The U.S. stock market landscape has seen a significant shift in recent years, with just a handful of companies dominating the market. The S&P 500, a widely recognized benchmark for U.S. stocks, serves as a telling illustration of this trend. The weight of the top 10 stocks in the S&P 500 has surged significantly, accounting for 27% of the index at the end of 2023, compared to just 14% a decade earlier. This rapid increase in concentration is the most substantial since 1950, signaling a concerning trend in the market dynamics.

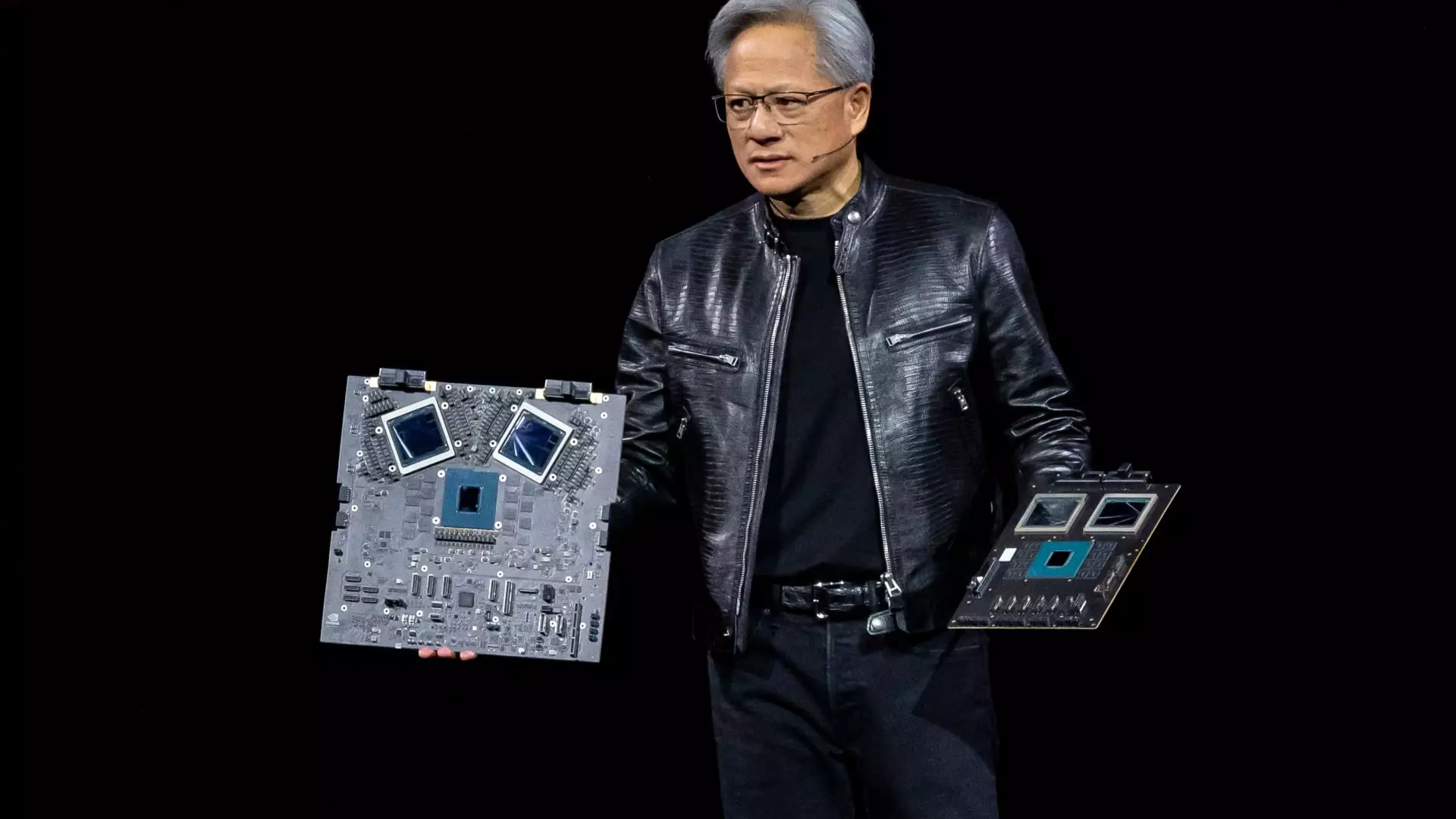

The so-called “Magnificent Seven” which includes Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, now make up about 31% of the S&P 500 index. These tech giants have experienced substantial growth, outpacing the overall returns of the S&P 500. The tech-stock euphoria has contributed to the higher concentration at the top, with the Magnificent Seven collectively up about 57% in the past year, more than double the index’s return during the same period.

While the concentration of the top stocks in the S&P 500 has boosted overall market performance, it also poses risks for investors. A downturn in one or more of these dominant companies could potentially impact a significant portion of investor portfolios. For instance, Nvidia’s recent market value decline of over $500 billion resulted in a multiday losing streak for the S&P 500. The substantial weight of just a few stocks in the index raises concerns about the lack of diversification and the vulnerability of investors to market fluctuations.

Many market experts have expressed varying views on the implications of the increasing concentration in the U.S. stock market. While some believe that the concerns are warranted, others argue that the current situation may not be as alarming as perceived. Historical analysis reveals that previous periods of high stock concentration have not always resulted in negative outcomes for the market. Additionally, the profitability of the top U.S. companies and the diversified nature of investors’ portfolios beyond the domestic market provide some level of reassurance.

To address the potential risks associated with stock concentration, financial experts recommend diversifying investment portfolios. A well-rounded equity portfolio should include stocks of large companies like those in the S&P 500, as well as middle-sized, small U.S., and foreign companies. Diversification across different sectors and asset classes can help reduce exposure to the volatility of individual stocks. Target-date funds offer a simple and effective way for investors to achieve diversification, adjusting asset allocation based on the investor’s age and risk tolerance.

The increasing concentration of a few dominant companies in the U.S. stock market presents both opportunities and challenges for investors. While these companies have propelled market gains, their overwhelming influence raises concerns about portfolio risk and the need for diversification. By understanding the implications of market concentration and adopting sound investment strategies, investors can navigate the evolving landscape of the stock market more effectively.

Leave a Reply