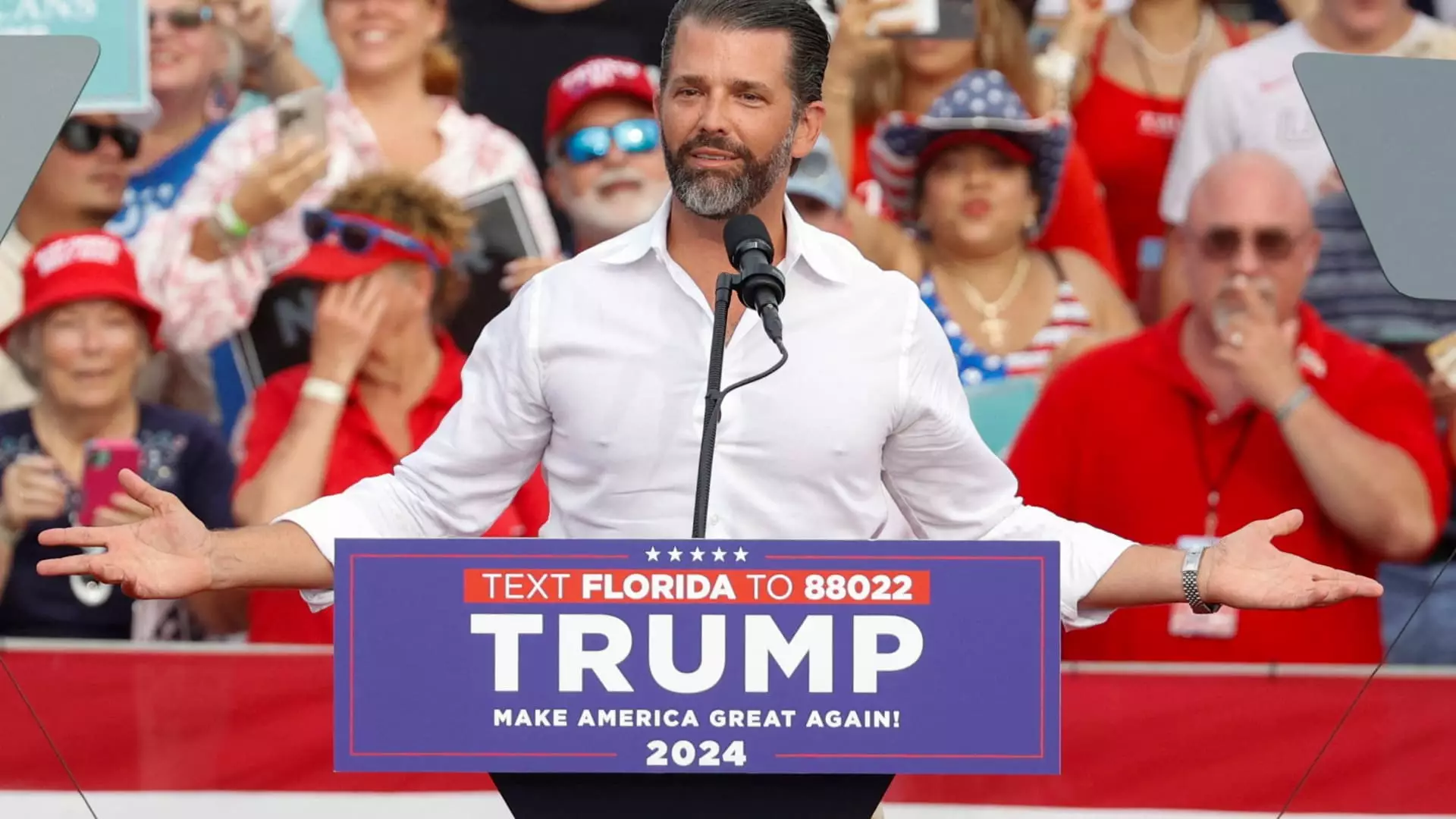

The recent appointment of Donald Trump Jr. to the board of PSQ Holdings has ignited considerable excitement in the financial markets, leading to a dramatic increase of 185% in the company’s stock price. This surge follows the announcement of Trump Jr.’s role in the company, which operates PublicSquare—an online marketplace that promotes commerce emphasizing themes such as life, family, and liberty. The news reflects not just Trump Jr.’s growing influence in corporate America, but also the potential for political connections to impact market dynamics.

PublicSquare, a microcap company with a valuation of approximately $72 million, has been relatively minor in size compared to larger corporations. Nevertheless, it has successfully captured the attention of conservative audiences, underpinning a unique business model that seeks to cater to those looking to avoid “cancel culture” in their economic choices. The company’s chairman and CEO, Michael Seifert, noted Trump Jr.’s background as an investor prior to the initial public offering, suggesting a long-standing commitment and vested interest in the company.

Financial Performance Under Scrutiny

Despite the excitement generated by Trump Jr.’s involvement, the financial health of PSQ Holdings raises questions about its long-term viability. For the September quarter, PublicSquare reported a modest net revenue of $6.5 million coupled with significant operating losses surpassing $14 million. Such a financial trajectory may cause potential investors to ponder if the stock price increase is sustainable or merely a speculative bubble fueled by political ties. The influx of attention to the company following Trump Jr.’s appointment could mask underlying challenges the business faces, making it essential for stakeholders to assess the company’s fundamentals critically.

The Broader Landscape of Conservative Investment

Trump Jr.’s board membership at PSQ is part of a broader trend of conservative investment and business endeavors aimed at creating alternative platforms outside mainstream culture. Just days prior to this move, Trump Jr. made headlines by joining the board of Unusual Machines, a drone manufacturer, leading to a swift increase in that company’s stock as well. As he also partners with 1789 Capital—a venture capital firm dedicated to conservative investments—it’s evident that Trump Jr. is strategically embedding himself within a network of enterprises that align with his ideological beliefs.

Additionally, the involvement of political figures, like Kelly Loeffler, in PSQ’s business dealings could suggest that the company is not merely benefitting from celebrity names but also from a calculated approach to attract investors that resonate with conservative values. Loeffler’s recent substantial purchase of 1.2 million shares for approximately $3.25 million underscores this intention, particularly given the recent equity surge.

The combination of political engagement and business acumen represented by Trump Jr.’s move to PSQ Holdings illustrates a fascinating intersection of market dynamics and ideological sentiments. While the immediate impact on stock prices is positive, the real test will be whether PublicSquare can convert this newfound attention into sustainable growth and profitability. Investors looking to ride the wave should remain cautious and consider both the potential rewards and inherent risks, as PublicSquare navigates its path in a complicated economic landscape.

Leave a Reply