MongoDB saw a significant uptick in its shares, soaring as much as 16% in after-hours trading following the announcement of its fiscal second-quarter earnings report. The company exceeded market expectations, reporting an adjusted earnings per share of 70 cents compared to the anticipated 49 cents. Additionally, MongoDB’s revenue for the quarter reached $478.1 million, outperforming the projected $464.1 million.

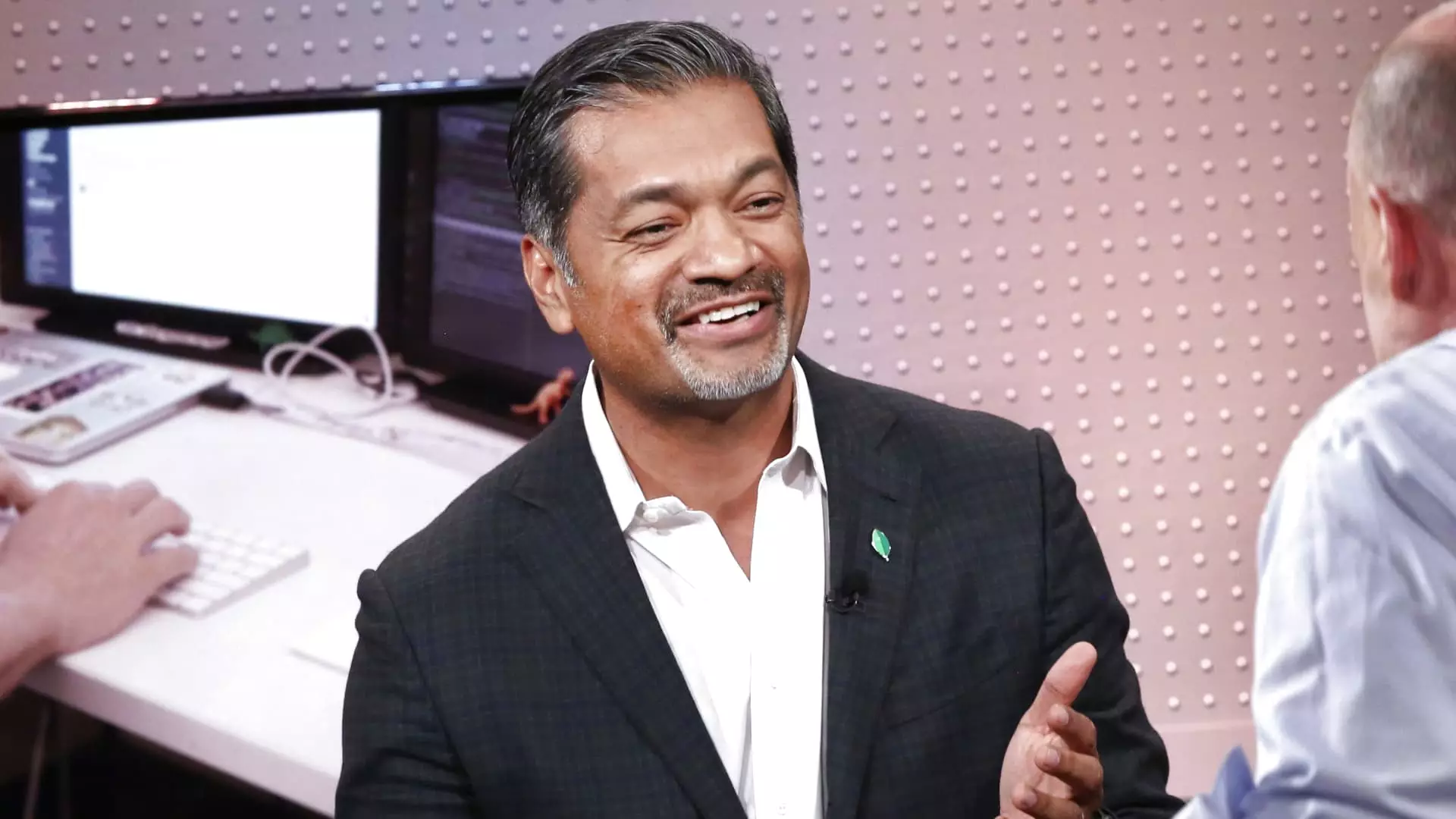

The company’s revenue increased by 13% year over year for the quarter ending on July 31. Despite a net loss of $54.5 million, or 74 cents per share, MongoDB remains optimistic about its future outlook. CEO Dev Ittycheria expressed confidence in the company’s ability to facilitate the integration of generative AI technology into customers’ operations and modernize legacy systems.

Atlas, MongoDB’s cloud database service, experienced stronger demand than anticipated, according to Ittycheria. Although there was a slowdown in consumption growth during the previous quarter due to economic challenges, the second-quarter results suggest a consistent trend. Ittycheria noted that MongoDB’s ability to attract new business remained unaffected by the macroeconomic environment, distinguishing it from competitors in the software industry.

In contrast to Elastic, another software provider, MongoDB’s performance stood out. Elastic faced difficulties in closing client commitments during its fiscal first quarter, leading to a sharp decline in its stock price. Ittycheria highlighted MongoDB’s value proposition in assisting companies with transitioning from Elastic products, underscoring the company’s competitive edge.

Looking ahead, MongoDB provided an optimistic outlook for the fiscal third quarter, projecting adjusted earnings of 65 to 68 cents per share and revenue ranging from $493.0 million to $497.0 million. The company also revised its fiscal 2025 forecast upward, expecting adjusted earnings of $2.33 to $2.47 per share and revenue of $1.92 billion to $1.93 billion. These updates represent a significant improvement from previous guidance and reflect MongoDB’s confidence in its growth trajectory.

Despite the positive earnings report, MongoDB’s stock had experienced a 40% decline year-to-date, contrasting with the S&P 500 index’s 17% increase over the same period. This discrepancy underscores the volatility of the market and the challenges that MongoDB faces in maintaining investor confidence amid evolving market conditions.

Leave a Reply