and “illegitimate”, has cast significant doubt on the future of any such programs. Higher education expert Mark Kantrowitz suggests that the Biden administration foresaw the likely demise of these forgiveness proposals under a Trump-led administration. The shifting political tides reveal a stark divide on education financing and the treatment of student debt, often reducing critical issues of economic mobility to partisan battles.

By retracting these policies, the Biden administration has reaffirmed the ongoing struggle faced by those affected by the student debt crisis. Advocates for students express profound disappointment at this missed opportunity for meaningful relief. Persis Yu, a notable figure at the Student Borrower Protection Center, voiced her concerns, emphasizing the potential economic opportunities that could have been unlocked for families and children in adverse financial circumstances. The retraction not only undermines the immediate relief sought by borrowers but also casts a long shadow over their hopes for substantial debt relief in the future.

Despite the setback, the Department of Education continues to offer a range of established student loan forgiveness programs, including the Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). These initiatives provide structured paths for certain public service workers and educators to obtain loan forgiveness under specific conditions. With PSLF, government and nonprofit employees can potentially eradicate their federal loans after a decade of consistent repayments, while TLF offers a means for teachers to access forgiveness after teaching in low-income areas for five years.

However, concerns linger among borrowers, particularly regarding the sustainability of these programs. Experts suggest that, although PSLF is legistically enshrined, its future could be jeopardized if new political leadership decides to dismantle it. Elaine Rubin of Edvisors evokes the growing anxiety among current borrowers regarding potential changes in relief availability, indicating a persistent need for clarity amid uncertain times.

For those seeking alternative paths to relief, the Department of Education’s website, Studentaid.gov, remains an invaluable resource. Travelers on this challenging journey can find various federal loan relief options, structured to cater to diverse circumstances and needs. Moreover, local initiatives like the Institute of Student Loan Advisors offer comprehensive databases that detail student loan forgiveness programs by state, catering to the unique challenges faced by borrowers in different regions.

The withdrawal of the Biden administration’s proposed student loan forgiveness plans stands as a sobering reminder of how intertwined educational policies are with the broader political landscape. As the nation prepares for a potentially drastic shift in its approach to student debt, borrowers are left to navigate a more uncertain future marked by both anticipation and apprehension. Although existing programs provide some solace, the need for comprehensive reform and relief remains ever-pressing, particularly for those deeply affected by the student debt crisis. The coming months will be crucial as borrowers brace for the repercussions of these developments and the next chapter of student loan policy unfolds.

Leave a Reply