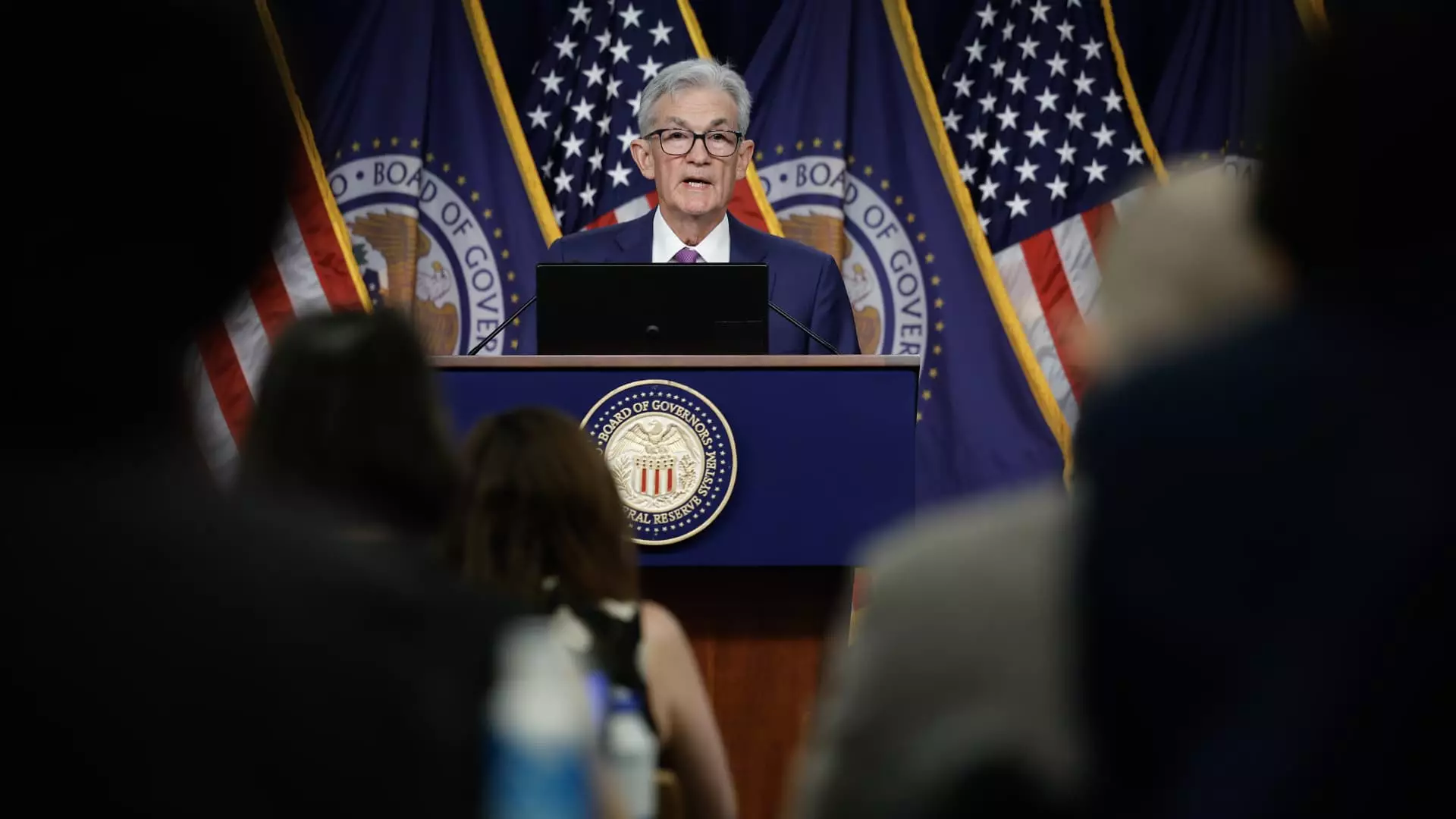

The Federal Reserve officials decided to maintain short-term interest rates at their current levels while indicating that inflation is moving closer to their target. This decision has sparked discussions about the possibility of future interest rate cuts. The central bankers acknowledged that there has been progress in economic conditions but maintained a cautious approach towards any rate reductions, emphasizing the need for further progress before any changes are made.

Upon analyzing the post-meeting statement by the Federal Open Market Committee, it is evident that there have been upgrades in the language used to describe inflation and economic conditions. The statement mentions that risks related to employment and inflation goals are moving into better balance, indicating an improvement from previous statements. The committee acknowledged that inflation has eased over the past year but remains somewhat elevated, showing a positive trend towards their 2 percent inflation objective.

The financial markets have been speculating about the possibility of rate cuts in the upcoming months, especially with futures pricing pointing towards such moves in the November and December meetings. Despite these expectations, the committee’s decision to maintain rates has led to a rally in the stock market. It is crucial to note that the Fed has made it clear that any decision regarding rate cuts will be data-dependent, emphasizing the importance of gaining confidence in inflation moving sustainably towards 2 percent.

Recent economic data has shown a decline in price pressures compared to previous years, with inflation hovering around 2.5% annually. The Fed’s preferred measure, the personal consumption expenditures price index, aligns with the 2% inflation target; however, other indicators suggest slightly higher readings. Despite maintaining a tight monetary policy, the economy has continued to expand, as evidenced by a 2.8% annualized growth rate in the second quarter driven by consumer and government spending.

While the labor market data has shown some signs of weakness, with private sector job growth slowing down and unemployment rates moving up slightly, there are positive indicators such as slower wage growth. The recent report by the Labor Department indicating a lower increase in wages, benefits, and salaries in the second quarter has raised concerns about the economy’s ability to sustain the current borrowing costs. Fed officials have reiterated their commitment to proceed cautiously and monitor the situation closely.

The Federal Reserve’s decision to keep interest rates steady reflects a balanced approach towards managing inflation and economic growth. While there are expectations and speculations about potential rate cuts, the Fed remains focused on data-driven decision-making. It is essential for investors and policymakers to closely monitor economic indicators and Federal Reserve announcements to navigate the evolving economic landscape effectively.

Leave a Reply