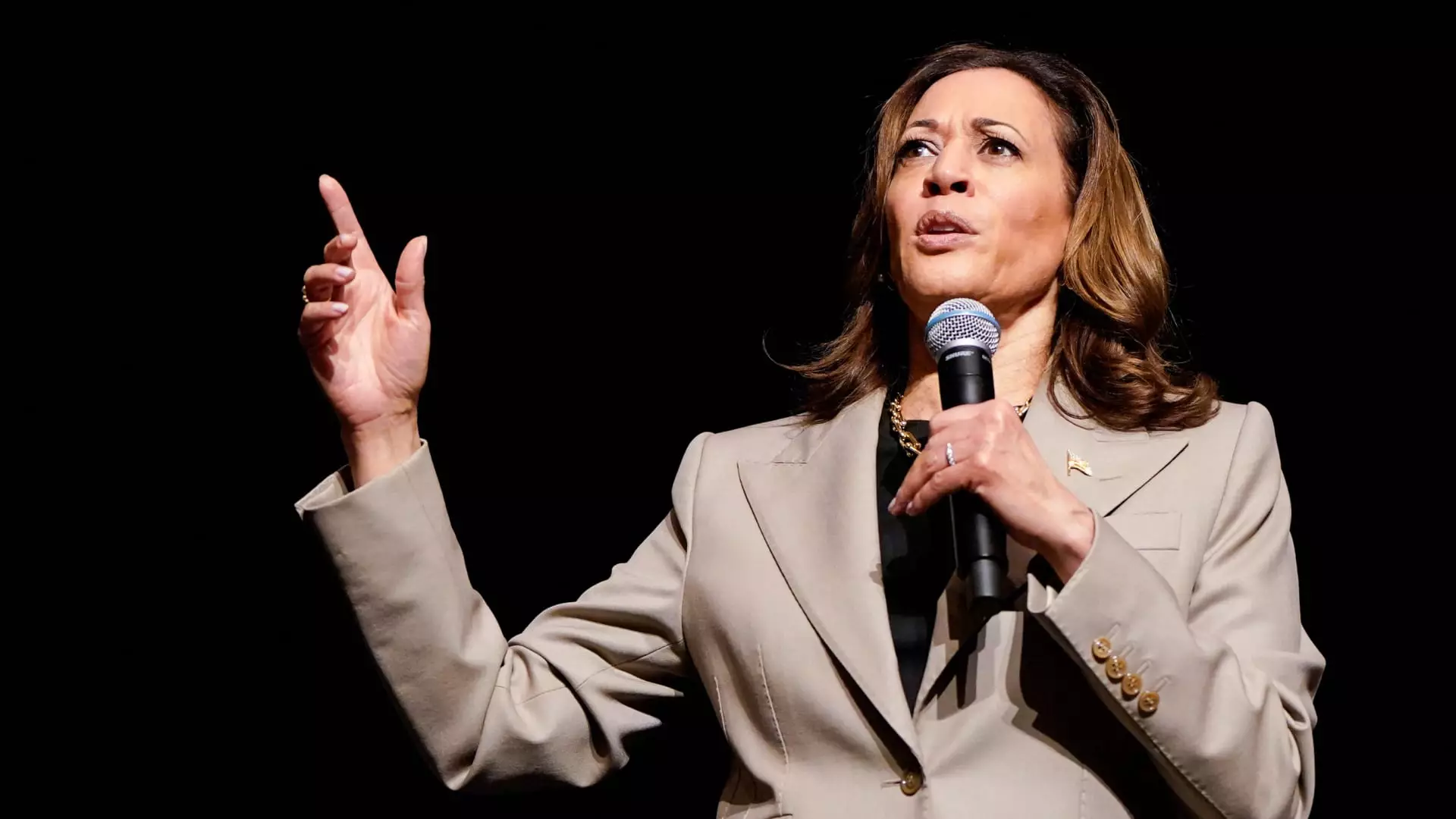

Vice President Kamala Harris recently announced a new economic plan that includes an expanded child tax credit of up to $6,000 for families with newborn children. This move is aimed at building on the higher child tax credit that was established through the American Rescue Plan in 2021. Under the previous plan, families could receive up to $3,600 in tax relief per child, depending on the child’s age and family income. Harris’ proposal seeks to increase this tax break for middle- to lower-income families for the first year after a child is born.

Shortly after Harris revealed her plan for the child tax credit, there were comparisons drawn between her proposal and that of former President Donald Trump’s GOP running mate, Sen. JD Vance. While Harris has aligned herself with President Joe Biden in terms of the child tax credit expansion, the addition of a $2,400 bonus for newborns has been described as both “different and somewhat surprising” by experts. This move has also been seen as a response to Vance’s $5,000 child tax credit proposal.

Despite the positive reception to the idea of expanding the child tax credit, there are significant challenges ahead when it comes to implementation. Senate Republicans recently blocked an expanded child tax credit that had gained support in the House, indicating a divide that may need to be addressed post-election. Additionally, the size and design of the future child tax credit will likely be influenced by which political party controls the White House and Congress.

Expanding the child tax credit, whether to $3,000, $3,600, or even $6,000 for newborns, comes with a hefty price tag. Lawmakers estimate that a $3,000 to $3,600 expansion could cost as much as $1.1 trillion over a decade, while the proposed $6,000 credit for newborns could have a price tag of $100 billion. These costs are especially concerning given the current federal budget deficit and the challenges associated with maintaining fiscal responsibility.

While there is bipartisan momentum behind the idea of expanding the child tax credit, the road ahead is uncertain. It remains to be seen how lawmakers will navigate the complexities of the tax code to ensure that families receive the support they need while also balancing the economic implications of such a move. Harris’ economic plan includes provisions for higher taxes on wealthy Americans and large corporations, signaling a commitment to addressing fiscal responsibility.

Vice President Kamala Harris’ proposed child tax credit expansion has sparked a national conversation about how best to support families with newborn children. While the idea of providing up to $6,000 in tax relief is appealing, the economic and political challenges associated with such a move cannot be overlooked. As lawmakers continue to debate the future of the child tax credit, it is crucial that they consider the long-term implications of their decisions on both families and the economy as a whole.

Leave a Reply