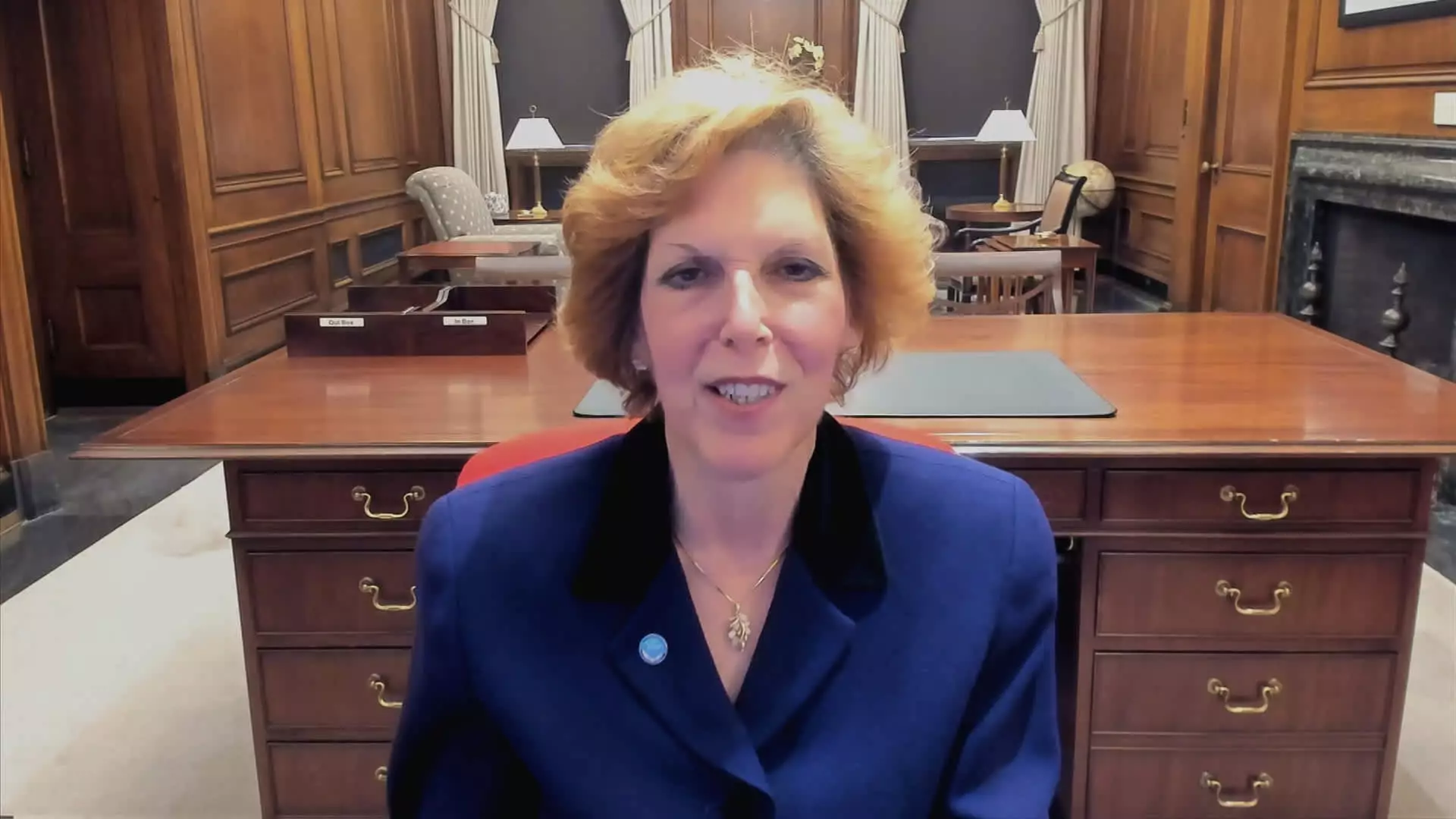

Cleveland Federal Reserve President, Loretta Mester, has stated that she still anticipates interest rate cuts to occur sometime this year. However, she has specifically ruled out the possibility of any cuts taking place at the next policy meeting in May. Mester has suggested that the long-run trajectory for interest rates is higher than what policymakers had previously assumed. She highlighted the progress made in terms of inflation, coupled with the continuous growth of the economy. Despite this positive outlook, she did not offer any clear guidance on when or to what extent these rate cuts may occur.

In her prepared remarks for a speech in Cleveland, Mester mentioned that she believes inflation will gradually decrease towards the target of 2 percent over time. However, she expressed the need for more data to increase her confidence in this prediction. Mester emphasized the importance of additional inflation readings in determining whether any unexpected data earlier this year were merely temporary anomalies or indicative of a potential halt in the progress towards the 2 percent inflation target.

Mester’s statements came shortly after the Federal Open Market Committee voted to keep the key overnight borrowing rate unchanged in the range of 5.25%-5.5%. The committee’s post-meeting statement echoed Mester’s sentiments, emphasizing the necessity of further evidence indicating progress towards the 2% inflation target before considering any rate reductions. It appears that any expectations for a rate cut at the upcoming FOMC meeting in April are unlikely, a sentiment that is reflected in market pricing as well.

Despite the likelihood of rate cuts in the future, Mester expressed her belief that the long-run federal funds rate would be higher than the previously assumed 2.5%. She identified the neutral or “r*” rate at 3%, which is the level at which policy is neither restrictive nor stimulative. After the March meeting, projections for the long-run rate increased to 2.6%, suggesting that other members of the committee are leaning towards higher rates as well. Mester acknowledged that the low rate during the Covid pandemic limited the Fed’s ability to stimulate the economy and emphasized the importance of calibrating policies effectively to avoid sudden, aggressive actions.

The Federal Reserve’s outlook on interest rate cuts is influenced by various factors, including inflation trends, economic growth, and long-term projections. While expectations for rate cuts persist, uncertainties remain about the timing and extent of these reductions. The comments from Federal Reserve officials like Loretta Mester provide insights into the ongoing discussions within the central bank regarding monetary policy and its implications for the broader economy.

Leave a Reply