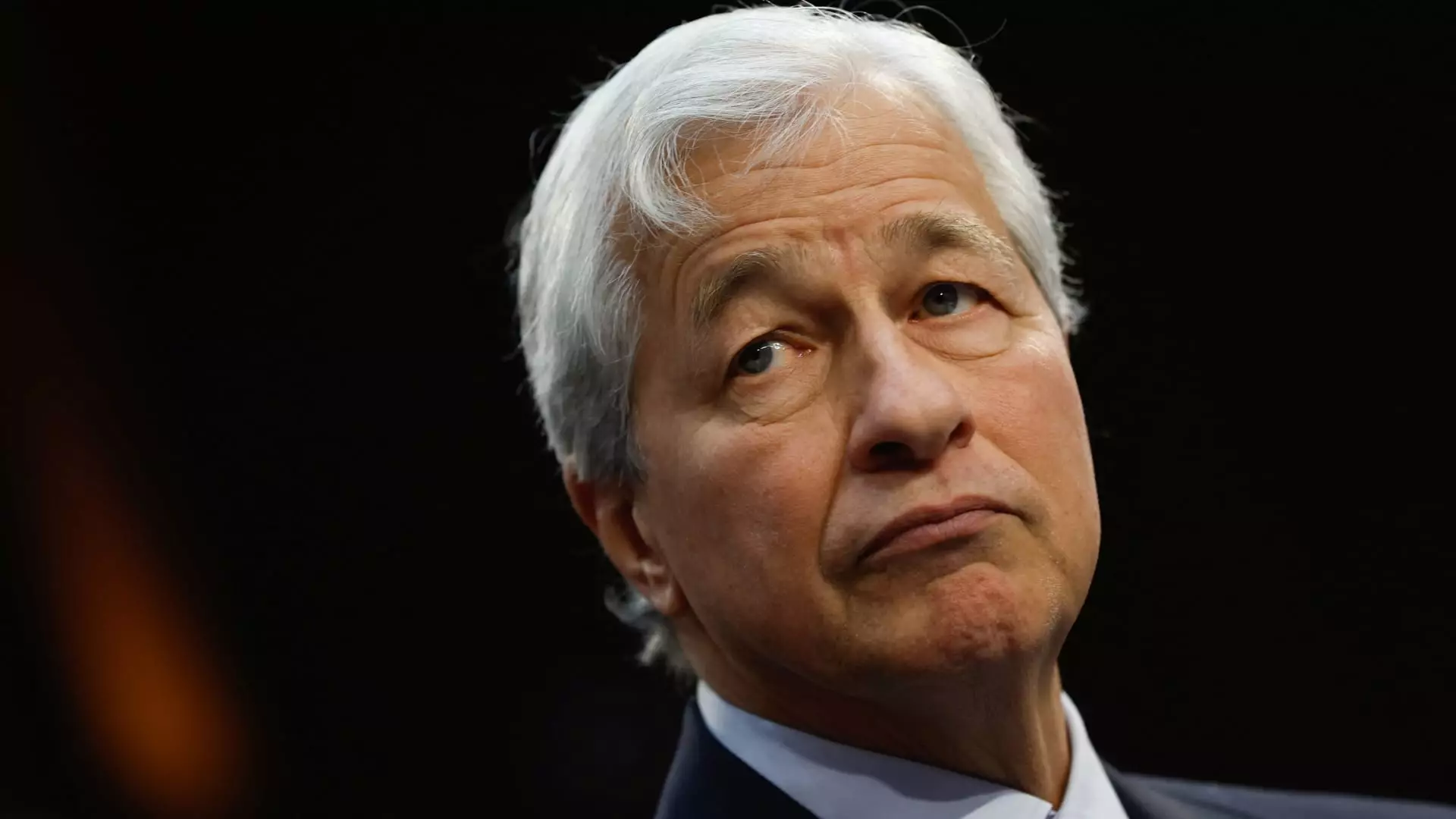

Jamie Dimon, the CEO of JPMorgan Chase, has articulated profound concerns regarding escalating geopolitical tensions that have the potential to significantly disrupt the global economic landscape. In a recent earnings release reflecting on the bank’s performance for the third quarter, Dimon expressed the urgent need for vigilance in light of ongoing conflicts, particularly in the Middle East and the continued fallout from Russia’s aggression in Ukraine. His comments underscore a growing sense of urgency as international instability threatens not just immediate economic conditions but the broader historical trajectory of global relations.

Dimon noted that the modern international order, which has been in place since the conclusion of World War II, is increasingly under strain due to a confluence of factors including the Israeli-Palestinian hostilities, heightened tensions with Iran and North Korea, and escalating U.S.-China rivalry. This multifaceted crisis poses a significant challenge for global leadership, as the consequences of inaction could result in historical ramifications that reshape global alliances and economic partnerships.

The Human Cost of Conflict

The humanitarian toll of these conflicts is severe and troubling. Dimon referenced escalating death tolls in ongoing skirmishes, with tens of thousands reported killed in the violence between Israel and Hamas. The conflict, which commemorated its one-year mark from Hamas’ initial attack on October 7, 2023, shows no sign of de-escalation; it continues to spiral with involvement from regional powers like Iran and Hezbollah, leading to broader chaos and instability. The recent Israeli airstrikes in Lebanon, claiming lives and inciting further injuries, exemplify how rapidly these tensions can escalate, thereby amplifying the risks of broader military confrontations.

Furthermore, the stark escalation in missile launches by Iran, and the resulting fear of possible retaliatory strikes by Israel on critical Iranian infrastructure, raises the stakes for all parties involved. As these tensions unfold, the likelihood of economic repercussions, not just regionally but across the global stage, looms large.

Economic Implications Amidst Geopolitical Uncertainty

In light of these daunting challenges, Dimon’s reflections extend to the economic ramifications of such geopolitical strife. Despite indications of a resilient U.S. economy, led in part by a Federal Reserve working to implement measures aimed at stabilizing economic conditions, he warned that these geopolitical crises present formidable barriers to sustainable growth. The interplay of large fiscal deficits, necessary infrastructure investments, and an urgent need for remilitarization emphasizes the precarious nature of the current economic climate.

Dimon’s assertion that strong leadership is imperative in addressing these multifaceted issues cannot be overstated. His calls for decisive action from U.S. and Western leaders highlight a critical need for coordinated efforts in mitigating risks associated with conflict and ensuring economic stability. As the world grapples with these complex challenges, the interplay between geopolitical stability and economic prosperity has never appeared more vital, underlying the need for proactive engagement and solutions that transcend national borders.

Leave a Reply