As Nvidia prepares to disclose its fiscal third-quarter earnings, anticipation runs high across Wall Street and among investors. Scheduled for release after market hours on Wednesday, the expectations, drawn from LSEG consensus estimates, spotlight significant figures: $33.16 billion in revenue with an adjusted earnings per share of 75 cents. However, while these results are essential, they are not the sole focus; the projections for the upcoming quarter hold equally critical importance. Investors are keenly interested in understanding whether Nvidia can sustain its remarkable growth trajectory, particularly in light of the ongoing artificial intelligence (AI) boom that shows no signs of waning.

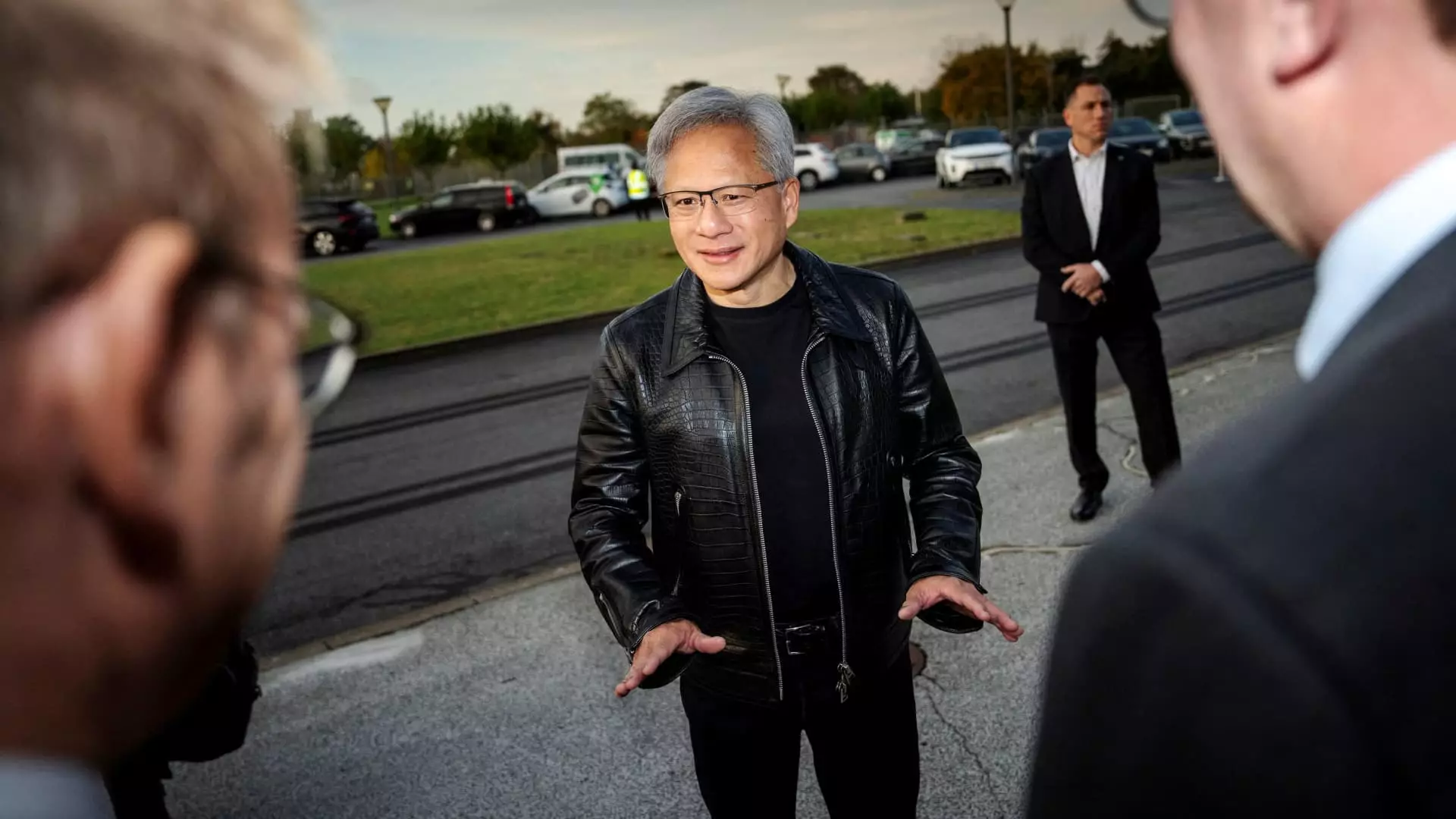

Wall Street analysts are looking for Nvidia to project earnings of 82 cents per share with anticipated sales reaching $37.08 billion. This expected growth is reportedly tied to the performance of Nvidia’s next-generation AI chip, Blackwell, designed for data centers and currently being distributed to major customers including Microsoft, Google, and Oracle. The reception of these chips is a determining factor for Nvidia’s sustained growth, making any insights shared by CEO Jensen Huang particularly vital. Investors will be scrutinizing Huang’s statements for indications about the market demand for Blackwell, which is pivotal for the company’s future revenue streams.

Amidst the excitement, reports of thermal issues with systems using Blackwell chips may pose a potential risk that Nvidia could address in its report. Such challenges could influence customer confidence and, consequently, sales projections. Several billion dollars in sales are expected from Blackwell in the upcoming January quarter, as reported by Nvidia in August. However, the company must navigate these emerging complications to ensure that the momentum of growth is not hampered.

Stock performance reflects investor sentiment, showcasing Nvidia’s upward trajectory, with shares nearly tripling since the beginning of 2024. While the most recent quarterly sales growth rate soared at an impressive 122%, it nonetheless marked a notable decrease from the staggering 262% and 265% growth witnessed in the preceding quarters. This decline raises critical questions about Nvidia’s ability to maintain hypergrowth as it confronts a maturing market and increased competition.

Overall, Nvidia’s forthcoming earnings report promises to be a pivotal moment for stakeholders. It will likely encapsulate not just the financial outcomes but a broader dialogue about the company’s innovative capacities and strategic direction. Nvidia stands at a crossroad, balancing robust growth mechanics with the unpredictability inherent in semiconductor technology and AI applications. The industry’s landscape will undoubtedly shape Nvidia’s adaptability and long-term viability as it pushes forward into the next chapter of technological advancement. The revelations during this earnings call could set the tone for Nvidia’s next steps and, by extension, the AI sector’s evolution at large.

Leave a Reply