Nvidia, the renowned chipmaker, recently saw its shares soar past the $1,000 mark in extended trading following the release of its fiscal first-quarter results. These results, which exceeded analyst expectations, have become a reliable indicator for investors looking to gauge the strength of the AI market that has captured the attention of the financial world in recent times.

With a staggering quarterly revenue of $26.04 billion, Nvidia reported a remarkable increase in net income compared to the previous year. The company’s success can be primarily attributed to the surging demand for its AI chips by tech giants like Google, Microsoft, Meta, Amazon, and OpenAI, who are investing billions of dollars in Nvidia’s cutting-edge graphics processing units.

Nvidia’s data center sales, which include AI chips and supplementary components for AI servers, experienced an impressive 427% growth to reach $22.6 billion in revenue. This exponential increase was largely fueled by the deployment of Nvidia’s Hopper graphics processors, such as the H100 GPU, with Meta’s recent adoption of 24,000 H100 GPUs for their latest large language model, Lama 3, serving as a notable highlight.

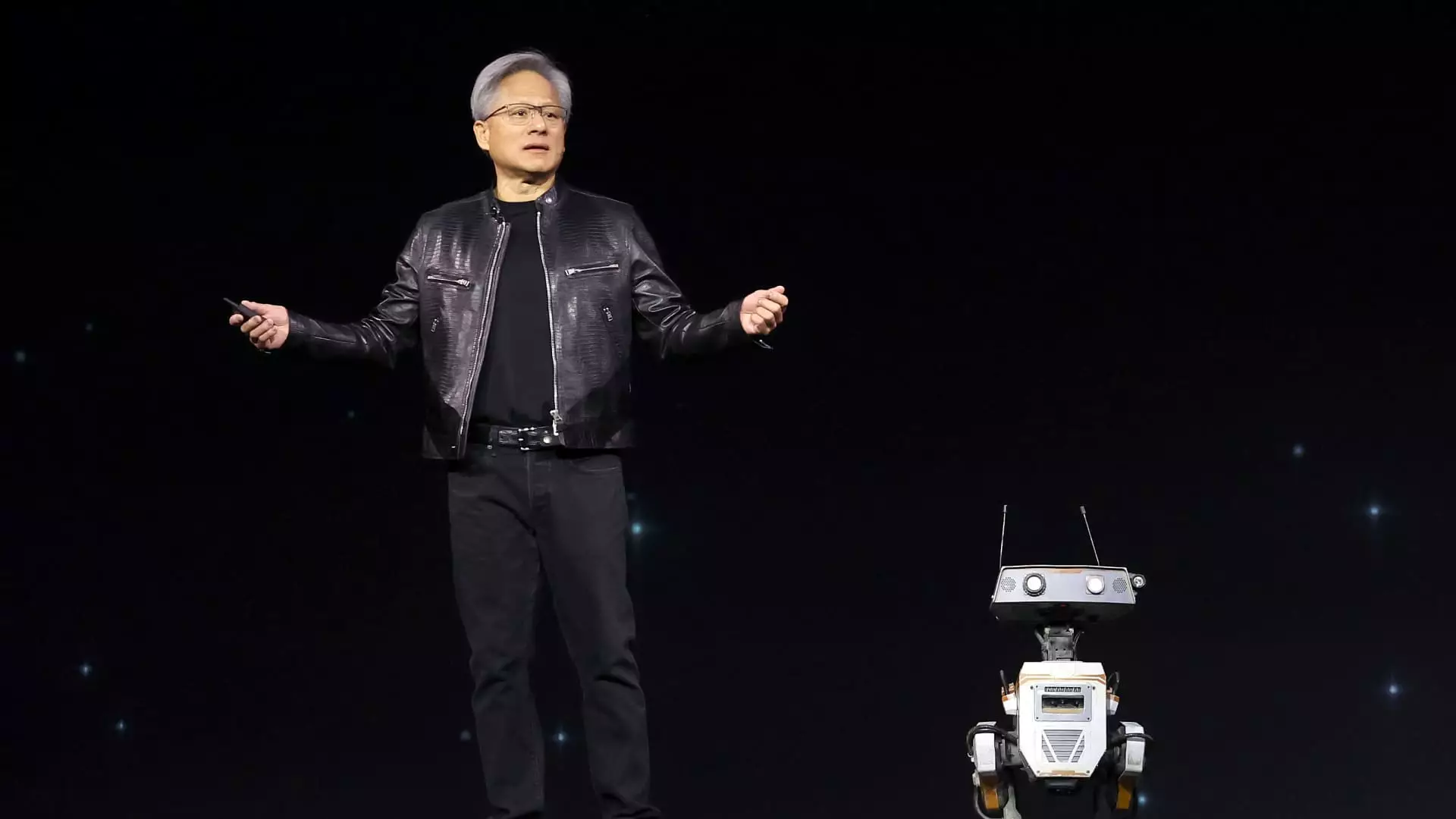

Looking ahead, Nvidia’s CEO, Jensen Huang, expressed optimism about the company’s next-generation AI chip, Blackwell, which is expected to drive additional revenue growth. Huang anticipates a significant influx of Blackwell revenue by the end of the year, with the new chip set to be integrated into data centers by the fourth quarter.

While Nvidia’s data center business remains its primary revenue driver, the company also witnessed robust sales in other segments. Gaming revenue, which increased by 18% to $2.65 billion, was buoyed by strong consumer demand. Moreover, Nvidia’s networking products, particularly its InfiniBand offerings, recorded a substantial revenue surge, indicating the growing importance of connectivity solutions for large-scale chip clusters.

In addition to its operational success, Nvidia undertook shareholder-friendly actions during the quarter. The company repurchased $7.7 billion worth of its shares and paid $98 million in dividends. Furthermore, Nvidia announced a dividend increase from 4 cents per share to 10 cents on a pre-split basis. Post-split, the dividend will amount to one cent per share.

Nvidia’s exceptional financial performance in the first quarter underscores the company’s pivotal role in driving innovation in the AI sector. With a robust product portfolio, strategic partnerships, and a solid financial foundation, Nvidia is well-positioned to capitalize on the burgeoning demand for AI technologies and maintain its trajectory of growth in the coming years.

Leave a Reply