- Gen Z and millennials in Asia spent over $50,000 on art during early 2023, reshaping collector demographics.

- Christie’s and Sotheby’s report soaring sales from young buyers, especially across Hong Kong, Singapore, and mainland China markets.

- Young collectors prefer digital art and emerging talent, showing a strong shift from traditional collecting practices and tastes.

The art market in Asia has been experiencing a surge in demand, thanks to the wealthy and young collectors in the region. This new wave of collectors, comprised of Gen Zers (aged 12 to 27) and millennials (aged 28 to 43), has significantly increased their spending on art and antiques.

According to the Art Basel & UBS Survey of Global Collecting 2023, high-net-worth millennials in Asia spent a median of $59,785 on art during the first half of 2023, while Gen Zers spent $56,000. These figures show a promising trend and highlight the growing importance of young Asian collectors in the international art market.

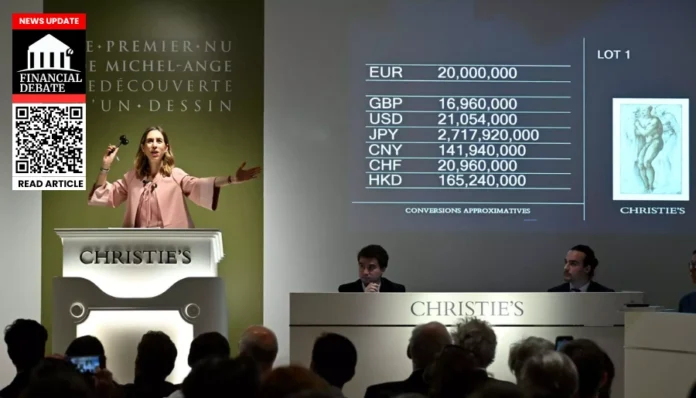

Christie’s, one of the world’s leading auction houses, has recognized Asia as a key market for millennial buyers. Mainland China, Hong Kong, and Singapore have emerged as major contributors to Christie’s global sales. For example, mainland China was the top contributing region by value for millennials at Christie’s Hong Kong 2023 Autumn Auctions, according to a spokesperson. Furthermore, Chinese collectors had the highest median expenditure of $241,000 in the first half of 2023, highlighting their position as the largest spenders globally.

Other renowned auction houses, such as Sotheby’s and Phillips, have also reported a surge in purchases by young Asian collectors. Sotheby’s 2023 report revealed that bidding activity by younger collectors grew to 30% in the first half of 2023, a significant increase from 6% in 2018. In addition, Phillips’ annual report showed that millennials accounted for nearly a third of global buyers and 40% of Asian buyers in 2022. This data further reinforces the influence of the younger generation in the Asian art market.

One notable difference between younger and older generations of collectors is their preferences in art. Millennial collectors tend to be drawn to figurative work, with a demand for surrealistic landscapes that portray spiritual spaces, according to Erin Remington, director of sales and curation at Saatchi Art. On the other hand, Gen Zers show a preference for digital art and prints.

Another interesting finding is the importance placed on emerging artists. 64% of younger buyers feel that it is important to have emerging artists in their collection, compared to only 43% of older buyers. This reflects a desire among the younger generation to discover and support new talent in the art world.

While physical auction numbers have rebounded to pre-pandemic levels, the online art market is here to stay. According to a report by Grand View Research, the size of the online art market is expected to grow to $17.76 billion by 2030. This growth can be attributed to high-net-worth collectors becoming more selective about physical art events and preferring the convenience of online auctions.

The COVID-19 pandemic has accelerated the shift towards digital platforms in the art world. Christie’s reported that in the first half of 2023, 80% of the bids across their auctions were placed online, compared to 45% in 2019. This increased comfort with online auctions can be seen in bidding amounts as well, with collectors now comfortable bidding up to $5.12 million online.

Auction houses understand the need to cater to younger buyers who are more digitally savvy and globally connected. As a result, they have been making significant investments in digital spaces. Christie’s, for example, has extended its digital reach through livestream auctions and online bids on social media platform WeChat. In 2023, Christie’s livestreams reached a record high of 60 million views, demonstrating the success of their digital initiatives.

The rise of wealthy, young collectors in Asia has significantly impacted the art market. Gen Zers and millennials have been driving demand, with a particular focus on online channels. Their preferences in art and their inclination to support emerging artists are reshaping the industry. As the market continues to evolve, auction houses and art platforms are investing in digital spaces to engage with this new generation of collectors.