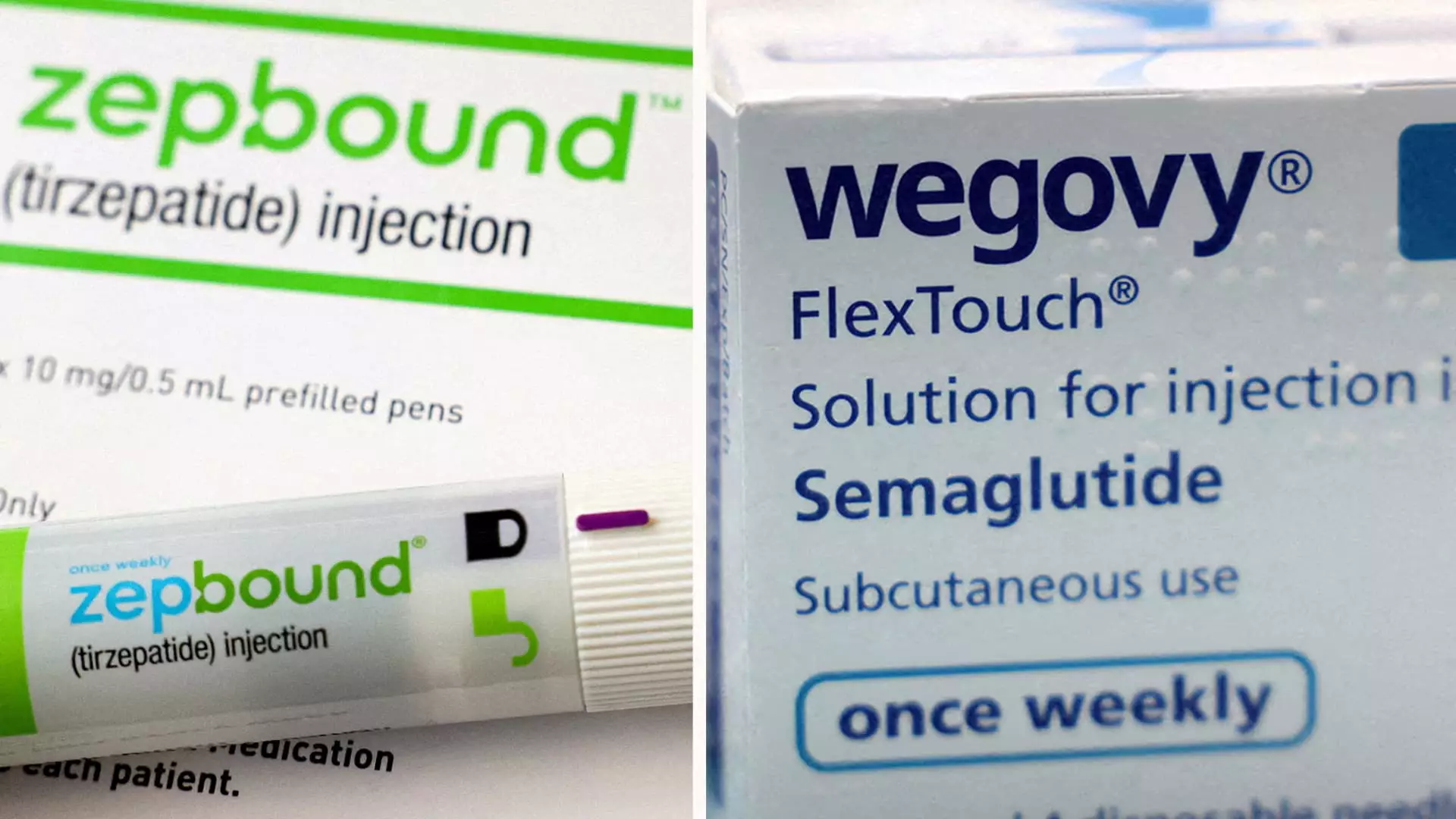

In a significant development in the realm of obesity medications, Eli Lilly announced on Wednesday that its drug Zepbound has surpassed its main competitor, Wegovy, manufactured by Novo Nordisk, in a head-to-head clinical trial. This finding emerges from a rigorous Phase III study, highlighting Zepbound’s potential as a more effective treatment option for those struggling with obesity or overweight conditions. While both drugs are weekly injections aimed at assisting patients in shedding excess weight, Zepbound demonstrated a remarkable ability to induce an average weight loss of 20.2%, or around 50 pounds, over 72 weeks in the trial. In contrast, Wegovy resulted in an average weight loss of 13.7%, equating to approximately 33 pounds during the same timeframe.

The implications of these results are profound for patients and healthcare providers alike. Eli Lilly reported that Zepbound achieved a 47% higher relative weight reduction compared to Wegovy. Notably, over 31% of patients on Zepbound lost at least a quarter of their body weight, whereas only about 16% of those on Wegovy reached that milestone. This stark contrast in efficacy suggests that Zepbound may be a game-changer in the pursuit of successful weight management, particularly for individuals with additional weight-related health issues.

Further supporting these findings, a late-stage study attributed an impressive weight loss average of over 22% to Zepbound, while previous investigations have shown Wegovy delivering around 15% weight loss. However, the comprehensive nature of the recent results—stemming from a carefully randomized trial involving 751 patients—positions them as particularly credible.

The distinct modes of action between the two drugs deserve examination. Zepbound operates through the regulation of appetite and blood sugar levels by stimulating two gut hormones: Gastric Inhibitory Polypeptide (GIP) and Glucagon-Like Peptide-1 (GLP-1). On the other hand, Wegovy focuses solely on activating GLP-1, omitting GIP, which some researchers suggest could play a crucial role in how the body metabolizes sugar and fat. This difference in hormonal action may account for the marked disparity in weight loss responses between the two treatments.

Eli Lilly’s revelation offers a significant advantage as it competes against Novo Nordisk for dominance in what analysts anticipate could become a staggering $150 billion weight loss drug market by the early 2030s. Even though Wegovy has enjoyed a two-year head start in the commercial space, Zepbound’s potential as a best-seller is gaining traction. According to projections from data analytics firm GlobalData, Zepbound could achieve annual sales of $27.2 billion by 2030, while Wegovy could reach $18.7 billion.

Furthermore, the demand for these medications has drastically outpaced supply. Both companies have invested heavily in scaling up their manufacturing capabilities, a testament to the soaring interest in obesity treatments. Currently, the Food and Drug Administration (FDA) has classified all doses of Zepbound and Wegovy as “available,” indicating improvements in production operations. However, many patients still find access to these drugs challenging due to inconsistent insurance coverage for weight loss treatments, with both medications priced around $1,000 monthly without assistance.

As Eli Lilly continues to assess its findings, the company plans to publish these results in a peer-reviewed medical journal and present them at an upcoming medical conference next year. Dr. Leonard Glass, senior vice president of global medical affairs at Eli Lilly Cardiometabolic Health, emphasized the intent behind this study—to empower healthcare providers and patients to make informed therapy choices.

The broader implications of Zepbound’s success are noteworthy not only for Eli Lilly and Novo Nordisk but also for the future landscape of obesity treatment. With rising obesity rates globally, effective and accessible weight loss therapies are essential. As both Zepbound and Wegovy view increased scrutiny and competition, the medical community remains hopeful that innovations in obesity care will lead to improved patient outcomes and enhanced quality of life for individuals battling weight issues.

Leave a Reply