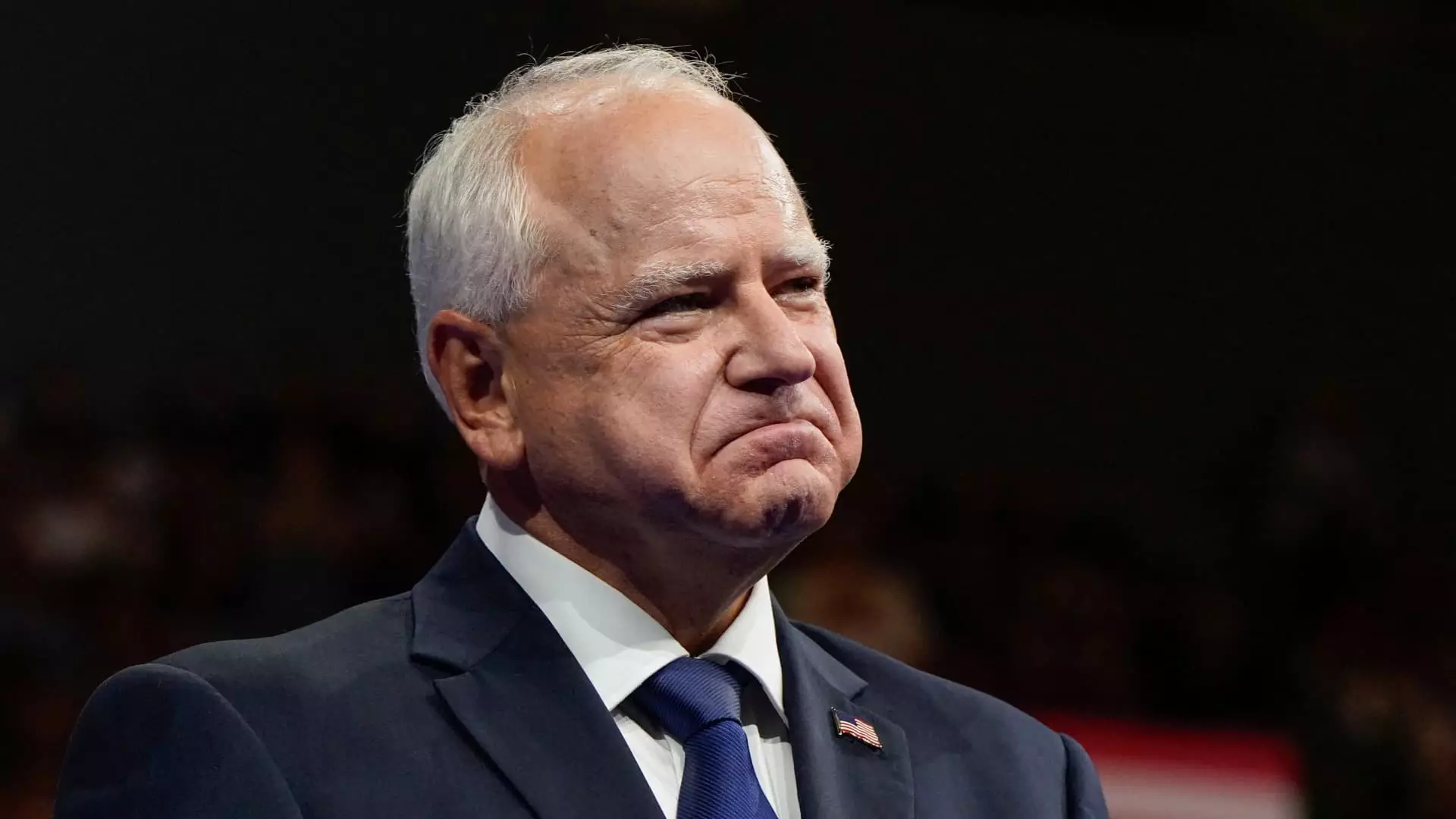

As more retirees struggle to make ends meet, there has been growing bipartisan support for exempting Social Security benefits from income taxes. This issue has gained attention in the 2024 election cycle, with Former President Donald Trump proposing a federal tax exemption and Minnesota Governor Tim Walz implementing state legislation in partnership with Vice President Kamala Harris. The goal is to alleviate the financial burden on seniors who rely on Social Security as their primary source of income.

While both federal and state initiatives aim to provide relief for seniors, there are distinct differences between the two. Federal income taxes on Social Security benefits are calculated based on “combined income,” which includes adjusted gross income, non-taxable interest, and half of the Social Security benefits received. The taxation thresholds vary for individuals and married couples filing jointly, with up to 85% of benefits subject to tax for those with higher combined incomes.

Transformative Impact of Tax Exemptions

According to Richard Auxier, a policy associate for the Urban-Brookings Tax Policy Center, Trump’s proposal to exempt Social Security from federal income tax could have a transformative effect. However, this change would come at a significant cost, potentially adding $1.6 trillion to the budget deficit over the next decade. Furthermore, expediting insolvency for the Social Security and Medicare trust funds could create additional challenges for the sustainability of these programs.

On the other hand, states like Minnesota have taken a more targeted approach to tax exemptions on Social Security benefits. In 2023, Minnesota expanded its state tax exemption to relieve most seniors from income taxes on their Social Security benefits. This policy adjustment aligns with other state tax codes and provides relief for retirees with adjusted gross incomes below $78,000 for individuals and $100,000 for married couples filing jointly.

Revenue Implications and Budget Ramifications

While state-level tax exemptions may have a lower revenue cost compared to federal proposals, they still have budgetary implications. As Auxier notes, each state’s decision to exempt Social Security benefits from income taxes can impact revenue, costs, and overall budget management. With only nine states currently taxing Social Security benefits, there is variability in how different jurisdictions choose to address this issue.

The debate over tax exemptions for Social Security benefits highlights the ongoing challenge of balancing fiscal responsibility with supporting retirees in need. While federal proposals like Trump’s aim to provide broad relief, they come with substantial costs and potential risks. On the other hand, state-level initiatives like Minnesota’s offer targeted assistance to seniors but require careful consideration of revenue implications. Ultimately, finding a sustainable solution to alleviate the tax burden on Social Security recipients will require thoughtful policymaking and collaboration at both the federal and state levels.

Leave a Reply