Wheeler Real Estate Investment Trust, Inc. (NASDAQ: WHLR) captured the spotlight on June 20, 2025, with an extraordinary surge in its stock price. This article provides an in-depth analysis of WHLR’s recent performance, the underlying drivers of its dramatic rally, and the broader context within the real estate investment trust (REIT) sector.

Overview of WHLR’s June 2025 Performance

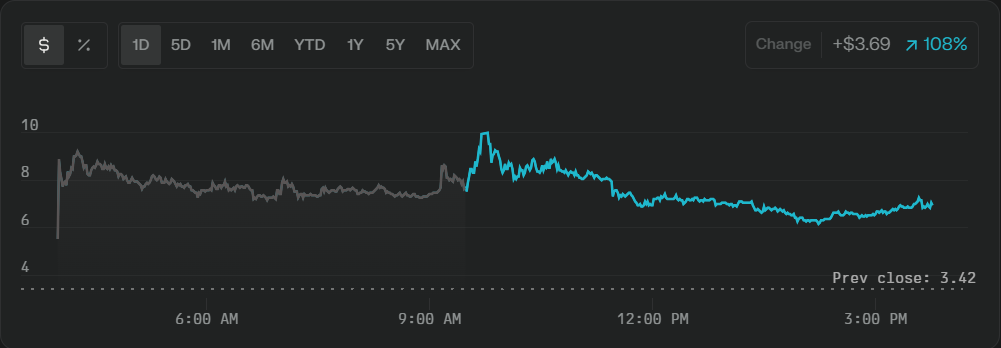

On June 20, 2025, WHLR experienced a remarkable 149.42% surge in pre-market trading, marking one of the most significant single-day moves in the company’s recent history. This extraordinary gain was not an isolated event but the culmination of several strategic and market-driven factors that have repositioned WHLR as a key player in the REIT space.

Key Performance Highlights

- Pre-market Surge: WHLR’s stock soared by 149.42% on June 20, 2025, reflecting renewed investor confidence and heightened market interest.

- Trading Activity: In the days leading up to this rally, WHLR had seen increased trading volumes, with over 2 million shares traded on June 18, 2025, and a closing price of $3.42, up 1.79% from the previous day.

- Volatility and Recovery: Despite a 35.35% decline over the prior ten days, technical indicators suggested a strong outlook, with analysts forecasting a potential rise of up to 67.91% over the next three months, projecting a price range between $2.26 and $9.49.

Recent Trading Activity: A Closer Look

Short-Term Volatility

The period preceding June 20 was marked by significant volatility. WHLR’s stock price had experienced a sharp downward trend, losing over a third of its value in just ten days. However, the increased trading volume and a modest rebound on June 18 signaled a shift in market sentiment.

Volume and Price Movements

- June 18, 2025: Closed at $3.42 (up 1.79%), with 3,434,400 shares traded.

- Pre-market June 20, 2025: The stock opened dramatically higher, reflecting the impact of both company-specific news and broader sector optimism.

Technical Outlook

Despite recent declines, technical analysis pointed to a robust recovery potential. The stock was positioned in the middle of a wide and strong rising trend, with a high probability of significant gains over the coming months.

Strategic Initiatives Driving Performance

WHLR’s dramatic rally was underpinned by a series of proactive strategic moves aimed at strengthening its financial position and operational efficiency.

Key Strategic Actions

- Property Sales: In Q1 2025, WHLR completed three property sales, generating $19.4 million in net proceeds. These disposals contributed to a $5.7 million gain, directly improving the company’s bottom line.

- Balance Sheet Strengthening: Management focused on reducing preferred stock obligations, retiring 332,125 shares of Series D Preferred Stock, and repurchasing 1.3 million shares of Cedar Series C Preferred Stock for $21.2 million. These actions are expected to reduce annual dividend payments by $3.4 million, enhancing financial flexibility.

- Net Income Turnaround: WHLR reported Q1 2025 net income of $5.4 million, a significant improvement from a $6.0 million loss in Q1 2024. This turnaround was primarily driven by gains from property disposals and effective cost management.

Investor Sentiment

These strategic initiatives have resonated positively with investors, signaling management’s commitment to delivering shareholder value and positioning the company for sustainable growth.

Broader Market and Sector Context

WHLR’s performance must also be viewed within the context of broader trends in the real estate investment trust sector.

Bullish Sector Trends

- Robust Demand: The real estate sector has experienced increased demand and favorable market conditions, providing a supportive backdrop for REITs like WHLR.

- Favorable Valuations: According to Hazelview Investments’ 2025 Global Public Real Estate Outlook Report, REITs are expected to benefit from strong fundamentals and attractive valuations throughout 2025.

- Regional Performance: The U.S. has been a leader in REIT returns, with key sectors such as healthcare and data centers outperforming due to heightened demand and limited supply.

Macroeconomic Factors

- Interest Rate Environment: Central banks’ decisions to cut policy rates in the latter half of 2024 improved investor sentiment and contributed to a rebound in REIT performance, despite some volatility from cautious Federal Reserve policies.

- Global Resilience: The global REIT market has demonstrated resilience, with mid-single-digit positive returns closing out 2024 and strong prospects for 2025.

WHLR’s Position in the REIT Landscape

Share Structure and Market Listing

- As of June 20, 2025, WHLR had 1,094,686 shares of common stock issued and outstanding, and its shares are listed on the Nasdaq Capital Market under the symbol “WHLR”.

Risk Considerations

- WHLR’s stock remains a high-risk investment, as highlighted in its prospectus and regulatory filings. Investors are advised to review risk factors carefully, including market volatility, sector-specific risks, and company-specific uncertainties.

Analyst Forecasts and Future Outlook

Technical and Fundamental Projections

- Short-Term Forecast: Analysts expect WHLR’s stock to rise by as much as 67.91% over the next three months, with a projected price range between $2.26 and $9.49, reflecting both technical momentum and fundamental improvements.

- Long-Term Potential: The company’s focus on strategic asset management, cost control, and balance sheet optimization positions it well for long-term value creation, provided it continues to execute effectively.

Key Factors for Future Performance

- Continued execution of strategic initiatives, including further asset sales and capital structure optimization.

- Ability to capitalize on favorable sector trends and maintain operational efficiency.

- Ongoing monitoring of macroeconomic conditions, particularly interest rates and demand dynamics in the real estate market.

Conclusion: WHLR’s June 2025 Rally in Perspective

Wheeler Real Estate Investment Trust, Inc. (WHLR) delivered a standout performance on June 20, 2025, with a pre-market surge of nearly 150%—a testament to both its internal turnaround efforts and the broader strength of the REIT sector. The company’s proactive approach to capitalizing on market opportunities, coupled with strategic financial management, has reignited investor confidence and positioned WHLR as a notable mover in the real estate investment space.

While risks remain, particularly given the stock’s recent volatility and the inherent uncertainties in the real estate market, WHLR’s recent actions and the sector’s favorable outlook suggest that the company is well-placed to navigate future challenges and capitalize on emerging opportunities.

Key Takeaways

- WHLR’s June 20, 2025, rally was driven by strategic initiatives, improved financial performance, and bullish sector trends.

- The company’s focus on asset sales, balance sheet strengthening, and cost control has yielded tangible results, including a return to profitability in Q1 2025.

- Broader REIT sector fundamentals remain strong, with analysts forecasting continued growth and resilience throughout 2025.

- Investors should remain mindful of the risks but can look to WHLR as a case study in effective turnaround management within the REIT sector.

Wheeler Real Estate Investment Trust’s dramatic performance in June 2025 underscores the importance of strategic agility, disciplined financial management, and the ability to capitalize on sector-wide trends. As the company continues to execute its growth strategy, its progress will be closely watched by investors and analysts alike.