The recent stock market trends have been influenced by softer retail sales and consumer price data for April. Despite weaker-than-expected reports, Wall Street has viewed this as positive news, as it indicates further disinflation. This is significant as it plays a key role in the Federal Reserve’s potential decision to cut interest rates in 2024.

The housing market has been a significant factor in the Fed’s battle against inflation, with housing costs being one of the stickiest sources of inflation. Reports have shown a slowing down in the housing market, following a trend that started in March 2023. However, housing prices remain above the Fed’s target of 2%, adding pressure on consumers and preventing the Fed from lowering rates.

Earnings Season Overview

The second-quarter earnings season has been mostly positive, with 78% of S&P 500 companies reporting a positive earnings surprise and 60% delivering a positive sales surprise. Technology, real estate, and healthcare sectors have led the upside, while industrials and consumer discretionary sectors have closed lower.

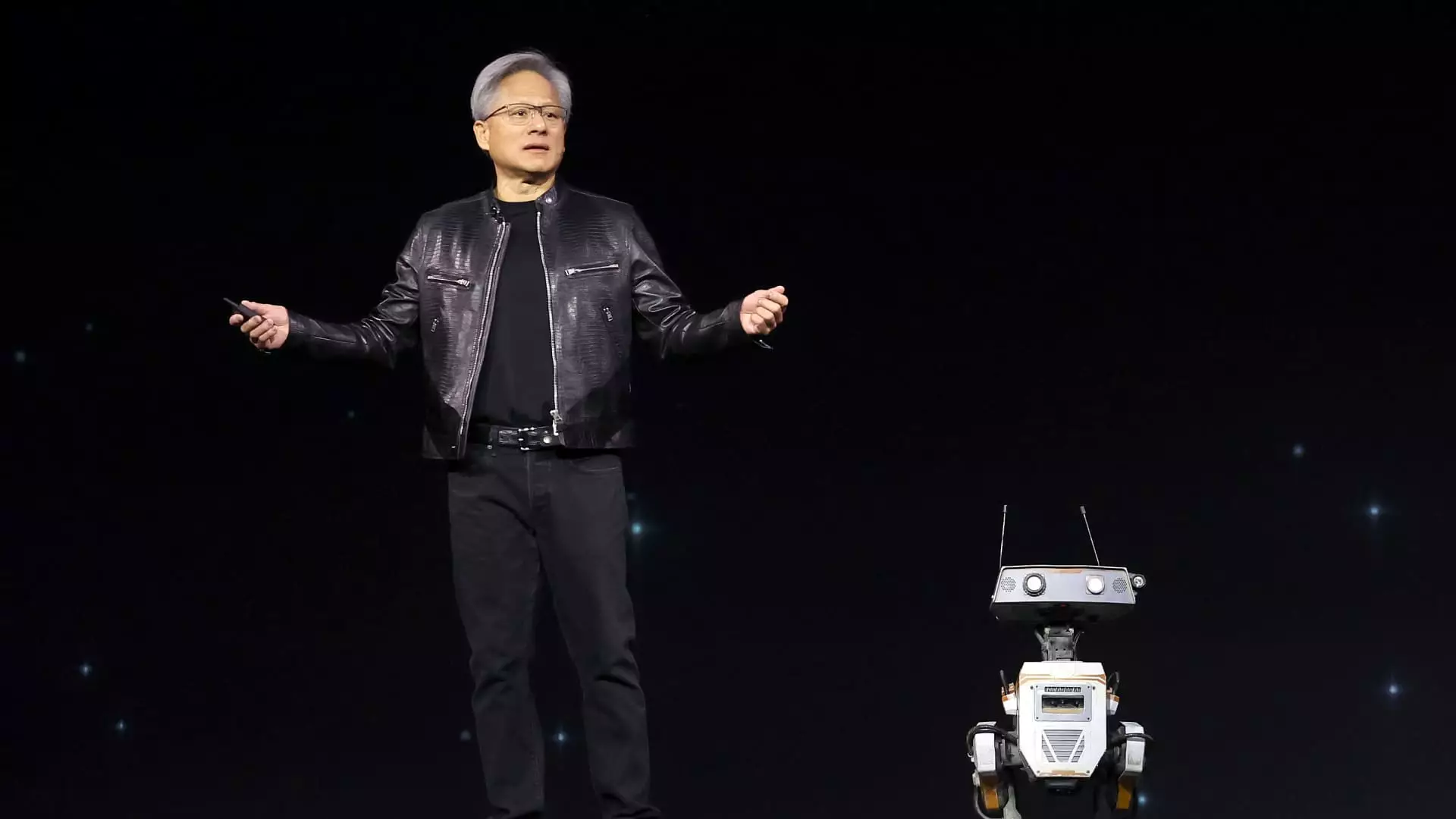

In the upcoming week, three portfolio companies are set to report earnings. Palo Alto Networks is expected to show improvement following a strategic shift in January. TJX Companies is anticipated to benefit from consumer trends during prolonged inflation. Nvidia is also expected to perform well with a focus on AI chips and software updates.

The stock market has been on an upward trend, with all three major averages closing higher for the week. The S&P 500 closed above 5,300 for the first time, and the Dow exceeded 40,000. Technology has led the upside, while real estate and healthcare have also performed well. The overall sentiment remains positive, with stocks continuing to rise despite some weaker economic data.

The upcoming week is slower in terms of economic data, with a focus on housing reports. Earnings reports from key portfolio companies will be closely watched to gauge market performance. The housing market reports, including existing and new home sales, will provide further insights into the state of the economy and the Fed’s inflation battle.

The recent stock market trends reflect a cautious optimism among investors. Despite some weaker economic reports, the overall sentiment remains positive, driven by expectations of further disinflation and potential interest rate cuts by the Federal Reserve. Earnings reports from key companies will play a crucial role in shaping market trends in the coming weeks. Investors should closely monitor housing market data and quarterly earnings to make informed investment decisions.

Leave a Reply