- Accelerant Holdings’ IPO skyrocketed over 30% on its first trading day, signaling strong investor interest.

- The insurance tech firm raised $724 million, exceeding expectations and attracting huge market demand.

- With rapid global growth, the company is now valued at over $6 billion after its public launch.

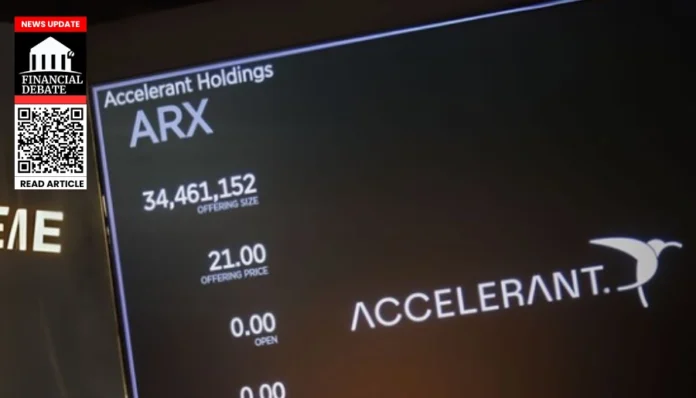

Accelerant Holdings started its public journey with a massive win. On its first day of trading, shares jumped over 30%. The stock opened at $28.50, well above its set price of $21. That jump pushed the company’s total value to more than $6 billion.

Investors welcomed the firm with open arms. Many were eager to buy shares, making the launch a major success. The company raised $724 million by selling 34.5 million shares, more than their original goal of 28.9 million.

Demand Far Exceeded Supply

Accelerant’s IPO was in high demand. Reports say that investors tried to buy 20 times more shares than were available. This strong response is rare and shows huge trust in the company’s business.

The offering was priced higher than expected. Originally, the share price was supposed to be between $18 and $20. But due to high demand, the final price was pushed to $21.

Why Investors Are Paying Attention

Accelerant is not a regular insurance firm. It uses technology to run a digital platform that connects insurers and capital providers. It offers data tools to improve how insurance risks are measured and shared.

With modern tools and strong performance, the firm looks different from old-style insurers. That makes it attractive for investors, especially during uncertain economic times.

Tech-driven insurance firms are becoming popular. Investors like them because they offer regular cash flow and steady business, even when other markets struggle.

Company Background

Accelerant Holdings was founded in 2018. It built a platform that links underwriters with groups that provide money, such as insurance companies, reinsurers, and big investors.

The company doesn’t just sell policies. Instead, it helps others do it better through its platform, which is now active in 22 countries.

More than 230 underwriting members use the system. It also works with 96 risk capital partners to offer over 500 different specialty insurance products worldwide.

Rapid Growth Numbers

Since its start, Accelerant’s growth has been impressive. Its written premiums—insurance policies sold through its platform—have grown at a rate of 217% every year.

By the end of March 2025, the firm had written $3.5 billion worth of premiums. In 2024, it reported $27.2 million in net income. These numbers are solid, especially for a company that is just 7 years old.

This strong financial performance helps explain the huge interest in its shares.

Use of Funds Raised

From the $724 million raised, Accelerant will receive around $426 million. The rest will go to early investors and insiders who sold their shares.

The money earned by the company will be used in a few ways. First, it plans to buy back some of its convertible preferred shares. These are special shares that early investors held.

Next, part of the funds will pay fees to Altamont Capital, one of the company’s earliest backers. Altamont will still hold most of the voting power in the company, even after the IPO.

Who’s Behind Accelerant’s Rise

Accelerant has some big names supporting it. One of them is Todd Boehly, the owner of Eldridge, a private investment firm. Altamont Capital, a private equity company, is another key investor.

These backers helped grow Accelerant from a small startup to a global insurance tech leader. Their support and experience also gave other investors more confidence.

The IPO was managed by top financial firms. Morgan Stanley and Goldman Sachs were the lead underwriters. BMO Capital Markets and RBC Capital Markets also played big roles in managing the sale.

A Boost for the IPO Market in 2025

Accelerant’s successful debut is part of a larger trend. The U.S. IPO market is showing signs of recovery in 2025. Many new companies have gone public this year.

Reports say that IPO earnings are 75% higher compared to the previous year. Investors are once again showing strong interest in new public firms, especially those in stable and growing sectors like insurance and finance.

Accelerant’s strong entrance could inspire more tech-focused insurance startups to go public.

Why Accelerant Stands Out

Accelerant is not trying to be the biggest insurer. Instead, it focuses on giving tools and data to insurance firms so they can do better business.

This strategy helps it avoid many risks that regular insurance companies face. It also allows Accelerant to grow fast without needing big offices or thousands of employees.

The company’s tech model makes it easy to expand into new countries and industries. This gives it an edge in today’s fast-changing insurance market.

What’s Next for Accelerant

Now that it is public, Accelerant has new goals. It will likely invest more in its technology and expand into more global markets.

Analysts say the company may also enter new types of insurance, such as cyber or climate-based products. With fresh funds and strong backing, it has room to grow quickly.

Investors will now be watching how the company performs in public markets. Strong quarterly results will be key to keeping trust high.

Final Thoughts

Accelerant Holdings showed that insurance tech has a bright future. Its first day as a public company was a major win. A 30% stock price jump is rare and shows how much belief the market has in the firm.

With strong growth, smart leadership, and support from big investors, Accelerant could shape the future of insurance. Its data-driven model fits well with the modern world. If it continues on this path, it may become one of the biggest players in global insurance innovation.