In recent years, China’s property market has emerged as a focal point of both economic growth and concern. Growing from a time when it constituted more than a quarter of the national economy, the sector now faces significant turmoil exacerbated by a governmental crackdown on unsustainable borrowing practices among real estate developers. This contraction not only threatens the vibrancy of the Chinese economy but also impacts local governments’ fiscal health and household wealth, creating a complex web of challenges that policymakers must navigate. Amidst these difficulties, top leaders in China have convened to discuss the need for measures aimed at halting the market’s decline and stabilizing the economy.

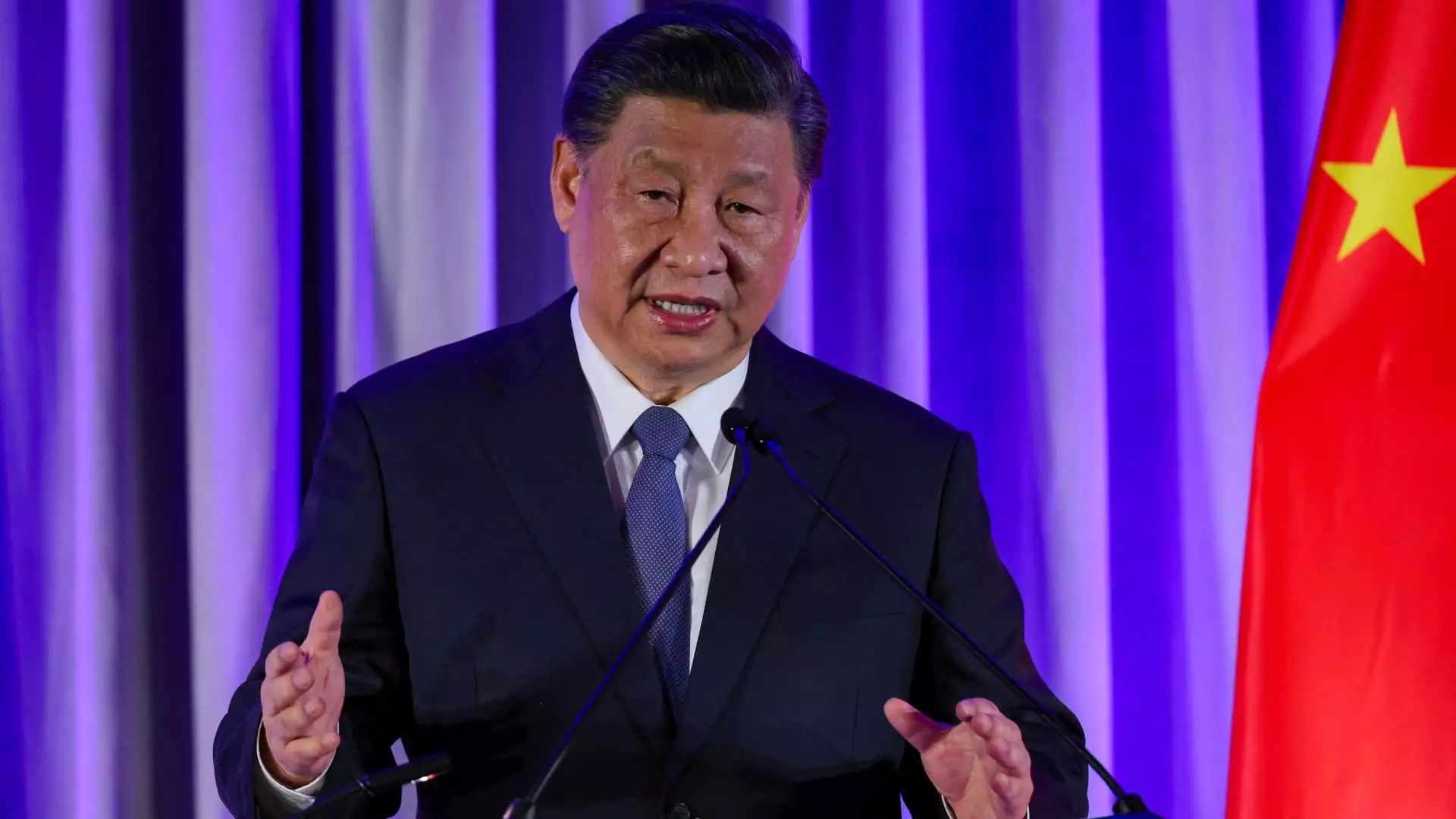

On Thursday, the Chinese Communist Party’s Politburo gathered for a crucial meeting to discuss ways to combat the persisting slump in the property market. Presided over by President Xi Jinping, the session concluded with a commitment to “stop the real estate market decline and spur a stable recovery.” According to reports from state media, discussions extended beyond real estate to encompass wider economic issues, including employment and demographic transitions. While specifics regarding timelines and financial implications of the proposed measures were sparse, analysts perceived the meeting as a crucial initial step toward a more coherent fiscal and monetary response.

Market Reactions: A Flicker of Hope

The meeting’s outcome notably influenced market performance, leading to an upswing in stock prices both in mainland China and Hong Kong. Property stocks, in particular, experienced a robust rebound, with an impressive surge of almost 12%. This seems to indicate a cautious optimism among investors in response to government acknowledgment of the issues facing the property sector. However, financial experts are wary and stress that the economy requires more than just a verbal commitment; tangible fiscal support is essential to sustain this initial bullish sentiment in the market.

Reports indicate that while the decline of the property market has slightly moderated, with fewer new homes sold year-on-year, average home prices continue to exhibit decreasing trends. The need for a sustainable recovery strategy is underscored by the evolving economic landscape; growth forecasts have been readjusted downward, with some analysts suggesting that the government’s previous growth targets might now be considered overly ambitious. This scenario raises pertinent questions about the possible need for more proactive measures aimed at stimulating growth while ensuring structural reforms are put in place—balancing short-term recovery with long-term economic stability.

According to the meeting notes, authorities are considering a range of interventions, such as limiting housing supply, increasing loan availability for select projects, and reducing interest burdens on existing mortgages. The People’s Bank of China has already suggested potential mortgage rate reductions that could relieve individuals of significant financial stress. Such measures signal a focused approach—aimed more at encouraging consumer purchases rather than inflating housing prices to create a sense of wealth, highlighting a desire to combat stagnation in homebuying behavior.

Prominent economists have voiced their perspectives on the meeting and its implications for the future of the Chinese economy. Zhiwei Zhang, a chief economist, considered the meeting as a sign of progress, albeit one that emphasizes the need for time and well-thought-out strategies. Analysts differ in their interpretations, with some expressing optimism about potential proactive initiatives, while others highlight lingering uncertainties regarding the scale and nature of the contemplated fiscal support.

The significant toxicity enveloping China’s property market presents a formidable challenge, yet the recent high-level meeting could signify a pivotal turn. To foster a genuine recovery, authorities must remain vigilant in their strategy, ensuring that the proposed measures effectively address both immediate economic concerns and foster long-term resilience against structural inadequacies. While the general sentiment hints at cautious optimism, only time will reveal whether these discussions translate into concrete action that safeguards the Chinese economy and restores vitality to its property sector. In this complex and shifting economic landscape, achieving balance will be key.

Leave a Reply