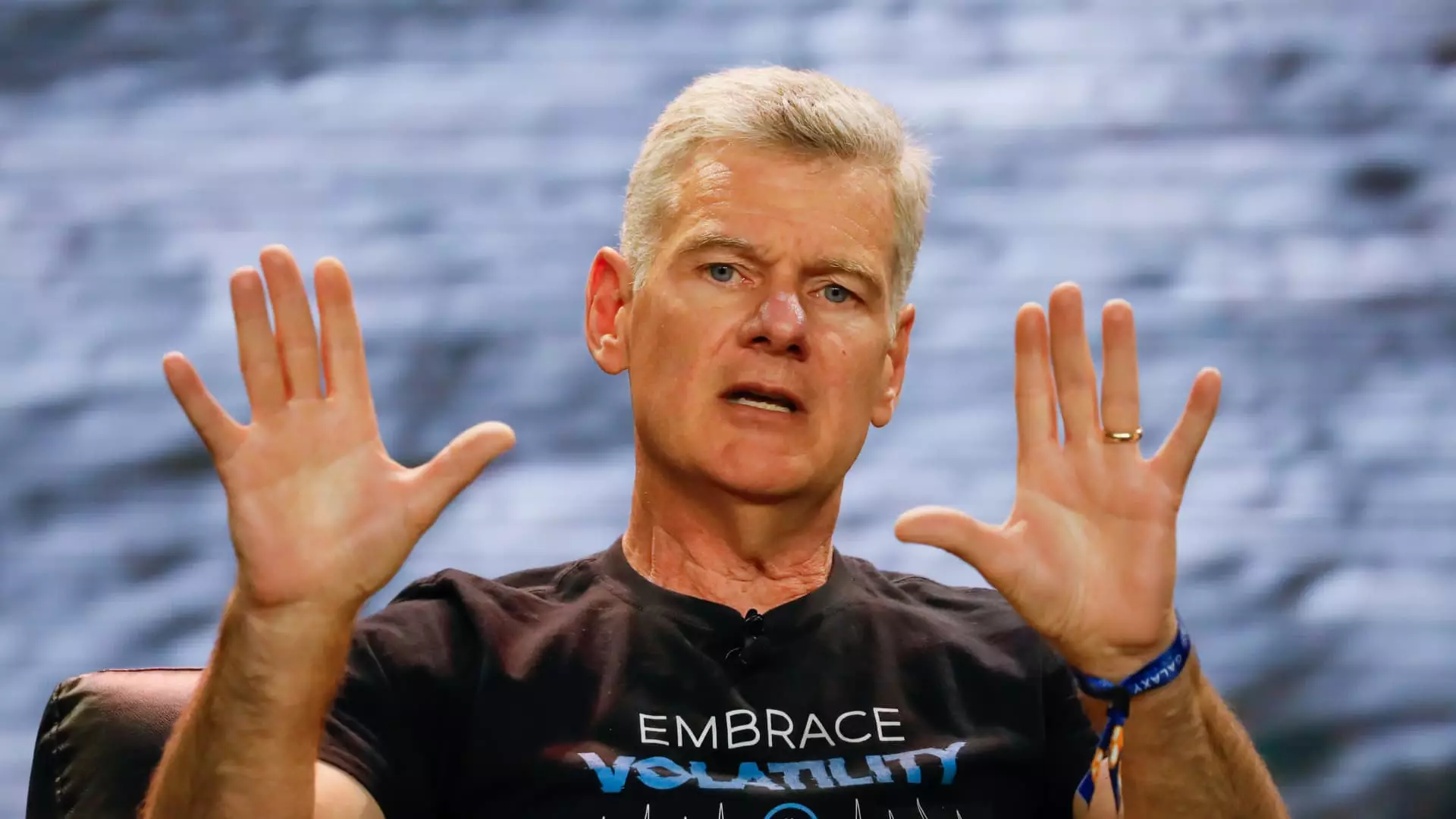

Renowned hedge fund manager Mark Yusko recently made a bold prediction regarding the price of Bitcoin, suggesting that the cryptocurrency could more than double in value this year to reach an impressive $150,000. This forecast was shared by Yusko during an interview on CNBC’s “Fast Money,” where he urged investors to “get off zero” and consider allocating at least 1% to 3% of their portfolios to Bitcoin. According to Yusko, Bitcoin is the dominant token and a superior alternative to gold.

As of the latest stock market close, Bitcoin has seen a significant increase of approximately 159% over the past year. While the cryptocurrency had briefly surpassed the $73,000 mark in March, it was trading at around $70,700 by Thursday evening. Yusko remains optimistic about Bitcoin’s potential for further growth, suggesting that it could potentially increase by tenfold over the next decade.

Yusko pointed out several factors that could drive Bitcoin’s price surge in the coming months. One key factor is the introduction of Bitcoin exchange-traded funds (ETFs) in January, which have been identified as a major bullish driver for the cryptocurrency. Additionally, Yusko highlighted the upcoming Bitcoin halving event, scheduled for late April, as a potential supply shock that could lead to significant tailwinds for Bitcoin.

According to Yusko, the period following the halving event is crucial for Bitcoin’s price trajectory. He anticipates that Bitcoin’s price will start to exhibit parabolic growth towards the end of the year. Historically, Bitcoin has experienced a peak in price approximately nine months after the halving, which aligns with the timing towards Thanksgiving or Christmas. This pattern suggests a potential surge in price before entering the next bear market phase.

In addition to Bitcoin, Yusko’s firm has also invested in the crypto online trading platform Coinbase. He expressed confidence in Coinbase’s future prospects, noting that the platform has significant potential for growth. Notably, Coinbase’s shares have surged by nearly 321% over the past 12 months, reflecting the overall positive sentiment surrounding the cryptocurrency industry.

Mark Yusko’s optimistic outlook on Bitcoin’s price trajectory and the potential for substantial growth in the cryptocurrency market highlights the ongoing evolution and maturation of digital assets as a viable investment option. While the future remains uncertain, the key catalysts and factors shaping Bitcoin’s price movements suggest a promising landscape for investors looking to capitalize on the digital asset boom.

Leave a Reply