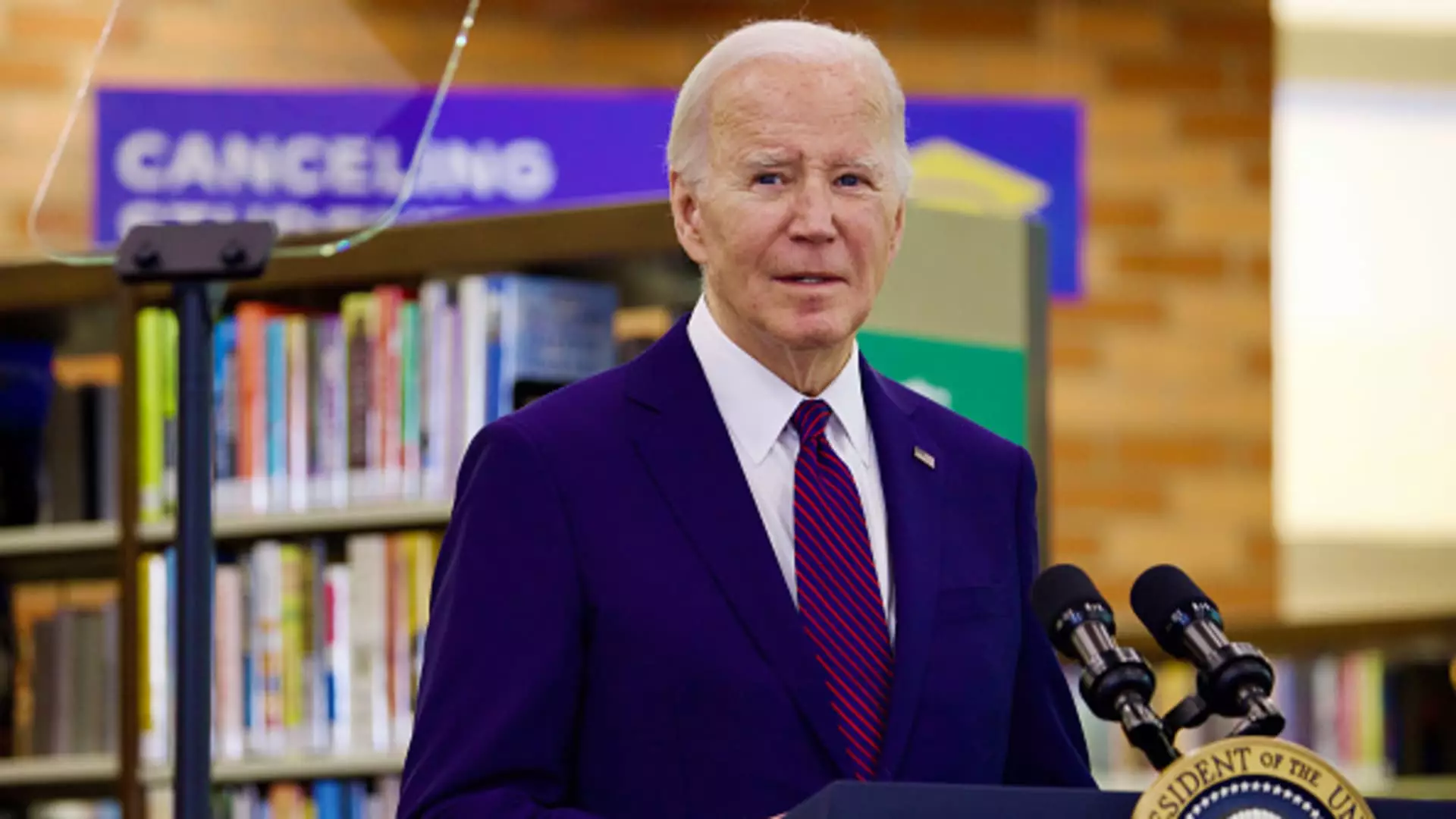

President Joe Biden is set to unveil a far-reaching student loan forgiveness plan that has the potential to benefit millions of Americans. The revamped aid package is expected to be disclosed during an event in Madison, Wisconsin. Following the Supreme Court’s rejection of his initial attempt to eliminate up to $20,000 in student debt per borrower last year, Biden has come up with a more narrowly tailored Plan B. Despite these limitations, the revised plan could still lead to the cancellation or reduction of outstanding balances for tens of millions of borrowers if it can withstand legal scrutiny.

The updated plan focuses on specific categories of borrowers. These include individuals who qualify for debt cancellation under an existing government scheme but have not taken advantage of it, as well as those who have been repaying their undergraduate loans for at least 20 years or their graduate loans for over 25 years. Furthermore, students who attended institutions of questionable value and those encountering financial hardship may also benefit from the revised plan. While the precise definition of financial hardship is yet to be determined, it might encompass individuals burdened by medical expenses or significant childcare costs.

In an effort to alleviate the financial burden on borrowers, President Biden’s plan includes provisions to cancel excessive interest charges for millions of individuals. Critics have long decried the practice of charging interest rates on federal student loans that exceed 8%, making it challenging for borrowers on certain payment plans or who have fallen behind to reduce their overall debt. The administration estimates that under the proposed plan, borrowers could have up to $20,000 of accumulated interest on their federal student loans forgiven, irrespective of their income levels. Additionally, lower- and middle-income borrowers may have the entire sum of accrued interest since entering repayment erased.

With an eye towards legal challenges, the Biden administration has opted for a different legal framework for its revised debt forgiveness plan. Unlike the previous failed attempt, this new initiative relies on the Higher Education Act of 1965 as its legal basis rather than the Heroes Act of 2003. The Higher Education Act grants the Secretary of Education the authority to waive or release student loan debt in certain circumstances, offering a more robust legal foundation for the administration’s efforts. This strategic pivot is aimed at ensuring the plan’s survival in the face of potential legal obstacles.

President Biden’s shift to the rulemaking process for student loan relief underscores his administration’s determination to deliver tangible benefits to borrowers. By opting for a regulatory approach rather than executive action, Biden is positioning himself to address the issue of student debt forgiveness in a more sustainable and systematic manner. Moreover, with an eye towards the upcoming elections, Biden is keen on making progress on this front to resonate with voters. A recent survey revealed that nearly half of registered voters consider student loan forgiveness a crucial issue for the upcoming elections, highlighting the electoral significance of this policy area.

President Biden’s new student loan forgiveness plan represents a significant step towards alleviating the financial burden on millions of borrowers. By targeting specific categories of individuals, addressing runaway interest charges, adopting a more legally defensible approach, and strategically positioning the issue within the political landscape, the administration is seeking to deliver meaningful relief to those grappling with student debt. As the details of the plan unfold and implementation progresses, it remains to be seen how this ambitious initiative will impact the lives of borrowers across the country.

Leave a Reply