The semiconductor industry is currently experiencing difficulties in recruiting workers due to the increasingly competitive talent landscape, fueled by funding from initiatives such as the CHIPS and Science Act. According to a 2023 study from the Semiconductor Industry Association, the U.S. chips industry is projected to face a shortage of 67,000 technicians, computer scientists, and engineers by 2030. This shortage is further compounded by the broader U.S. economy, which is set to experience a gap of 1.4 million such workers by the same year. Deloitte also highlighted the challenges in the semiconductor space, citing global economic factors and ongoing supply chain issues as contributing factors to the talent crunch.

GlobalFoundries, one of the top chipmakers globally, has been actively working to address the talent shortage by implementing various recruitment strategies. The company has been targeting veteran candidates, participants in its workforce reentry program, and women in construction initiatives. Additionally, GlobalFoundries launched the semiconductor industry’s first registered apprenticeship program in 2021, offering full-time paid positions with benefits and no-cost training. This program, completed in two years or less, is open to individuals with a high school diploma or equivalent and an interest in the mechanical field. GlobalFoundries has successfully onboarded 50 apprentices through this program and continues to recruit graduates with technical associate degrees from community colleges and veterans transitioning out of the military.

Chief People Officer Pradheepa Raman emphasized the importance of continuously evolving the workforce to meet the industry’s growing demands. GlobalFoundries aims to fill hundreds of roles worldwide and hires thousands of employees annually to keep up with the pace of expansion. Raman highlighted the necessity of exploring alternative talent pools and cross-training individuals from different fields to address the talent shortage. The company remains committed to workforce development efforts to attract and retain talent in a competitive environment, offering avenues for professional growth and advancement within the organization.

GlobalFoundries has introduced employee benefits and incentives to support its workforce and enhance employee satisfaction. The company launched a program in May that provides eligible U.S.-based employees and new hires with a tax-free lifetime total of $28,500 towards student debt. This benefit covers qualified loans for all degree types and credit-based certificate programs offered by U.S. universities and colleges. Over 200 employees have applied for this program, surpassing the company’s expectations. Employees like Morgan Woods, who started as a technician and transitioned into a training and development analyst role, have taken advantage of these benefits to improve their financial stability and support their career growth.

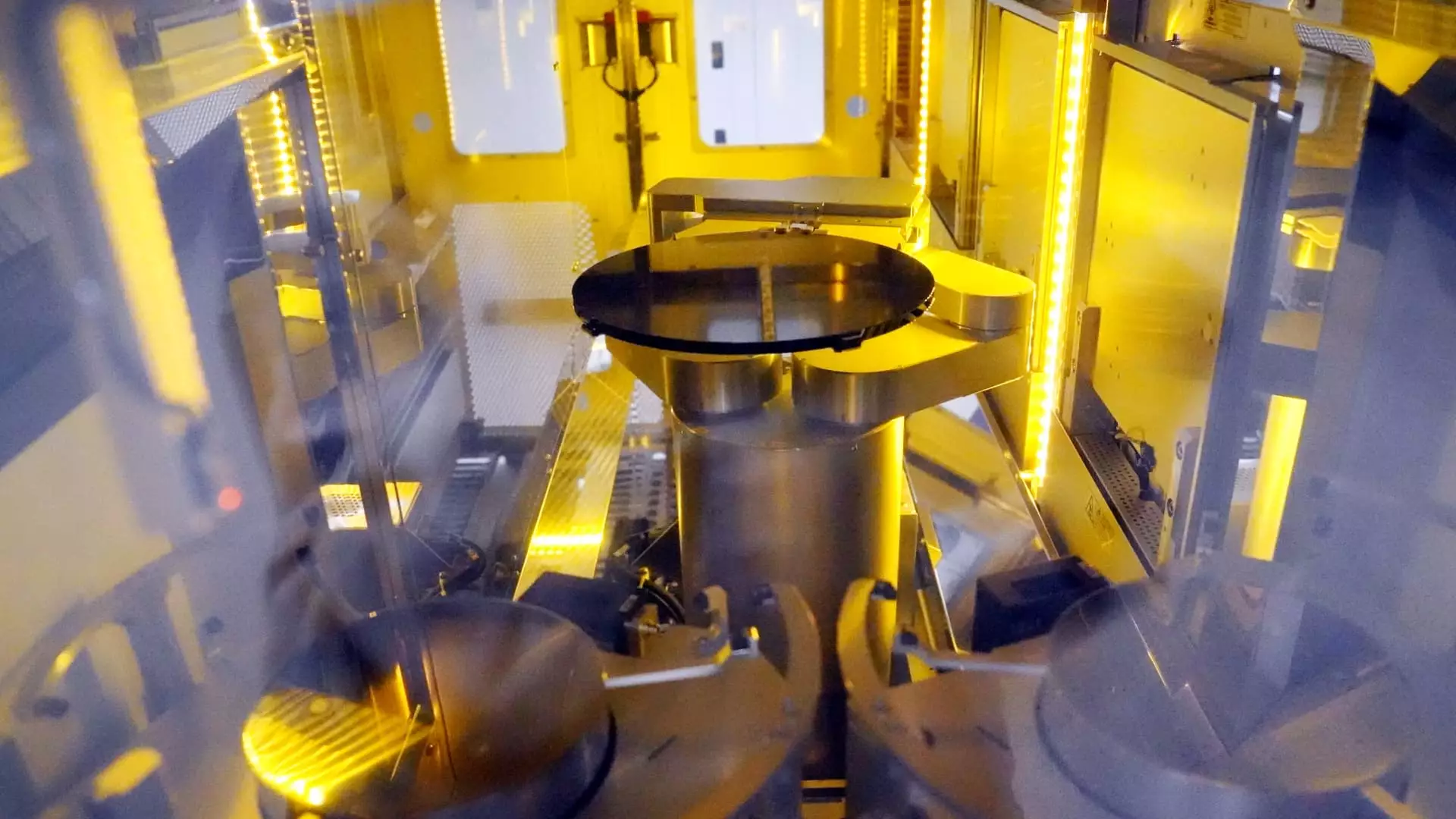

Apart from addressing the talent shortage, funding from the CHIPS and Science Act will contribute to the growth of GlobalFoundries’ manufacturing facilities in New York and Vermont. The company announced plans to invest $1.5 billion in CHIPS funding to expand manufacturing capacity, which is projected to create 1,500 manufacturing jobs and 9,000 construction jobs over planned projects’ lifetime. By leveraging these investments and offering attractive benefits to employees, GlobalFoundries aims to position itself as one of the best places to work in the industry and attract top talent.

The semiconductor industry faces significant recruitment challenges, driven by the competitive talent landscape and projected workforce shortages. GlobalFoundries’ proactive recruitment strategies, workforce development efforts, and employee benefits play a crucial role in addressing these challenges and positioning the company for continued growth and success in the semiconductor market. As the industry evolves, companies must prioritize talent acquisition and retention to meet growing demands and ensure a sustainable workforce for the future.

Leave a Reply