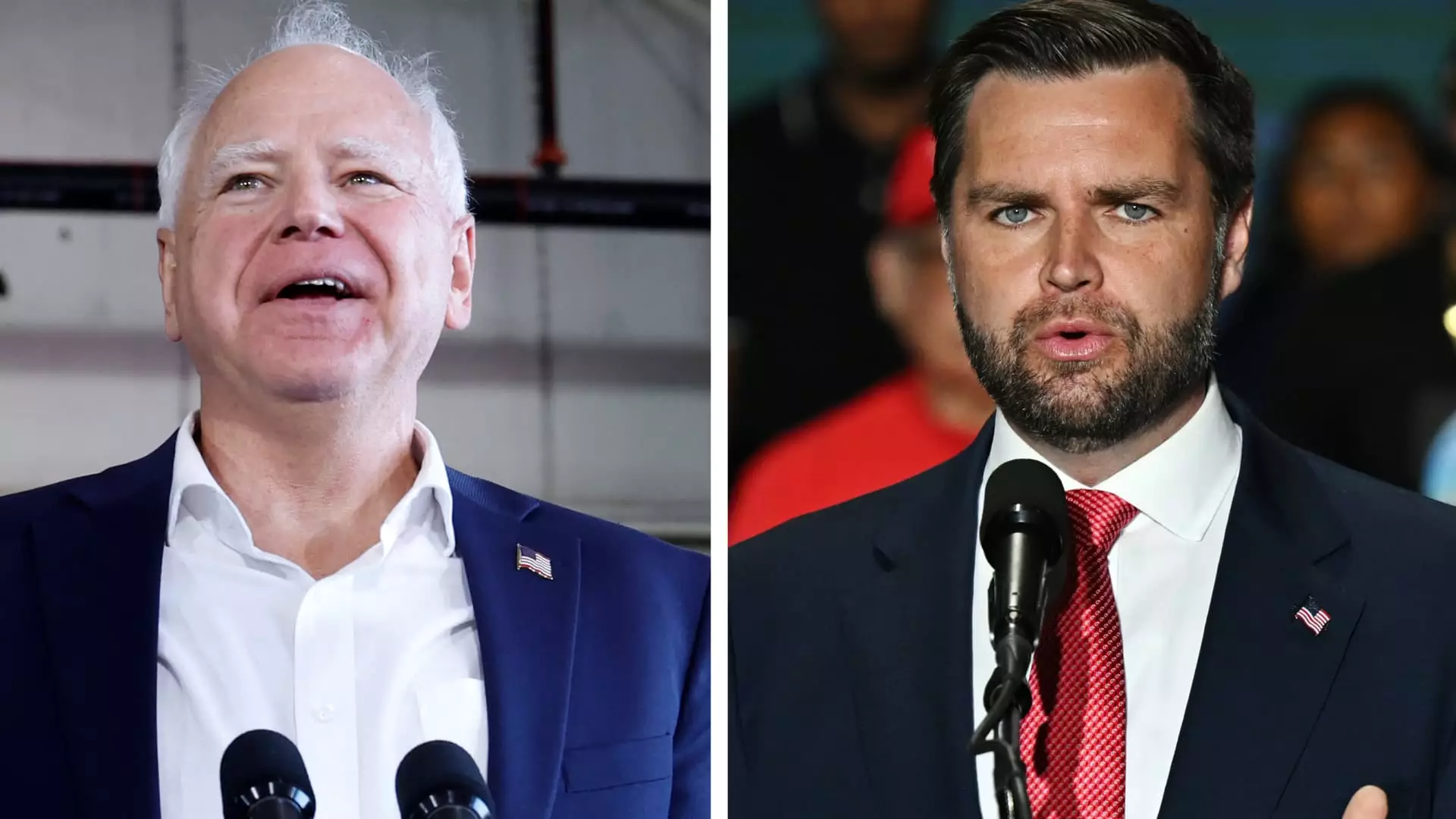

As the major party tickets are finalized for the upcoming election, voters are closely examining the candidates’ personal finance policies that could directly impact their wallets. With Vice President Kamala Harris revealing her running mate, Minnesota Governor Tim Walz, and former President Donald Trump selecting Senator JD Vance of Ohio, the stage is set for a battle of ideologies. Both sets of candidates are engaged in class warfare, attempting to portray the opposition as disconnected from the middle-class Americans they aim to represent.

Affordable housing is a topic of significant importance for many Americans, and both Governor Walz and Senator Vance have addressed this issue in various ways. Governor Walz signed housing legislation that included substantial financial aid in 2023, which highlighted his commitment to helping individuals and families secure housing. On the other hand, Senator Vance has also emphasized the importance of affordable housing, pointing out the need to tackle poverty by addressing this fundamental issue. Vance has been vocal about his opposition to institutional ownership of rental homes and foreign buyers in the U.S. real estate market.

The issue of the child tax credit has been a point of contention following trillions of tax breaks enacted by the Trump administration that are set to expire after 2025. While Congress approved a temporary expansion of the child tax credit in 2021, which significantly reduced child poverty rates, a permanent federal child tax credit expansion remains uncertain. Governor Walz played a crucial role in enacting a state-level child tax credit in Minnesota, focusing on low-income households despite prospects of a federal expansion facing challenges due to budgetary constraints.

Senator Vance has taken a firm stance against student loan forgiveness policies, portraying them as a benefit primarily to the wealthy and college-educated individuals. Vance has argued against forgiving student debt and believes it disproportionately favors those in elite institutions and high-income brackets. However, Vance has shown some flexibility by supporting specific cases of loan forgiveness for parents who took on debt for a child with permanent disabilities. On the other hand, Governor Walz has championed initiatives to ease the burden of student debt, particularly for lower-income individuals. His support for student loan forgiveness programs and tuition assistance reflects a commitment to addressing the challenges faced by students and families seeking higher education opportunities.

The personal finance policies put forth by the presidential candidates could have far-reaching implications for middle-class Americans. The contrasting views and approaches of Governor Walz and Senator Vance underscore the importance of informed decision-making and the need for policies that address the diverse needs of individuals and families. As voters evaluate the candidates and their proposals, it is essential to consider the potential impact on personal finances and overall economic well-being.

Leave a Reply