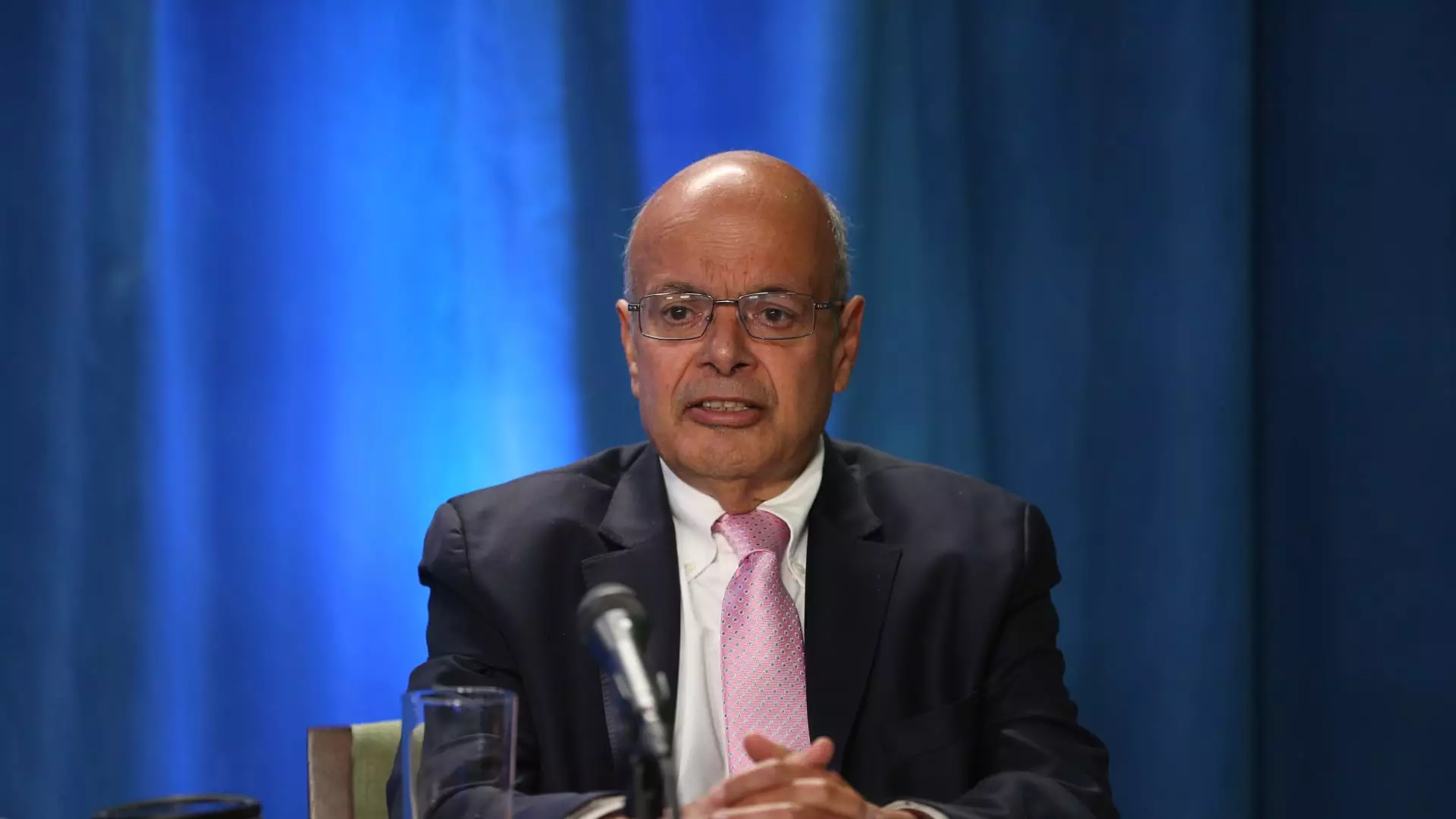

Ajit Jain, an influential figure in the financial world and a key executive at Berkshire Hathaway, has recently made headlines with a substantial decision to offload a significant portion of his stake in the conglomerate. According to a regulatory filing, the 73-year-old vice chairman of insurance operations divested 200 Class A shares of Berkshire Hathaway on a recent Monday. This transaction, conducted at an average price of $695,418 per share, resulted in an approximate cash influx of $139 million. Consequently, Jain now holds merely 61 shares directly, while additional family trusts and his philanthropic Jain Foundation hold smaller portions of his previous stake. This notable sale constitutes over 55% of his total holdings, marking the most significant reduction since he joined the company in 1986.

The reasons behind Jain’s decision remain ambiguous, but financial analysts speculate that he capitalized on Berkshire’s recent surge in stock value. At the close of August, the stock value soared above $700,000, allowing the company to reach a staggering market capitalization of $1 trillion. Experts suggest this sale could indicate Jain’s sentiment towards Berkshire’s current valuation. David Kass, a finance professor, noted that this action suggests Jain perceives Berkshire as fully valued. This aligns with the broader market trend, where significant fluctuations within stock valuations prompt intelligent investors to reassess their positions and make strategic adjustments.

Alongside Jain’s divestment, broader indicators point to a cooling off in Berkshire Hathaway’s share buyback activities. Recent reports reveal that the company repurchased only $345 million worth of its own stock in the second quarter, a stark drop compared to the $2 billion average spent in the preceding quarters. Bill Stone, Chief Investment Officer at Glenview Trust and a Berkshire shareholder, articulated that the recent selling activity indicates that the stock’s valuation is relatively high and does not present a bargain opportunity. With the stock trading at around 1.6 times its book value, investors, including Jain, may anticipate limited future repurchase activity by the company at current pricing.

Jain’s tenure at Berkshire Hathaway has been marked by remarkable success and transformational leadership. He is credited with spearheading Berkshire’s foray into the reinsurance sector and revitalizing the company’s Geico auto insurance division, often referred to as its “crown jewel.” His performance has not gone unnoticed; Warren Buffett himself has lauded Jain’s contributions, stating in a past letter to shareholders that Jain has created vast value for shareholders, emphasizing his pivotal role in Berkshire’s robust financial strategy. Such commendations nearly led to speculation about Jain’s potential succession of Buffett at the helm of the conglomerate, although recent clarifications have indicated that Jain has never aspired to run the company.

The implications of Jain’s sale resonate beyond just personal finance; they reflect broader trends within Berkshire Hathaway. As market scenarios evolve, strategic divestments can serve as barometers for the company’s long-term outlook and investor confidence. The decrease in stock buybacks coupled with Jain’s substantial liquidation of assets may signify an ongoing reevaluation at Berkshire Hathaway. While many view Buffett’s leadership as a guiding light, Jain’s actions could reveal essential insights into the company’s future priorities and potential shifts in strategy.

Ajit Jain’s recent decision to offload a significant portion of his Berkshire Hathaway holdings enhances the complex narrative surrounding the company’s current trajectory. While the motivations behind this divestment may be multifaceted, the market’s response to recent valuations and broader operational strategies cannot be ignored. Observers continue to monitor these developments closely as they unfold in an increasingly unpredictable economic landscape. With figures like Jain and Buffett at the forefront, Berkshire Hathaway remains a focal point of interest in the financial world, leaving investors curious about what comes next in this ever-evolving saga.

Leave a Reply