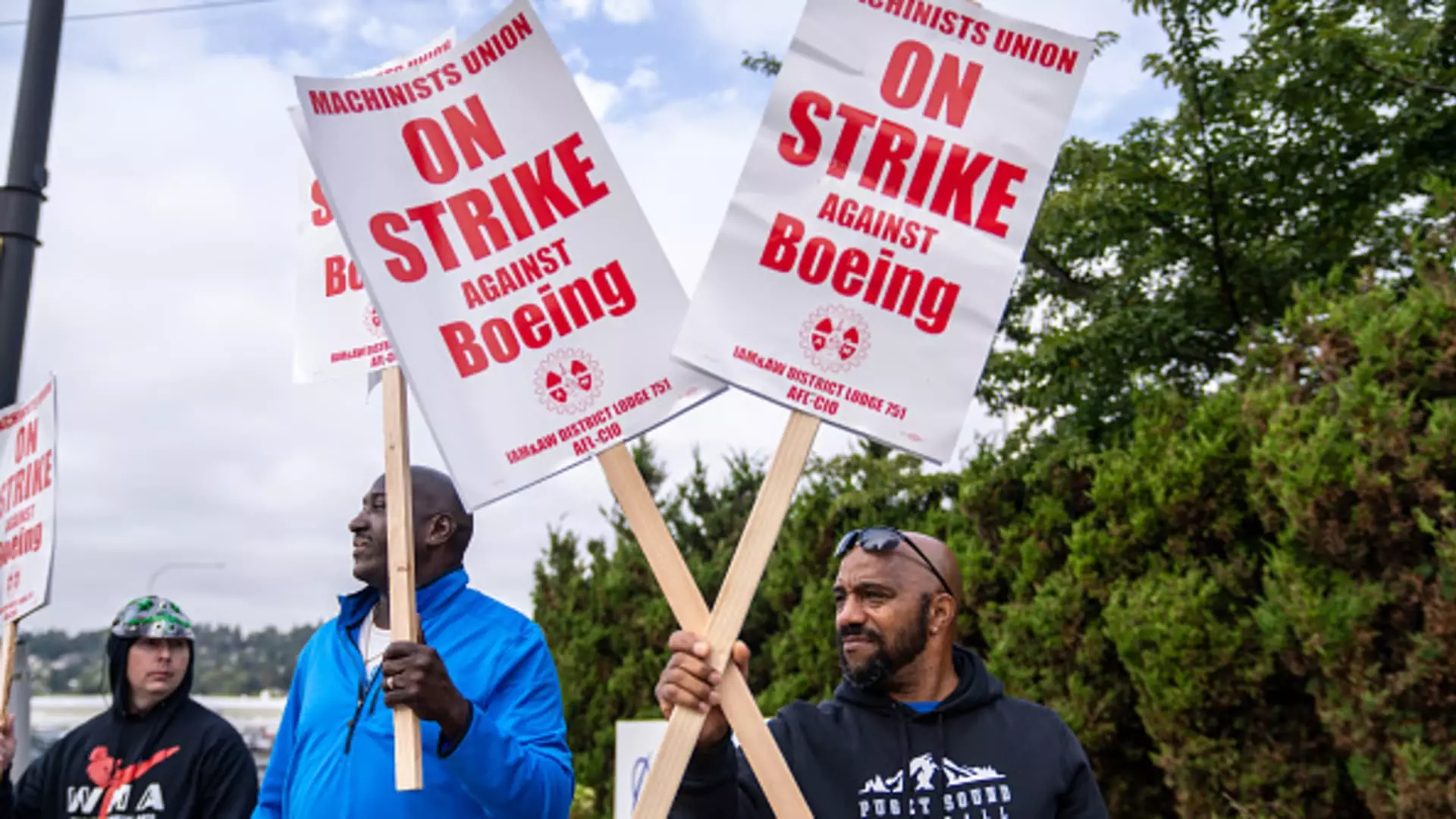

The aviation giant Boeing is currently facing a period of unprecedented turmoil, marked by a significant strike that has seen over 30,000 machinists walk off their jobs after rejecting a tentative contract agreement. This labor dispute has exacerbated the company’s existing challenges, putting immense pressure on its recently appointed CEO, Kelly Ortberg, who was expected to stabilize the company following years of crises.

The fallout from the strike has been severe, with estimates from S&P Global Ratings indicating that the disruption is costing Boeing approximately $1 billion per month. This decline in production capabilities comes at a time when the company is already grappling with staggering financial losses. The ongoing labor dispute comes after a tumultuous year that began with a serious technical malfunction in the 737 Max and continues to haunt Boeing in the wake of two fatal crashes involving the aircraft. The rejection of the proposed contract—where an overwhelming 95% of union members voted against it—reflects the growing dissatisfaction among workers, who are increasingly fed up with labor practices that seem out of touch with their needs and aspirations.

The relationship between Boeing’s management and its workforce appears to have reached a standstill. After the union’s rejection of Boeing’s sweetened proposal, the company felt compelled to withdraw the offer and instead filed an unfair labor practice charge against the union, accusing it of negotiating in bad faith. Such actions are indicative of a deepening rift, with calls for a return to negotiations being met with skepticism. Union representatives, particularly Jon Holden of IAM District 751, have publicly expressed a desire for genuine dialogue but also criticized management’s tactics as reminiscent of historical labor relations where intimidation overshadowed constructive engagement.

Interestingly, the current strike doesn’t fully mirror the hardships faced by workers in past disputes. Despite not receiving regular paychecks and losing health benefits at the end of September, the workers have more alternative job opportunities available in the Seattle area compared to previous strikes, such as the notable labor action in 2008. This current scenario has allowed some machinists to explore gig work and temporary employment options while the strike endures, softening the financial blow to an extent.

Ortberg’s leadership is further complicated by the company’s decision to cut its workforce by about 10% in the coming months, alongside significant layoffs in managerial positions. This decision is prompted by troubling preliminary financial results that forecast substantial losses, including expectations of almost $10 per share for the third quarter and an overall expectation of about $5 billion in charges. The company has not turned an annual profit since 2018, leading analysts to question the sustainability of its operations.

Boeing is at a crossroads; the inability to stabilize production, especially for its flagship 737 Max model, has become a critical concern. Industry expert Richard Aboulafia poignantly comments that while labor costs account for a mere 5% of the final assembly of an aircraft, the repercussions of the strike and operational instability are likely to reverberate throughout the entire supply chain. The company’s decision to stop producing commercial 767 freighters and the ongoing delays with its 777X model only add to the perception of a company in crisis.

On October 23, Ortberg will face investors for his inaugural earnings call as CEO, which promises to be closely scrutinized given the plummeting share price—down 42% this year, marking the most significant decline since the 2008 financial crisis. The sentiment surrounding Boeing has grown more bearish, with credit ratings agencies warning of a potential downgrade to junk status due to its mounting financial woes. This atmosphere of uncertainty could lead to drastic measures, including speculation about a capital raise potentially reaching up to $15 billion.

As the strike continues, the ramifications for Boeing extend beyond the immediate labor market. Suppliers like Spirit AeroSystems are also feeling the pressure, contemplating possible furloughs in light of Boeing’s cost-cutting measures. Without resolution, instability within Boeing may very well spill over, undermining the health of the broader aerospace supply chain.

Ultimately, Boeing stands at a critical juncture, with its reputation and operational viability on the line. Striking the right balance between addressing the needs of its workforce and stabilizing production processes will be paramount for Ortberg. As the company grapples with its ever-deepening crisis, stakeholders—workers, investors, and the public alike—will be watching closely to see how Boeing maneuvers through this tumultuous period. Whether it emerges stronger or falters under the weight of its challenges remains yet to be seen.

Leave a Reply