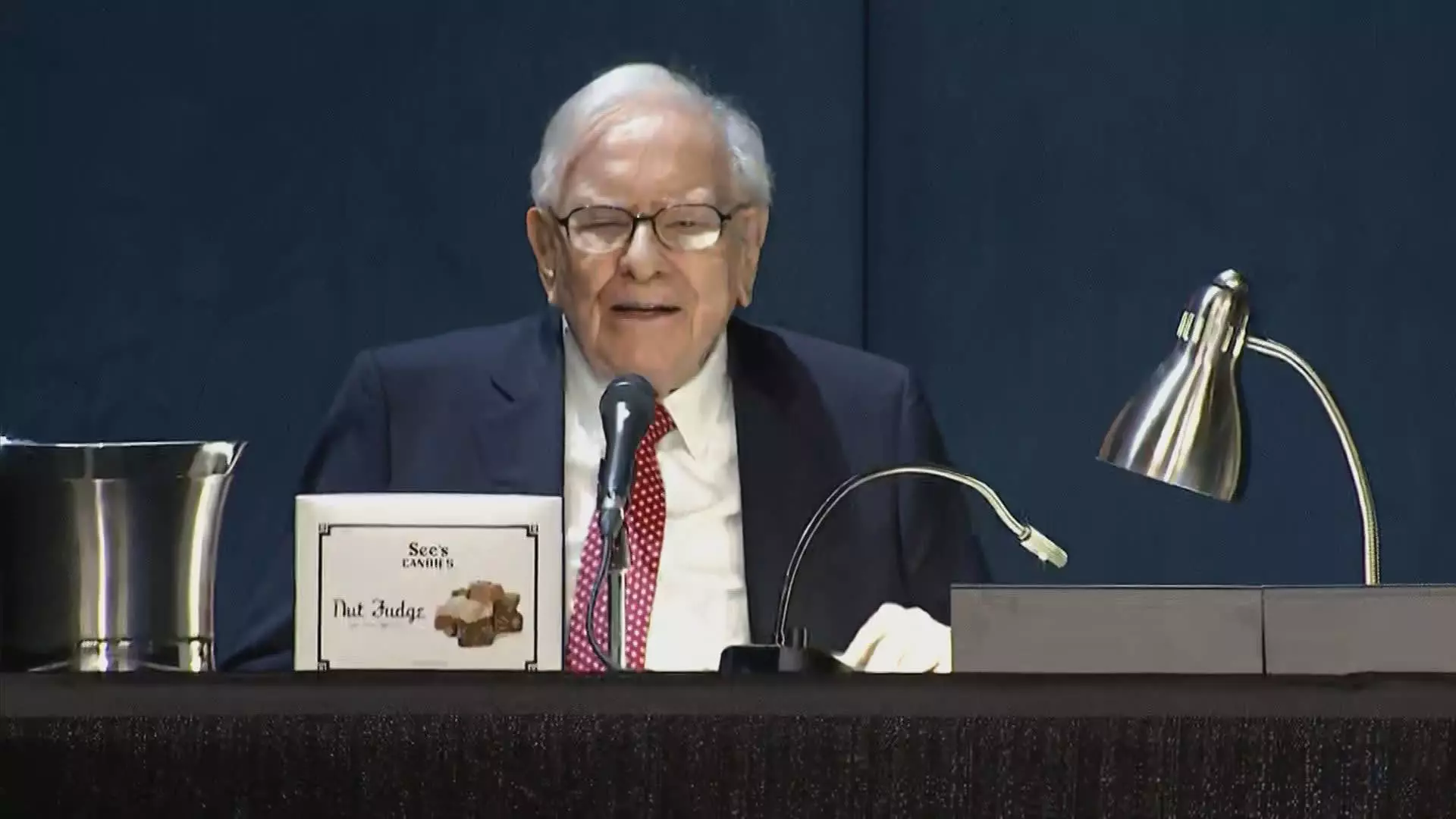

Warren Buffett, the legendary investor who is approaching his 94th birthday, recently made his largest annual donation to date. The donation totaled $5.3 billion in Berkshire Hathaway shares, which he distributed among five different charities.

Significance of the Donation

This generous act of philanthropy involved converting 8,674 of his Berkshire Class A shares into more than 13 million Class B shares. The bulk of these shares, approximately 9.93 million, were allocated to the Bill & Melinda Gates Foundation. The remaining shares were divided among the Susan Thompson Buffett Foundation, named after his first wife, and three charities associated with his children, Howard, Susan, and Peter Buffett.

Known as the “Oracle of Omaha,” Warren Buffett has committed to giving away the fortune he accumulated through his leadership of Berkshire Hathaway, a conglomerate based in Omaha, Nebraska. He has been making annual donations to the same five charities since 2006, reflecting his ongoing dedication to philanthropic causes.

In an interview with The Wall Street Journal, Buffett revealed his plans for the future of his wealth. After his passing, his substantial fortune will be directed towards a new charitable trust that will be managed by his three children. Emphasizing the importance of assisting those less fortunate, Buffett expressed his desire for his wealth to make a meaningful impact on society.

Buffett disclosed that his children will serve as both executors of his will and trustees of the charitable trust that will inherit the vast majority of his wealth. While the Bill & Melinda Gates Foundation has been a major beneficiary of his donations in the past, Buffett announced that it will no longer receive contributions after his passing.

Succession Planning at Berkshire

At Berkshire’s annual meeting in May, Buffett addressed the topic of succession and the eventual transition of leadership within the conglomerate. Greg Abel, the vice chairman for noninsurance operations at Berkshire, has been identified as Buffett’s successor and has assumed a significant role in managing the company’s operations.

Transparency in Wealth Disposition

Buffett has been vocal about his commitment to transparency in the handling of his assets posthumously. He stated that his will be made public following his passing, with no intricate trusts or entities designed to evade public scrutiny. Buffett’s straightforward approach reflects his belief in accountability and openness in matters of wealth management.

Warren Buffett’s substantial donation and his strategic plans for the future management of his wealth highlight his enduring commitment to philanthropy and social responsibility. As one of the world’s most successful investors, Buffett’s legacy extends beyond financial success to encompass a profound impact on charitable causes and the betterment of society as a whole.

Leave a Reply