Investors in the K-pop industry have experienced a tumultuous start to the year, with stock prices plummeting due to lower fourth-quarter sales, diminishing profits, and various scandals affecting major entertainment companies. Companies like JYP Entertainment, YG Entertainment, Hybe, and SM Entertainment have all witnessed a decline in their stock values. In particular, SM Entertainment faced backlash following a dating scandal involving one of its artists, which resulted in a significant drop in market value. Despite these challenges, Goldman Sachs believes that the industry is “misunderstood” and has the potential for a significant revaluation.

Redefining Success Metrics

Goldman Sachs introduced a different perspective on evaluating the performance of K-pop companies by challenging the traditional focus on album sales as a primary indicator of success. While album sales are often associated with fan engagement and company prospects, Goldman argued that in-person concert attendance serves as a more reliable metric for assessing the industry’s growth. The analysts highlighted the impact of wallet share, emphasizing that multiple album purchases by individual fans can distort the perception of the fan base. They also pointed out that the surge in album sales during the pandemic, driven by the lack of offline interactions, skewed the relevance of this metric.

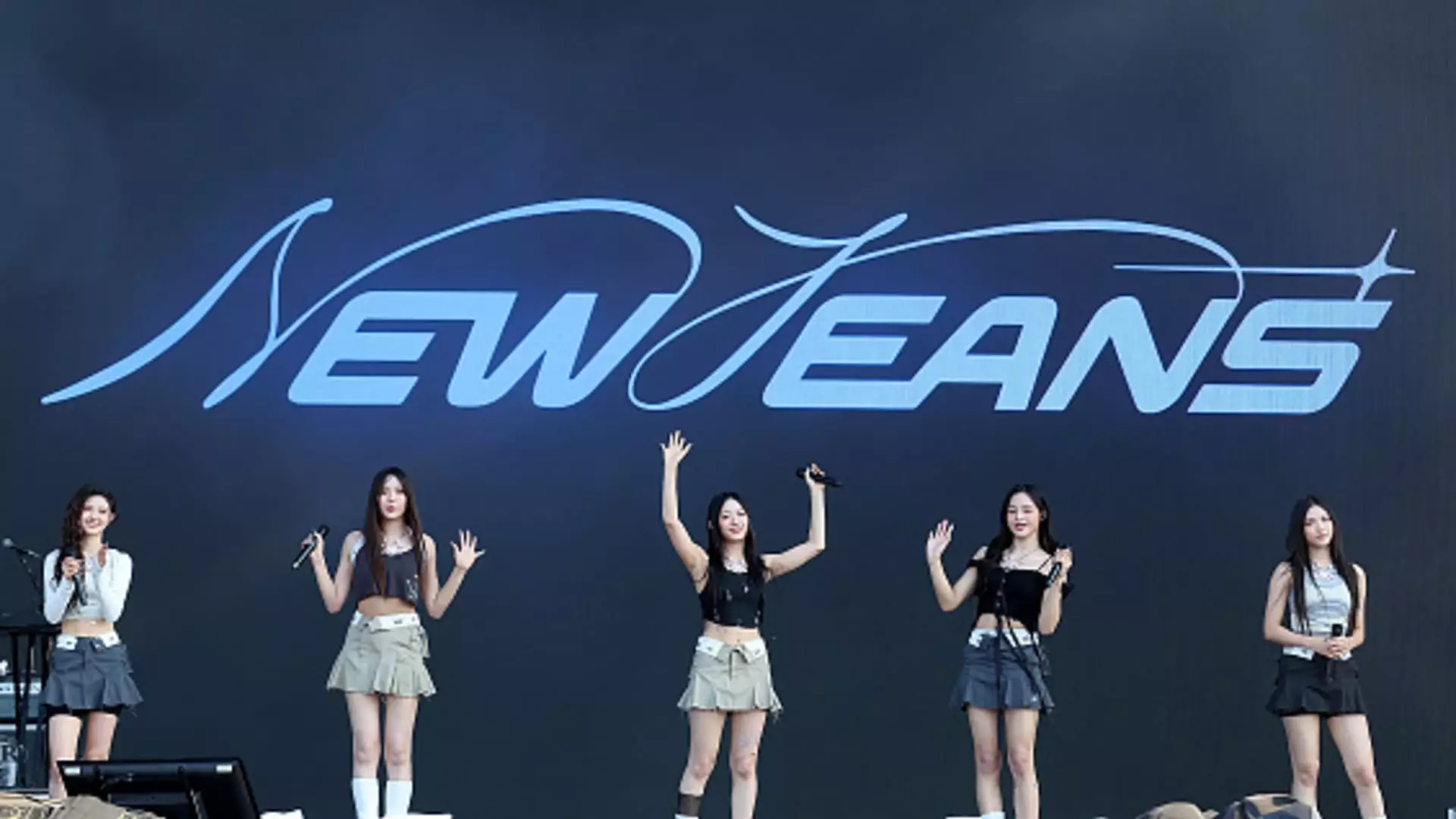

Despite the current challenges facing the K-pop sector, Goldman Sachs identified significant growth opportunities, particularly in Japan. The analysts emphasized the overlooked potential in the Japanese market, citing the favorable shift towards K-pop artists following a scandal involving a top talent agency. The invitation of multiple K-pop groups to prominent Japanese music shows signaled a growing acceptance and demand for K-pop entertainment in the region. Goldman projected a substantial increase in concert audiences in Japan, with companies like Hybe, SM, and JYP poised to capitalize on this growth. The analysts also highlighted the global fan base expansion of K-pop, especially in markets like the U.S., where groups like NewJeans have achieved remarkable success on the music charts.

Hybe, one of the leading companies in the K-pop industry, has made significant strides in expanding its international presence. The partnership with Universal Music Group, offering exclusive distribution rights for Hybe’s artists and labels, signifies a strategic move towards mainstream global recognition. By leveraging the success of groups like NewJeans and Le Sserafim, Hybe aims to solidify its position in the global music market, competing with established Western artists. Goldman Sachs views these developments as indicators of K-pop’s increasing influence on the global music scene, providing companies with stronger bargaining power in business relationships.

While the K-pop industry has faced some setbacks and challenges in recent times, the assessment provided by Goldman Sachs offers a positive outlook on the sector’s growth potential. By redefining performance metrics, identifying untapped markets, and pursuing strategic global expansion initiatives, K-pop companies have the opportunity to thrive in an evolving industry landscape. As the global demand for K-pop entertainment continues to rise, companies that adapt to changing trends and prioritize fan engagement are likely to secure long-term success in the highly competitive music industry.

Leave a Reply