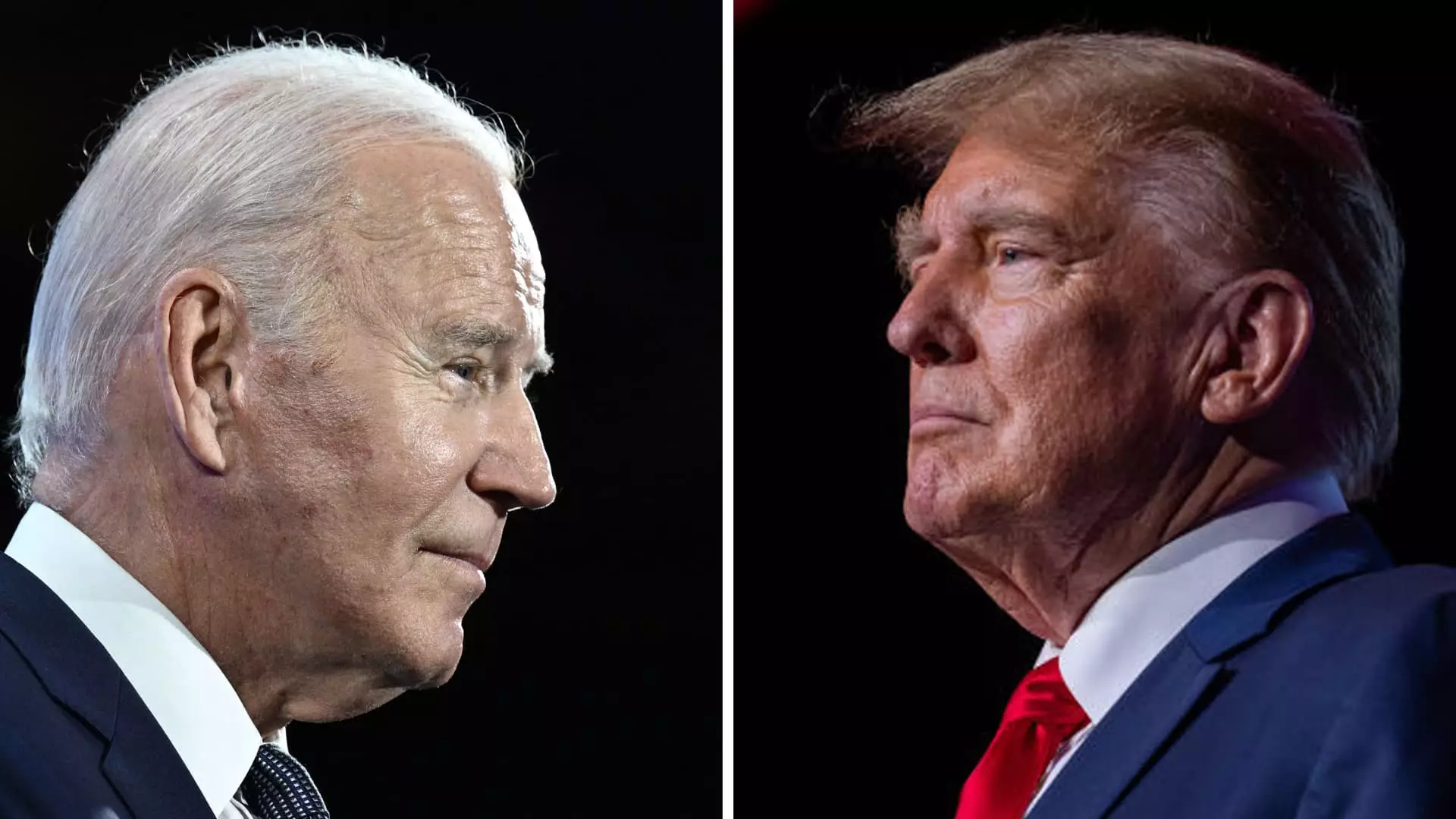

As the 2025 tax cliff looms closer, both President Joe Biden and former President Donald Trump have vowed to extend expiring tax breaks for most Americans. However, the issue at hand is how to finance these extensions. Trillions of dollars in tax breaks introduced by Trump through the Tax Cuts and Jobs Act of 2017 are set to expire after 2025, leading to a potential increase in taxes for over 60% of filers. Individual provisions at risk of expiring include lower federal income brackets, higher standard deductions, a more generous child tax credit, and more. According to Erica York, a senior economist, extending these provisions could potentially add an estimated $4.6 trillion to the federal deficit over the next decade. The budget deficit poses a significant challenge as the country approaches the 2025 tax cliff.

Initial estimates in 2018 suggested that the economic growth resulting from the Tax Cuts and Jobs Act would cover about 20% of the cost of the tax cuts. However, subsequent studies have shown that the effects were not as significant as initially anticipated. Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, stated that most economists do not believe that the Tax Cuts and Jobs Act paid for itself, let alone that extending it or making it permanent would be financially sustainable. There is a discrepancy between the expectations of some TCJA supporters, who believe that the 2025 extensions would be self-funded through accelerated economic growth, and analyses from various organizations that estimate only a 1% to 14% offset.

While Trump aims to extend all provisions of the TCJA, Biden intends to focus on providing tax breaks to individuals earning less than $400,000, which encompasses the majority of Americans. Biden’s economic advisor, Lael Brainard, has proposed increasing taxes on the ultra-wealthy and corporations to finance the extension of tax breaks for middle-class Americans. On the other hand, Trump has expressed support for tariffs on imported goods as a means of generating revenue. The uncertainty surrounding these policy proposals is compounded by the unknown outcome of the upcoming elections, which will determine which party controls the White House and Congress.

Implications of Policy Choices

The decisions made regarding the extension of tax breaks will have significant implications for the economy and the average American taxpayer. While both Biden and Trump aim to alleviate the financial burden on middle-class Americans, their approaches differ in terms of funding sources and long-term economic impact. It remains to be seen how the federal government will navigate the impending 2025 tax cliff and address the growing budget deficit while striving to support economic growth and financial stability for all Americans.

Leave a Reply