The semiconductor industry has been experiencing a significant boom in artificial intelligence (AI) investment, with some companies reaping the benefits while others struggle to keep up. The latest financial results from various semiconductor firms shed light on the complexities of the sector’s supply chain and the dominance of certain companies over others in different areas of the industry.

The current interest in AI primarily revolves around large language models (LLMs) and generative AI. Companies like Google and OpenAI are developing chatbots and other applications that rely on LLMs, which require substantial computing resources and data to train effectively. As a result, tech giants like Meta and Microsoft are ramping up their capital expenditure to support AI research and product development efforts.

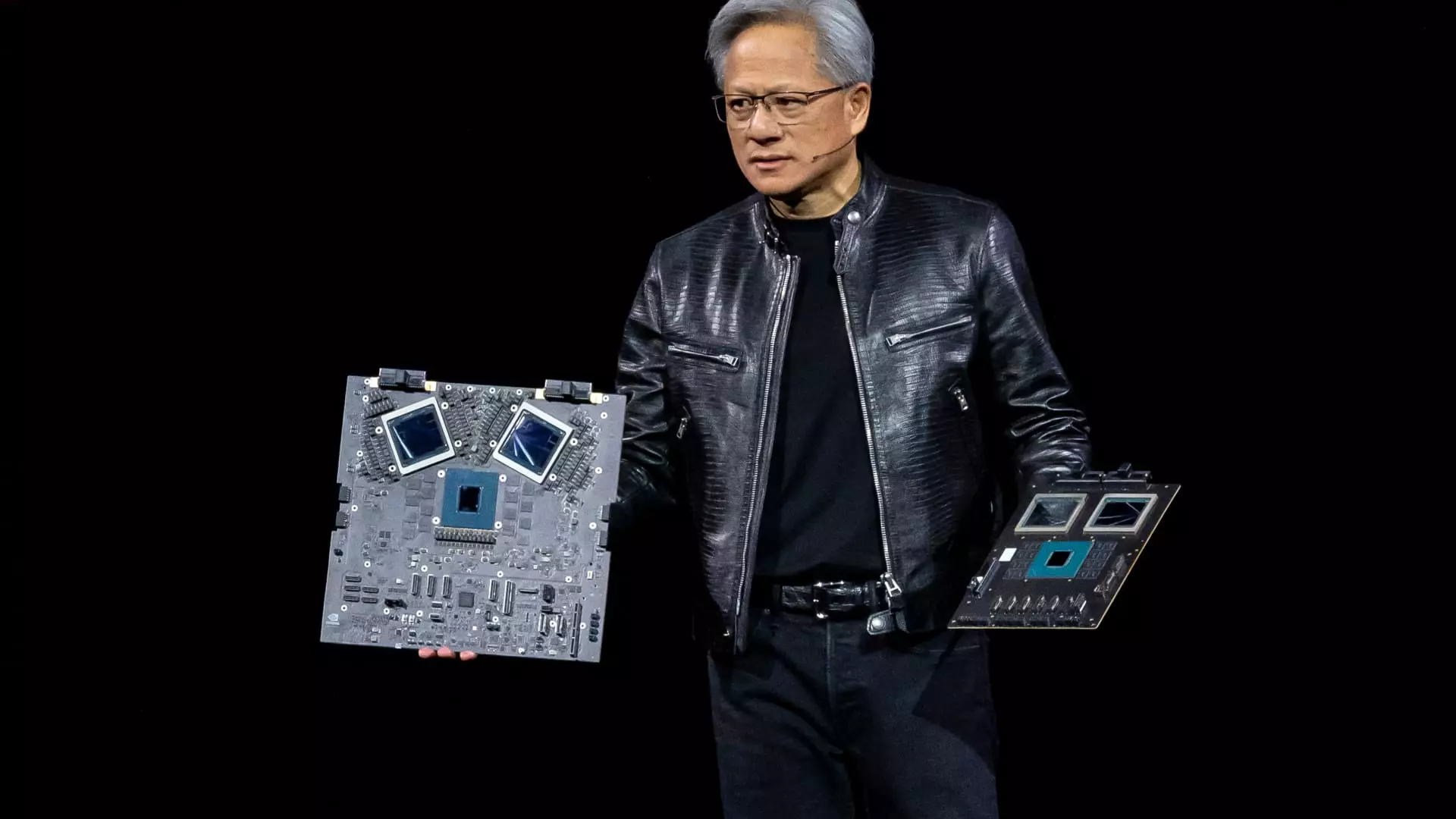

Nvidia has been a major beneficiary of the AI boom due to its graphics processing units (GPUs) being used for training LLMs. The company’s market position has been strengthened by the spending spree of tech giants adding computing resources. However, AMD has also entered the AI chip market and expects significant growth in data center GPU revenue, providing stiff competition to Nvidia.

Chip manufacturing and tool companies like TSMC and ASML have also seen a positive impact from the AI investment wave. TSMC reported a significant increase in net profit, driven by strong demand for semiconductors. ASML’s net bookings jumped by 24% year-on-year, showcasing the demand for its specialized tools in manufacturing advanced chips. Samsung, a key player in the semiconductor industry, saw a substantial rise in operating profit, indicating the overall growth in the sector.

Not all semiconductor firms have been able to capitalize on the AI investment trend, with companies like Qualcomm and Arm experiencing challenges. Despite their efforts to emphasize their importance in AI applications, the reality is that their exposure to the technology remains limited. Arm’s revenue still comes predominantly from consumer electronics, while Qualcomm’s chips are primarily used in smartphones, not in the data centers driving AI technology advancements.

While companies like Arm and Qualcomm may see potential benefits from AI in the future, the immediate impact on their financial performance is limited. As the semiconductor industry continues to evolve, companies will need to adapt to the changing landscape brought about by AI investment and development.

The complexities of AI investment in the semiconductor industry are becoming more evident as companies navigate the challenges and opportunities presented by the growing demand for AI technology. While some companies have successfully capitalized on the trend, others are struggling to keep up with the pace of innovation and market dynamics. Moving forward, it will be crucial for semiconductor firms to stay abreast of AI developments and adapt their strategies to remain competitive in the rapidly evolving industry.

Leave a Reply