Monday saw an increase in U.S. stocks following gains from the previous session. The S&P 500, Dow, and Nasdaq all rose by over 1% after a softer-than-expected jobs report. This boost in the market was attributed to signs that the Federal Reserve’s monetary tightening efforts were having a positive impact on the U.S. economy, paving the way for potential interest rate cuts.

Jim Cramer described Monday as the beginning of a “benign week” for the market. He noted the absence of significant economic data releases or Federal Reserve communications that could sway market sentiment in the coming days. Investors seemed optimistic about the current trajectory of the economy and were hopeful for continued positive outcomes.

Former Starbucks CEO Howard Schultz shared his thoughts on the company’s performance, emphasizing the need to enhance the customer experience in U.S. stores to regain traction. The comments came after Starbucks reported a disappointing quarter with lowered full-year projections, leading to a sharp decline in the company’s stock. Despite expectations of a tough quarter, the outcome was worse than anticipated.

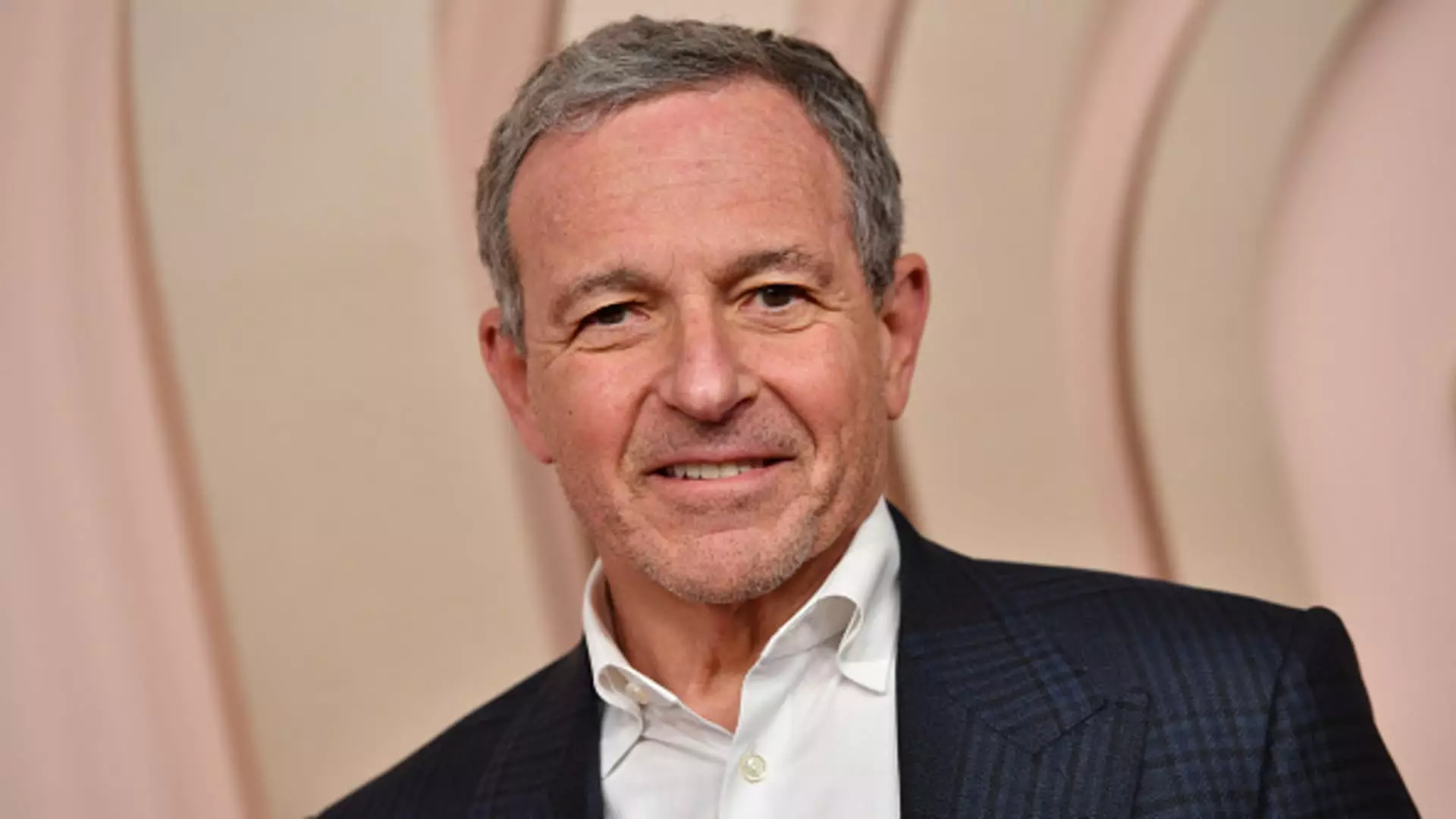

Walt Disney experienced a 1.5% increase in stock price following price target upgrades from analysts at Deutsche Bank and Loop Capital. Investors are anticipating Disney’s earnings report on Tuesday, particularly focusing on the performance of its direct-to-consumer business, which includes streaming services like Disney+ and Hulu. Shareholders are hopeful for positive developments in this segment, which has previously operated at a loss.

Subscribers to the CNBC Investing Club with Jim Cramer receive trade alerts before Jim executes any trades in his charitable trust’s portfolio. There are specific waiting periods before Jim finalizes a trade, ensuring that all actions are well-considered. The Club emphasizes the importance of following their terms and conditions, privacy policy, and disclaimer. No guaranteed outcomes or profits are promised, and no fiduciary obligations are established through the provision of information.

The insights shared during the CNBC Investing Club Morning Meeting provide valuable information for investors looking to navigate the current market conditions and make informed decisions. It is essential for individuals to stay informed, exercise caution, and consider all factors before engaging in trading activities.

Leave a Reply