Oracle Corporation has kicked off a promising trajectory with a significant rise in its stock value, particularly after the company announced an upward revision of its revenue guidance for the fiscal year 2026. Following its latest financial update, Oracle’s shares jumped approximately 6% in after-hours trading, a clear indication of investor confidence fueled by the company’s optimistic outlook. The database giant has now set a revenue target of at least $66 billion for fiscal 2026, eclipsing the prior expectations of analysts who predicted $64.5 billion. This projection reflects not only Oracle’s robust growth strategy but also its ability to outperform market expectations consistently.

In the broader context, Oracle’s shares have gained roughly 15% over the last three trading days, reaching new heights following the release of quarterly results that surpassed expectations. Year-to-date, Oracle’s stock has surged an impressive 55%, making it a standout performer among large-cap tech firms, second only to Nvidia in terms of gains. This week has been particularly beneficial for Oracle, showcasing investor enthusiasm and an overall favorable market response to its strategic initiatives, including plans that extend well into fiscal 2029.

Long-Term Vision and Strategic Partnerships

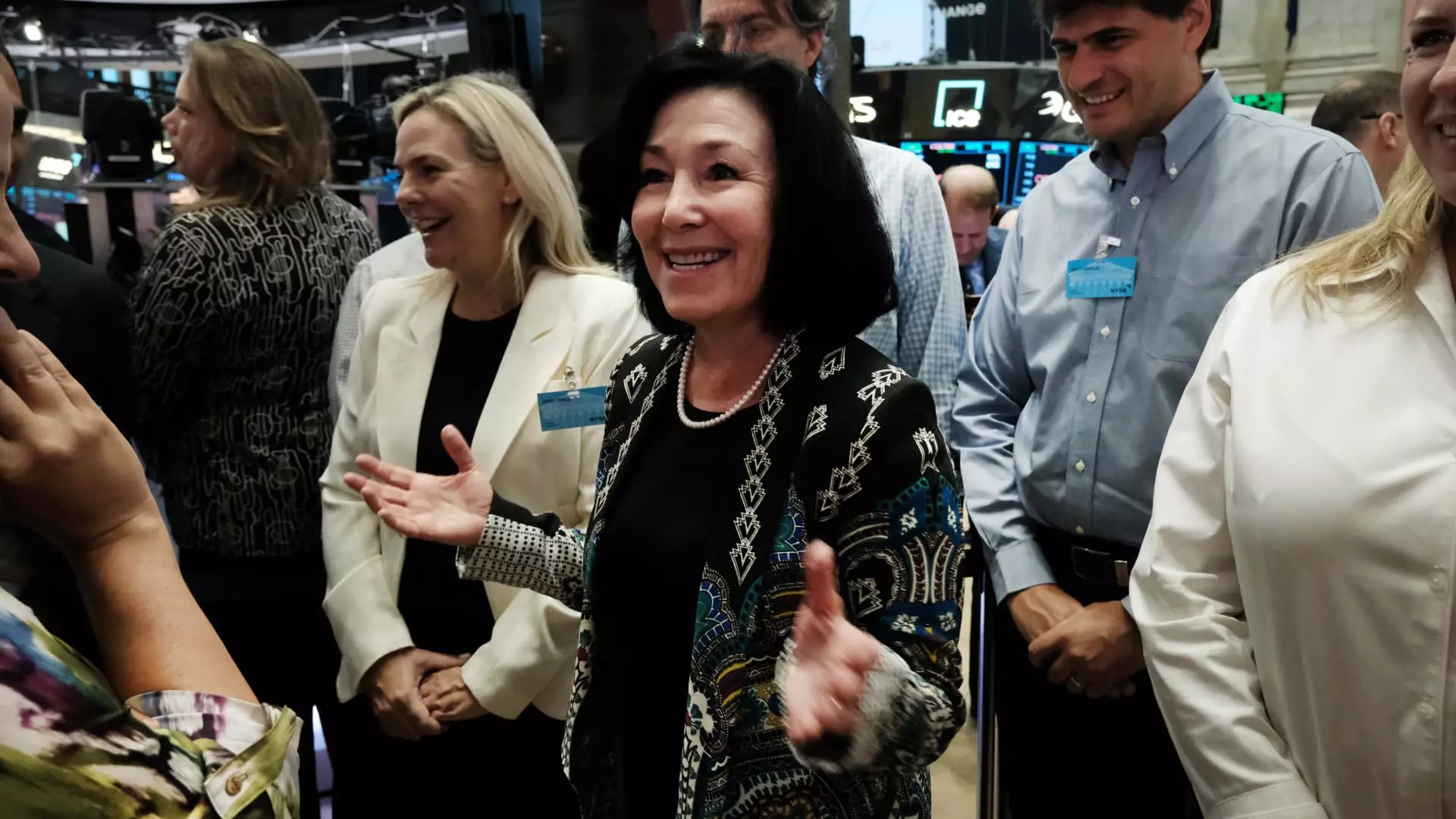

During the recent Oracle CloudWorld conference in Las Vegas, CEO Safra Catz articulated the company’s ambitious long-term vision, forecasting over $104 billion in revenue for the fiscal year 2029, coupled with an expected year-over-year earnings growth of 20%. Catz emphasized the pivotal role of strategic partnerships in achieving this growth, particularly the alliances with industry leaders like Amazon, Google, and Microsoft. By integrating Oracle’s database solutions with these major cloud providers, the company is positioning itself as a critical player in the rapidly evolving cloud landscape.

Capitalizing on Cloud and AI Growth

A significant aspect driving Oracle’s revenue growth is the impressive 45% increase in its cloud infrastructure revenue over the latest quarter, outpacing its competitors such as Amazon and Google. This growth is not merely a reflection of shifting workloads to the cloud; it represents a transformational shift in how businesses approach data management and infrastructure. Furthermore, Oracle’s ambition in the artificial intelligence arena is underscored by its announcements regarding the acquisition of a large cluster of next-generation graphics processing units from Nvidia. This strategic move places Oracle in a favorable position to leverage the rapidly advancing AI technologies, expanding their offerings and capabilities.

To support its growth ambitions, Oracle has indicated a significant increase in capital expenditures, expecting to double its investment in the fiscal year 2025. This aggressive financial strategy is indicative of a company not only poised for growth but also dedicated to sustaining its competitive edge amid a backdrop of intense competition in the tech industry. By fortifying its infrastructure and scaling operations, Oracle is setting the stage for a sustained upward trend.

Oracle’s combination of strong revenue guidance, strategic partnerships, aggressive investment plans, and aggressive positioning in both the cloud and AI markets illustrates a compelling narrative for investors. As the company continues to execute its growth strategy, it remains a noteworthy player in the tech landscape, with the potential for remarkable returns.

Leave a Reply