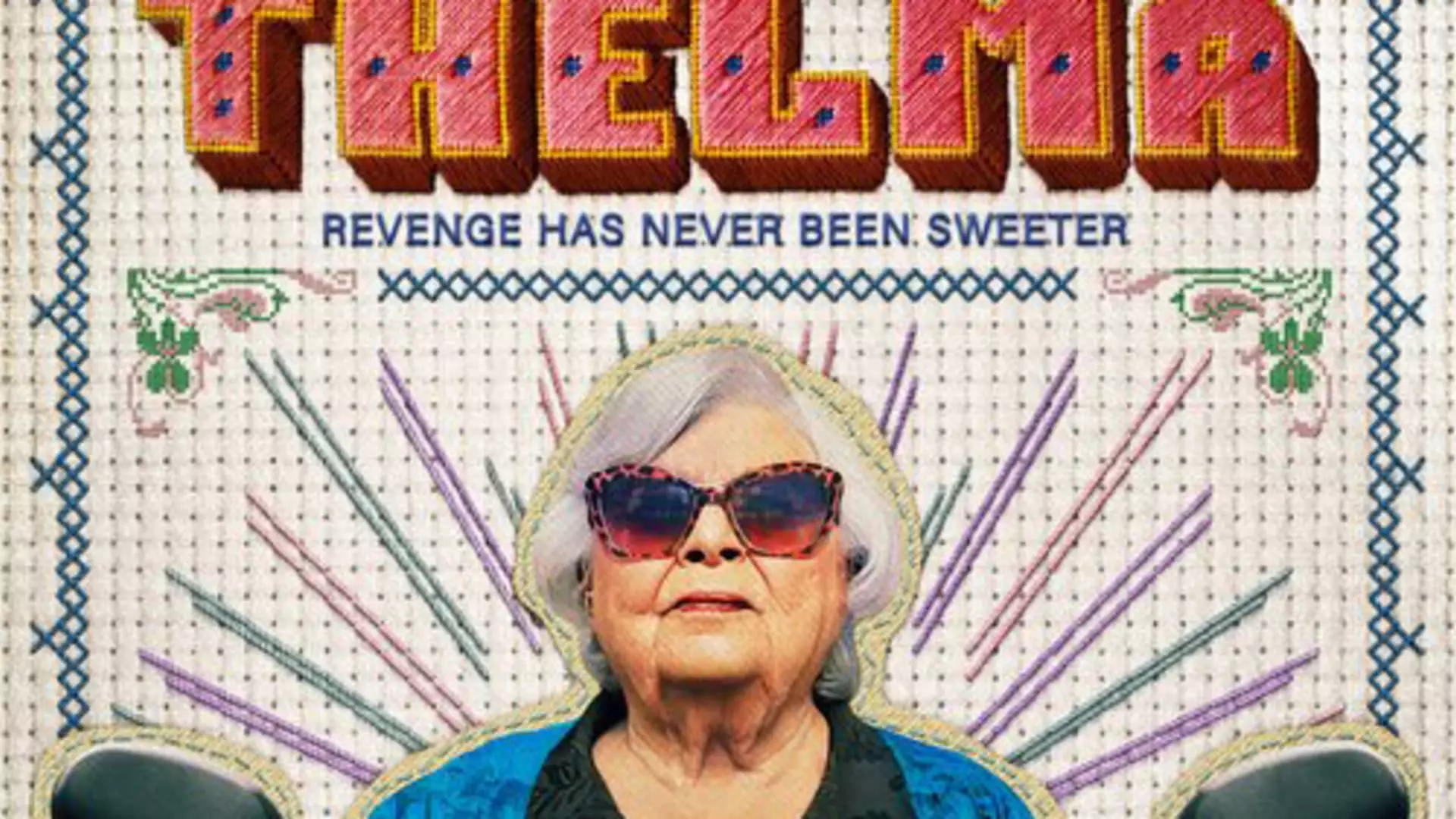

Imposter fraud, commonly known as grandparents’ scams or family emergency scams, is on the rise in the digital age. The story of Thelma Post in the movie “Thelma” sheds light on the vulnerability of older adults to such scams. With losses from imposter fraud reaching nearly $2.7 billion last year, it is crucial to be vigilant in protecting oneself and loved ones from falling victim to these fraudulent schemes.

The advent of generative AI has enabled scammers to create deep fake scams that mimic distress calls from loved ones. With just a few seconds of audio from social media platforms like TikTok, scammers can manipulate voices to create urgent pleas for financial help. This poses a serious threat as these scams often target individuals who are emotionally vulnerable and in need of immediate assistance.

While older adults are commonly targeted due to cognitive decline and slower decision-making processes, younger generations are also at risk. With increased online presence and exposure to technology, younger individuals, especially Gen Z and millennials, are falling victim to an alarming number of scams. It is essential to educate and raise awareness across all age groups to prevent falling prey to these fraudulent schemes.

Establishing an aging plan in your late 50s or early 60s can help prepare for potential scams in the future. Including family members in discussions about financial surrogacy and decision-making can provide a support system for vulnerable individuals. It is important to address the issue of autonomy and independence sensitively when discussing the need for assistance with technology and personal care.

Practical Security Measures

Taking proactive steps to protect personal information is essential in safeguarding against scams. Basic security practices such as freezing credit, setting up multifactor authentication on accounts, and investing in identity theft insurance can serve as barriers against fraudulent activities. By implementing these measures, individuals can create a strong defense against potential scams and protect their financial well-being.

The threat of imposter frauds and scams is a growing concern in today’s digital landscape. By staying informed, proactive, and vigilant, individuals can protect themselves and their loved ones from falling victim to these deceptive schemes. Education, communication, and practical security measures are key components in safeguarding against scams and ensuring financial security in an increasingly connected world.

Leave a Reply