Reservoir Media represents a significant player in the music industry landscape, functioning across multiple segments including music publishing, recorded music, and rights management, particularly in the Middle East. Established as a company that not only preserves but also promotes a rich catalogue of music, Reservoir aims to capitalize on the enduring appeal of its offerings. The company boasts an impressive roster of over 150,000 copyrights and 36,000 master recordings, featuring seminal artists such as Joni Mitchell, John Denver, and The Isley Brothers. This positions Reservoir as a vital entity not just in terms of revenues but also as a custodian of cultural heritage.

Following its initial public offering (IPO) in July 2021, Reservoir has shown robust financial growth, almost doubling its gross profit from $47.39 million to $89.38 million within a short span. Its business model bifurcates into two core segments: Music Publishing, which contributes 66.41% of total revenue, and Recorded Music, contributing 29.25%. The growth rates of 14.74% and 21.66% year-over-year in these segments exemplify Reservoir’s stability in a rapidly changing industry landscape. With the burgeoning shift towards subscription streaming services—a market that expanded by 11.2% in 2023—Reservoir’s strategic emphasis on leveraging streaming platforms as a revenue source seems well timed, with streaming and downloading services accounting for around 54.17% of total revenue.

Despite these promising figures, a looming concern persists—Reservoir’s 22.24% decline in share price since its IPO. This paradox generates scrutiny concerning the firm’s long-term strategy and market perception.

Irenic Capital’s involvement with Reservoir underscores a crucial dynamic in the contemporary business environment where activist investors are increasingly vocal about corporate strategies. Founded by seasoned investment professionals in 2021, Irenic has urged Reservoir to conduct a strategic review. Such a review could potentially uncover options for optimizing asset allocation or restructuring to enhance shareholder value. Despite a somewhat critical view of “sell the company” sentiment, Irenic’s calls for an examination of Reservoir’s corporate structure illuminate the potential misalignment between the company’s financial performance and its market valuation.

Reservoir’s status as primarily a collector of royalties rather than an operational entity further complicates its market positioning. The comparison of royalties to a bond’s coupon payment illustrates a broader financial reality—its revenues can only expand significantly if music catalogues are either aggressively marketed or if dealing with established artists whose popularity is already waning.

The initial thesis surrounding Reservoir’s public offering suggested that it might leverage high SPAC valuations to acquire peers with lower multiples, consolidating royalty streams under its portfolio. However, with current market realities resulting in its shares trading at considerably lower rates compared to peers, this strategy appears increasingly challenging. As a result, discussions of acquisition or merger opportunities gain relevance, particularly when considering the financial backing and industry experience of its existing shareholders—most notably the Khosrowshahi family, who hold 44% equity, alongside Irenic’s and Richmond Hill Investment’s positions.

Capitalizing on these dynamics could present opportunities for a strategic buyer to enter the space—perhaps a financial buyer seeking to acquire Reservoir for a premium, considering its substantial catalogue and steady revenue stream. Recent acquisitions within the industry, exemplified by Blackstone’s purchase of Hipgnosis at attractive multiples, illustrate the attractiveness of such portfolios in the eyes of investors.

The Importance of Leadership and Governance

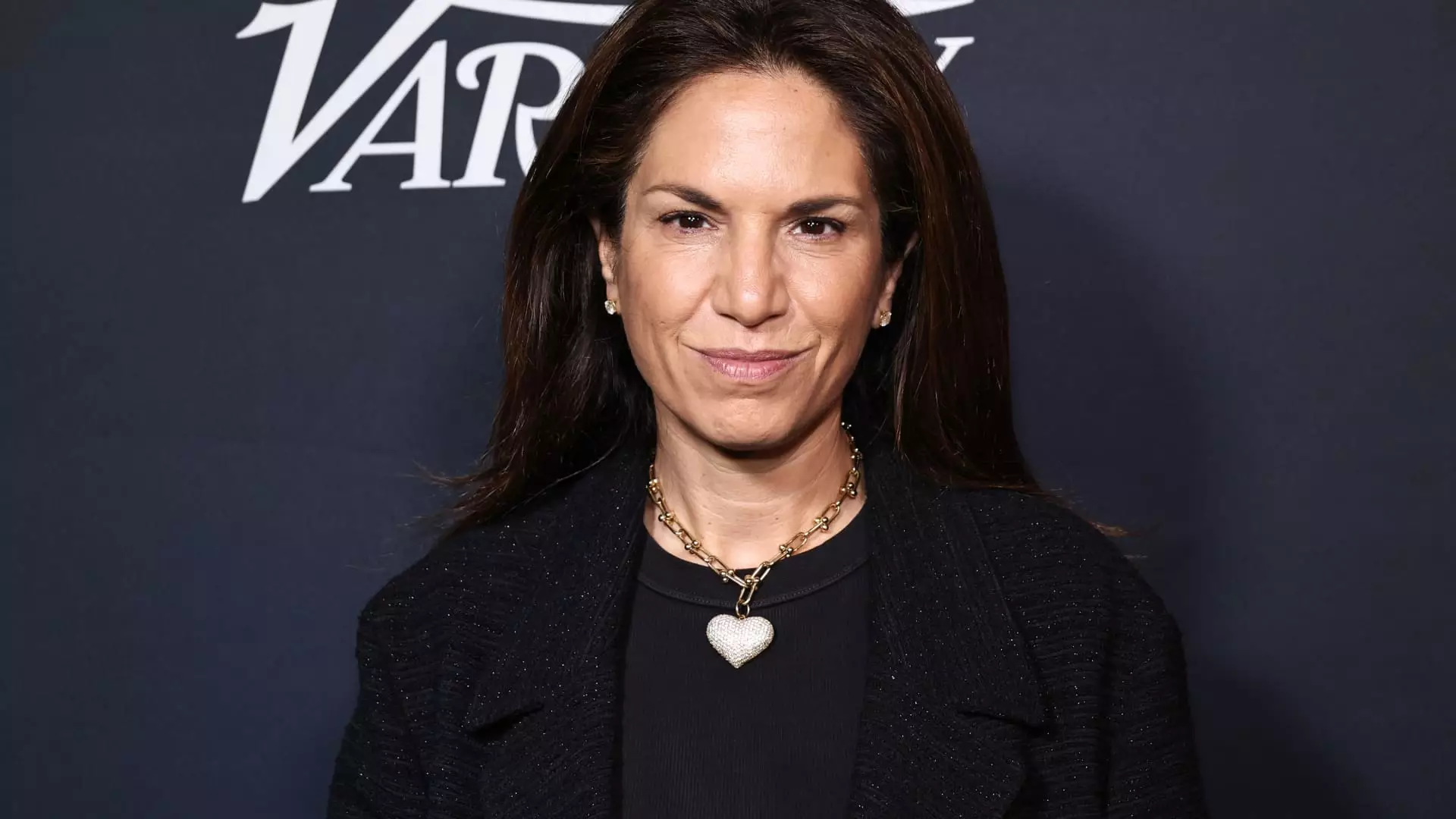

The strategic direction under current CEO Golnar Khosrowshahi, who is also a significant stakeholder, emphasizes the importance of stable leadership during these transitional times. Her reputation for effectively managing and driving growth in the industry positions her as an asset for any prospective buyer. The leadership’s vision will be paramount in navigating the complexities of potential acquisition scenarios while ensuring that Reservoir’s future strategies align with long-term shareholder interests.

Reservoir Media stands at a consequential juncture, where its established business model, reinvigorated by a thriving digital music environment, converges with the uncertainties stemming from activist pressure and market volatility. The firm possesses strong assets and competent management; however, the realization of its full potential will depend on the ability to adapt to evolving market conditions, leverage strategic partnerships, and navigate investor expectations. The evolution of Reservoir Media’s corporate strategy, aligned with the interests of its diverse shareholder base, will be critical as it strives to assert its position in a transformed industry landscape.

Leave a Reply