The Chinese government is making significant strides to address the challenges facing its real estate sector. Recent announcements from key officials indicate a comprehensive strategy aimed at bolstering the economy and restoring confidence among investors and homebuyers alike. With a promise to expand the “whitelist” of real estate projects and accelerate bank lending, the government is seeking to inject liquidity into an ailing market that has seen unprecedented setbacks in recent years.

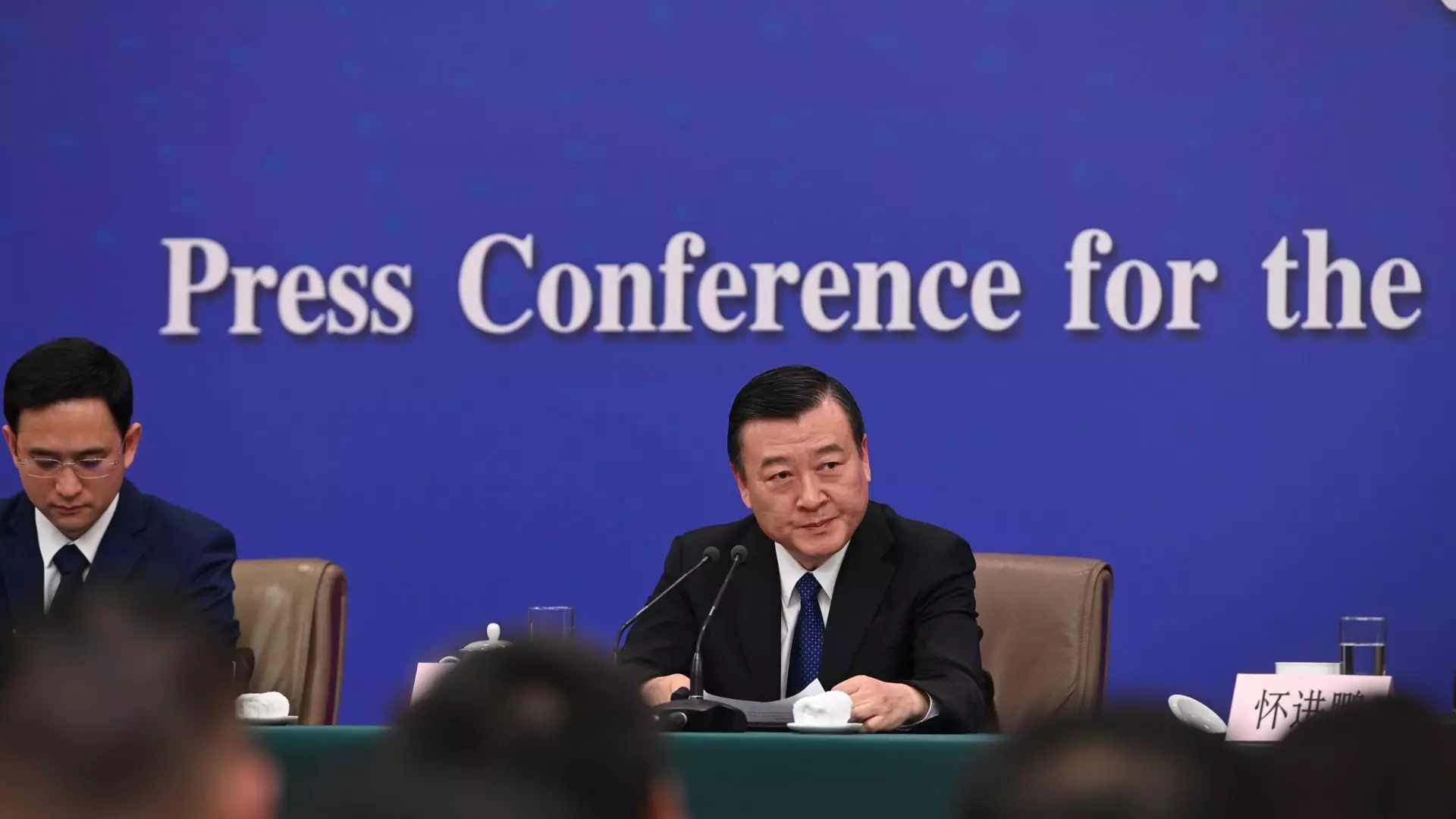

Launched in January, China’s “whitelist” initiative seeks to streamline financing for unfinished residential projects. City governments are now authorized to recommend specific developments to banks for expedited funding, which aims to complete stalled constructions and deliver homes to waiting buyers. Recent statements from China’s Housing and Urban-Rural Development Minister Ni Hong underscored the plan to increase the total approved lending to real estate developers from 2.23 trillion yuan to a staggering 4 trillion yuan ($561.8 billion) by the end of 2024. This doubling of financial support underscores an urgent need for revitalization in the sector, particularly as the economy encounters significant headwinds.

This expanded lending has broader implications for the economy. By accelerating the flow of capital to developers, the government hopes to not only complete projects but also to instill confidence in a market characterized by a lack of buyer trust. The wholesale eligibility of commercial housing projects for inclusion on the whitelist indicates a willingness to adopt a more flexible approach to addressing sector-wide problems.

In a related move, officials from various financial institutions, including the People’s Bank of China, have engaged in concerted monetary policy adjustments to stimulate the economy. The recently announced 50 basis-point cut to the reserve requirement ratio (RRR) is designed to enhance liquidity within the banking sector. Additionally, lowering the minimum down payment for second-home loans from 25% to 15% reflects an attempt to encourage purchasing and increase transaction volumes.

These policy shifts underscore a pivotal moment for China’s economy as it grapples with the effects of previous restrictions and market volatility. However, some analysts remain skeptical regarding the efficacy of these measures. Economist Bruce Pang has emphasized that while these changes are indicative of an effort to bolster the economy, tangible improvements in sales and property investment may take time to manifest. As the market remains volatile, investor sentiment holds a crucial role in determining the trajectory of recovery.

Despite these policy announcements, the immediate reactions from investors have been mixed. Following the government’s briefing, the Chinese CSI 300 real estate index experienced a notable downturn, dropping over 5%, a sharp decline from earlier gains in the week. Such volatility reflects a lack of consensus among investors regarding the effectiveness and long-term impact of the government’s stimulus efforts.

Economic experts such as Chi Lo from BNP Paribas have suggested that uncertainty surrounding the scope and effectiveness of policy measures is prompting hesitancy among investors. A rapid reassessment of market conditions, particularly after previous government interventions yielded limited results, underscores the precarious state of investor confidence.

China’s real estate sector was once a dominant force in its economy, contributing significantly to GDP. However, the onset of a severe downturn, attributed to high debt levels and regulatory crackdowns, has pushed many developers to the brink of bankruptcy, leaving numerous projects unfinished. As observed, new home prices have plummeted, presenting a daunting challenge for the government.

National statistics indicate that new home sales experienced a sharp decline of 23.6% through August this year, with price drops that reflect a cautious market. In an effort to reinvigorate demand, various cities are rolling out measures to reduce homebuying restrictions and provide incentives to prospective buyers.

As officials work to halt the real estate market’s decline, comprehensive reforms are vital to rebuild consumer confidence and stabilize prices. The release of more special bonds for local governments, paired with the flexibility to use affordability subsidies on existing inventories, marks a significant pivot towards rectifying previous market constraints.

While the Chinese government’s recent policy measures have stirred cautious optimism, the landscape remains complex. The expansion of the “whitelist” initiative and adjustments to monetary policy form the basis of a multifaceted strategy aimed at reviving the real estate market. However, the success of these policies will ultimately depend on the perception of stability and growth in the sector. As the government fine-tunes its approach, sustained efforts are critical to restoring equilibrium in a market deeply affected by years of regulatory challenges and economic uncertainty. The path forward will require not only innovative solutions but also a concerted effort to nurture investor confidence and facilitate a broader economic rebound.

Leave a Reply