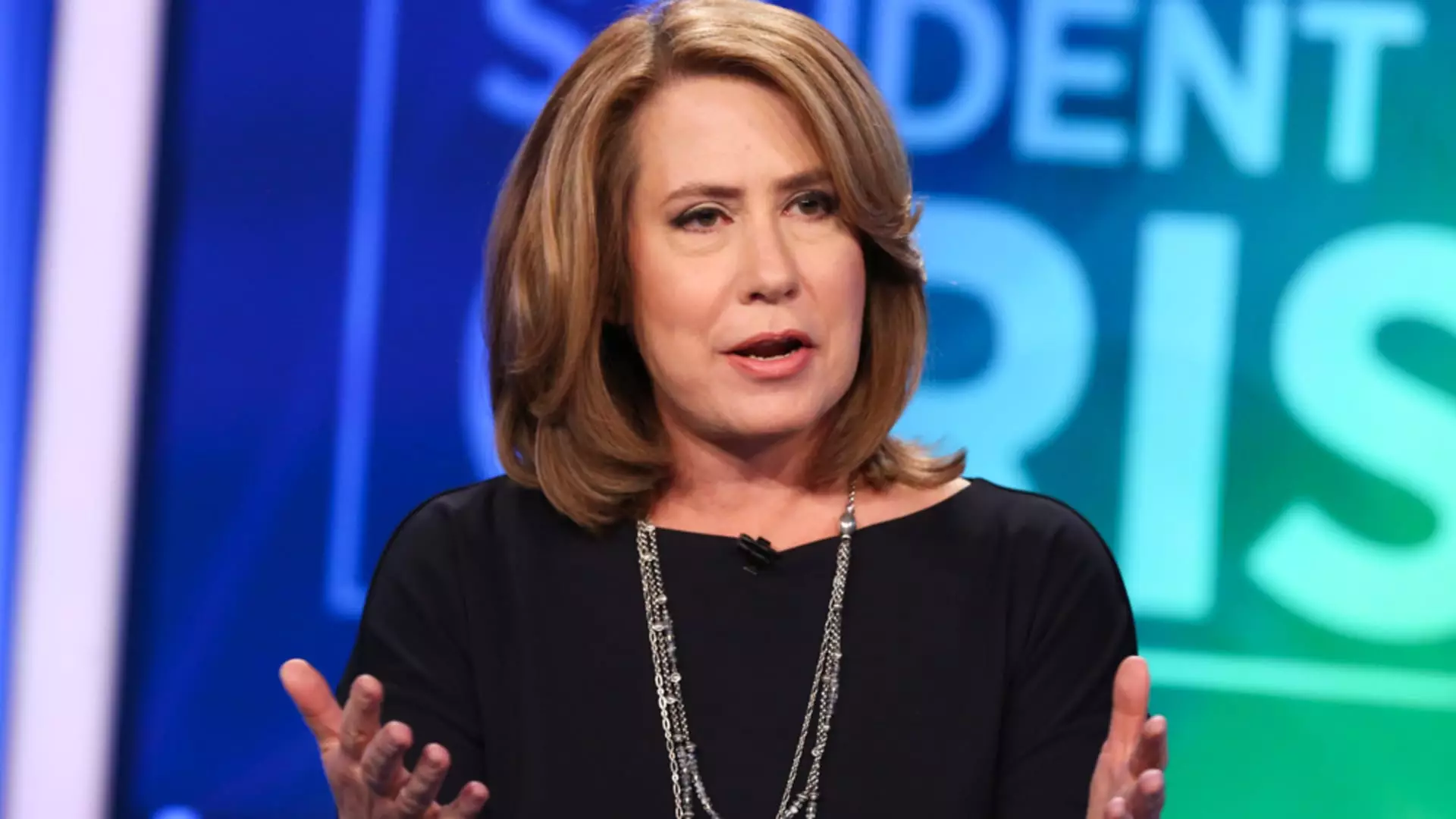

Former chair of the U.S. Federal Deposit Insurance Corp, Sheila Bair, has raised red flags regarding the upcoming earnings reports of regional banks. She expressed her worries about the reliance on industry deposits, concentrated commercial real estate exposure, and the potential instability of uninsured deposits among regional banks. Bair, who led the FDIC during the 2008 financial crisis, fears that the issues faced by regional banks in 2023 have not been fully addressed.

The SPDR S&P Regional Bank ETF (KRE) has suffered a significant decline of almost 13% this year, with only four of its members showing positive growth in 2024. New York Community Bancorp stands out as the biggest laggard, plummeting more than 71% this year. Other regional banks such as Metropolitan Bank Holding Corp., Kearny Financial, Columbia Banking System, and Valley National Bancorp have also seen significant losses, with declines of over 30% in the same time period.

The recent increase in the benchmark 10-year Treasury note yield to over 4.6% has further exacerbated the challenges faced by regional banks. Bair is concerned that higher yields could lead to increased stress on commercial real estate borrowers, a sector where regional banks have substantial exposure. With many commercial real estate loans up for refinancing this year and next, rising interest rates could result in heightened distress for borrowers trying to make their payments.

While regional banks struggle with these issues, larger money-center banks could stand to benefit. Bair pointed out that regional bank distress often leads to increased business for bigger institutions. The challenges faced by regional banks create opportunities for larger players in the banking industry to expand their market share and capitalize on the weaknesses of their smaller counterparts.

The vulnerabilities of regional banks exposed through their earnings reports highlight significant risks and challenges facing these institutions. The concerns raised by Sheila Bair underscore the need for regulatory action and strategic decision-making to address the issues at hand. As regional banks navigate through this difficult period, the potential impact on the broader banking industry remains a topic of interest and concern for investors and regulators alike.

Leave a Reply