Penn Entertainment, a major player in the gaming and media industry, has recently announced that it will be laying off approximately 100 employees as part of its efforts to focus on the growth of ESPN Bet. The decision comes following the company’s acquisition of Canadian media and gaming powerhouse theScore in 2021. CEO Jay Snowden explained in an internal email to staff members that these changes are necessary to enhance operational efficiencies within the organization. With a workforce of around 20,000 people, Penn Entertainment is looking to streamline its operations and drive growth in its interactive business.

New Phase of Growth and Partnership with Disney’s ESPN

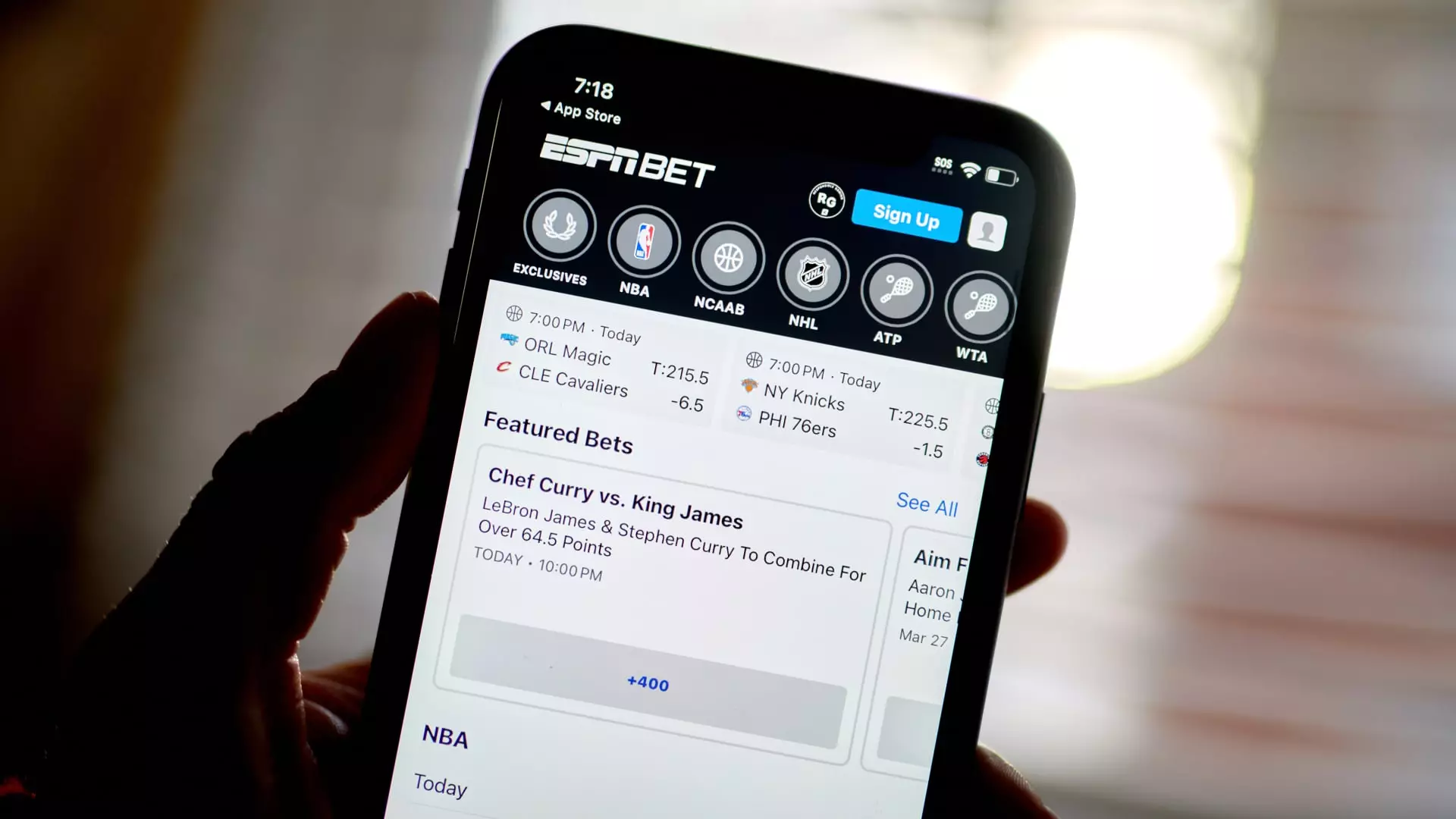

Snowden emphasized in the memo that Penn Entertainment is entering a new phase of growth, particularly in its interactive business which includes ESPN Bet. The company recently secured a $2 billion branding partnership with Disney’s ESPN, signaling its commitment to expanding its presence in the sports betting market. The initiatives for growth include product enhancements and deeper integration into ESPN’s ecosystem. Investors are eager to see the rebranded sportsbook in action, with rumors circulating about potential interest from other online gaming and casino companies.

Despite the optimism surrounding Penn Entertainment’s growth plans, the company has faced challenges in meeting investor expectations. Activist investor Donerail Group has urged the board to consider selling the casino company, adding pressure on Penn to deliver results. Analysts point out the complexity of a potential sale, which could involve major divestitures. However, Truist gaming analyst Barry Jonas believes that the release of new ESPN Bet features this fall could significantly enhance the product and attract more customers. The focus on cost control demonstrates Penn’s determination to make its investments pay off in the long run.

Penn Entertainment’s stock has experienced a 25% decline year to date, reflecting concerns about its financial performance. The company has missed earnings expectations in recent quarters and had to lower its guidance, leading to uncertainty among investors. Analyst Barry Jonas notes that there is still speculation about what a successful ESPN Bet venture could look like and how much additional investment may be required to achieve the desired results. Despite these challenges, Truist maintains a buy rating on Penn Entertainment and has set a price target of $25, indicating some confidence in the company’s future prospects.

Leave a Reply