Super Micro shares plunged by 15% in after-hours trading following the release of its fiscal third-quarter results that fell slightly below expectations. Despite providing an optimistic outlook for its top-line performance, the server maker’s revenue of $3.85 billion missed the mark, with analysts anticipating $3.95 billion.

Despite the revenue miss, Super Micro reported adjusted earnings per share of $6.65 compared to the expected $5.78. The company’s revenue soared by 200% year-over-year for the quarter ending on March 31, a substantial improvement from the 103% increase in the previous quarter. Net income also experienced significant growth, reaching $402.5 million compared to $85.8 million in the same quarter of the previous year.

Super Micro raised its fiscal 2024 revenue guidance to a range of $14.7 billion to $15.1 billion, surpassing analysts’ expectations of $14.60 billion. This updated forecast implies a remarkable 582% year-over-year revenue growth, showcasing the company’s confidence in its future performance.

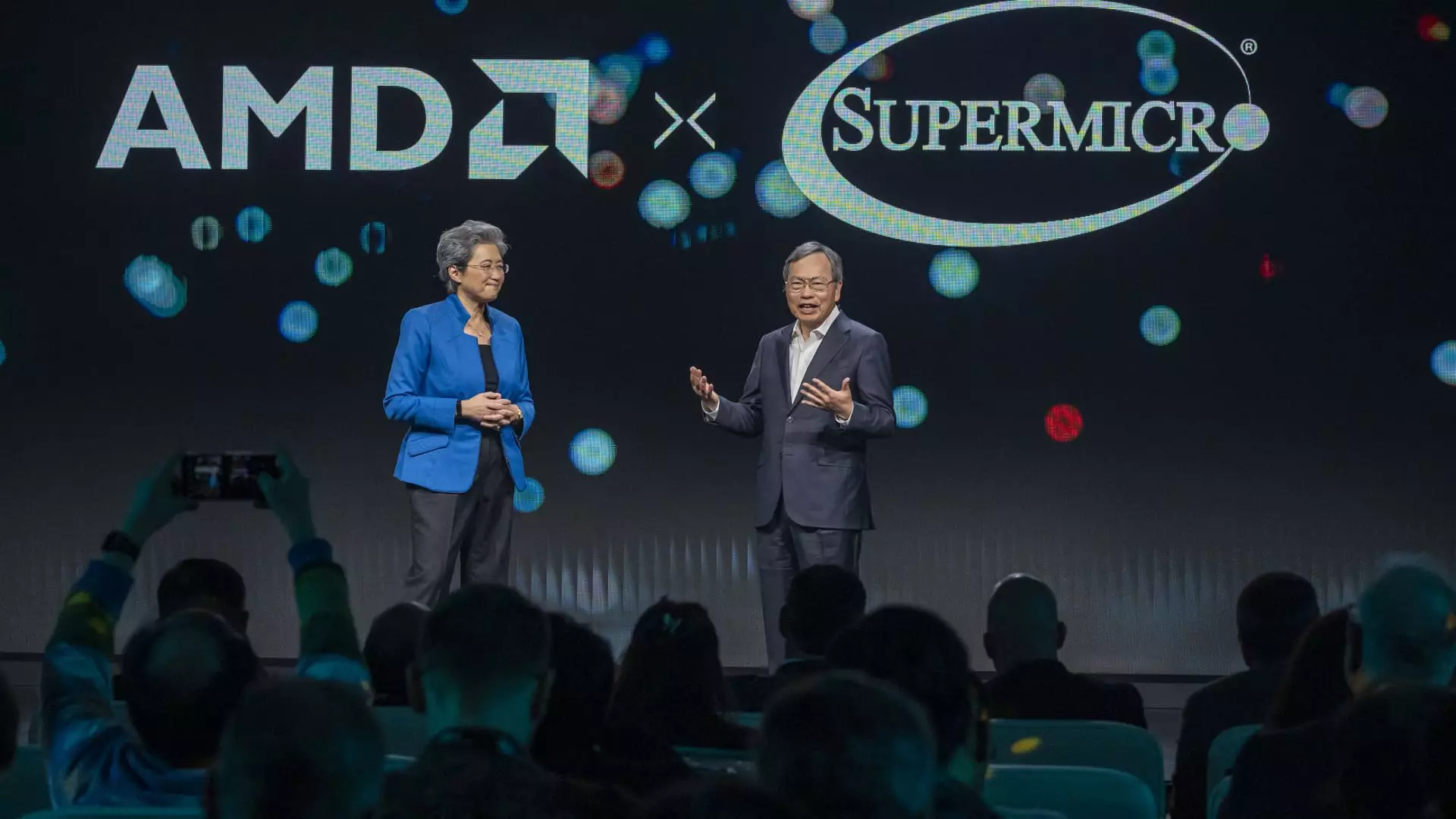

While Super Micro has seen a substantial stock increase of 205% year-to-date, uncertainties loom as the company faces competition from traditional IT equipment providers like Hewlett Packard Enterprise. Additionally, the global supply chain constraints have hindered Super Micro’s ability to fully capitalize on its growth potential, as noted by CEO Charles Liang during a recent conference call.

Despite existing challenges, Super Micro remains bullish on the prospects of AI-driven technologies and anticipates continued growth in this sector for the foreseeable future. The company’s strategic shift towards offering liquid-cooled servers as a more energy-efficient alternative further underscores its commitment to innovation and sustainability in the data center industry.

While Super Micro’s recent financial results may have disappointed some investors and analysts, the company’s strong earnings, robust revenue growth, and ambitious revenue projections for the future demonstrate its resilience and potential for long-term success in a rapidly evolving market landscape.

Leave a Reply